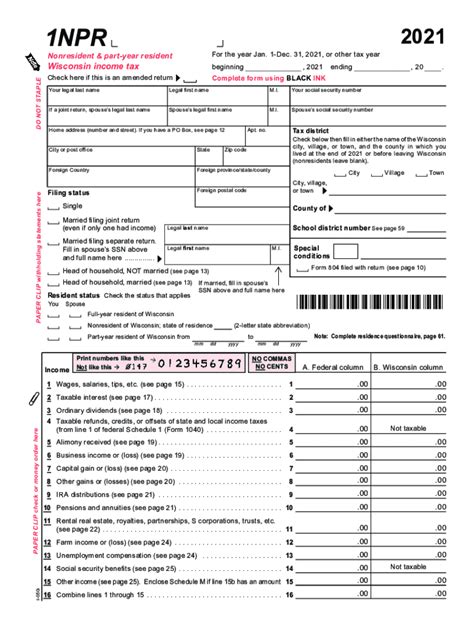

Filing tax returns can be a daunting task, especially for those who are not familiar with the process. In Wisconsin, individuals who are exempt from paying state income tax must file Form 1NPR, also known as the Wisconsin Nonresident and Part-Year Resident Income Tax Return. This form is used to report income earned in Wisconsin by nonresidents and part-year residents. In this article, we will guide you through the process of filling out Wisconsin Form 1NPR correctly.

Wisconsin Form 1NPR is a complex document that requires careful attention to detail. Failure to complete the form accurately can result in delays or even penalties. Therefore, it is essential to understand the requirements and follow the correct procedures when filling out the form. In the following sections, we will break down the 8 steps to fill out Wisconsin Form 1NPR correctly.

Step 1: Gather Required Documents

Before starting to fill out Form 1NPR, you will need to gather all required documents. These documents may include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments

- Dividend statements

- Any other relevant income statements

It is essential to have all these documents ready, as you will need to refer to them when completing the form.

Step 2: Determine Your Filing Status

Your filing status will determine which sections of the form you need to complete. Wisconsin recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your situation.

Step 3: Complete the Identification Section

The identification section requires you to provide personal details, such as:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your date of birth

Make sure to enter this information accurately, as it will be used to identify you and process your return.

Step 4: Report Your Income

In this section, you will need to report all income earned in Wisconsin, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Rent and royalty income

Use the W-2 and 1099 forms you gathered earlier to complete this section.

Step 5: Claim Deductions and Credits

Wisconsin allows various deductions and credits to reduce your tax liability. Some common deductions and credits include:

- Standard deduction

- Itemized deductions (such as mortgage interest and charitable donations)

- Earned Income Tax Credit (EITC)

- Child tax credit

Review the instructions and claim any deductions and credits you are eligible for.

Step 6: Calculate Your Tax Liability

Using the income and deductions you reported earlier, calculate your tax liability. You can use the tax tables or worksheets provided in the instructions to determine your tax liability.

Step 7: Complete the Payment and Refund Section

If you owe tax, you will need to complete the payment section. You can pay online, by phone, or by mail. If you are due a refund, you will need to complete the refund section.

Step 8: Sign and Date the Form

Finally, sign and date the form. Make sure to sign in the correct boxes, as this will validate your return.

By following these 8 steps, you can ensure that you fill out Wisconsin Form 1NPR correctly and avoid any potential issues. Remember to double-check your work and seek help if you are unsure about any part of the process.

We hope this article has been informative and helpful. If you have any questions or concerns, please don't hesitate to comment below.

What is the deadline for filing Wisconsin Form 1NPR?

+The deadline for filing Wisconsin Form 1NPR is typically April 15th of each year.

Can I file Wisconsin Form 1NPR electronically?

+Yes, you can file Wisconsin Form 1NPR electronically through the Wisconsin Department of Revenue's website.

What happens if I fail to file Wisconsin Form 1NPR?

+If you fail to file Wisconsin Form 1NPR, you may be subject to penalties and interest on any tax due.