As a business owner or tax professional, you're likely familiar with the importance of filing Form 7004, also known as the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. However, the traditional paper-based filing process can be time-consuming and prone to errors. That's where TurboTax comes in – offering a streamlined and efficient way to e-file Form 7004 online. In this article, we'll guide you through the process of e-filing Form 7004 with TurboTax, highlighting the benefits, steps, and key information you need to know.

Benefits of E-Filing Form 7004 with TurboTax

E-filing Form 7004 with TurboTax offers numerous benefits, including:

- Convenience: File from the comfort of your own home or office, 24/7, without the need to visit a physical IRS office or mail in paperwork.

- Accuracy: Reduce errors and ensure accurate calculations with TurboTax's built-in validation and checks.

- Speed: Get instant confirmation of your filing and receive your extension approval quickly.

- Security: Rest assured that your sensitive information is protected with TurboTax's robust security measures.

Who Needs to File Form 7004?

Form 7004 is used to request an automatic six-month extension of time to file certain business income tax returns, including:

- Form 1041: U.S. Income Tax Return for Estates and Trusts

- Form 1120: U.S. Corporation Income Tax Return

- Form 1120S: U.S. Income Tax Return for an S Corporation

- Form 1065: U.S. Return of Partnership Income

- Form 8804: Annual Return for Partnership Withholding Tax

If you're responsible for filing any of these forms, you may need to file Form 7004 to request an extension.

Steps to E-File Form 7004 with TurboTax

E-filing Form 7004 with TurboTax is a straightforward process. Here's a step-by-step guide:

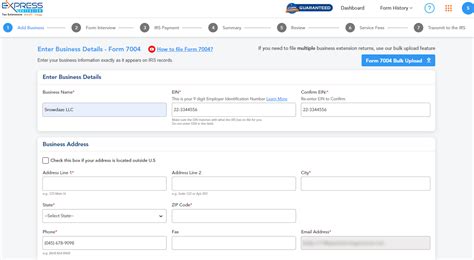

- Gather necessary information: Ensure you have all required documents and information, including your business's Employer Identification Number (EIN), tax year, and estimated tax liability.

- Create a TurboTax account: If you haven't already, sign up for a TurboTax account and select the business tax filing option.

- Select Form 7004: Choose the Form 7004 option and follow the prompts to enter your business information and estimated tax liability.

- Review and validate: Review your information for accuracy and ensure that TurboTax's validation checks are complete.

- Submit your filing: Once you've reviewed and validated your information, submit your Form 7004 filing to the IRS.

- Print or save your confirmation: Keep a record of your filing confirmation, which will include your extension approval.

What to Expect After Filing

After e-filing Form 7004 with TurboTax, you can expect:

- Instant confirmation: Receive instant confirmation of your filing and extension approval.

- Email updates: Get email updates on the status of your filing and any further actions required.

- Extended deadline: Enjoy the peace of mind that comes with knowing you have an additional six months to file your business tax return.

TurboTax Support and Resources

TurboTax offers a range of support and resources to help you with the e-filing process, including:

- Phone support: Get help from TurboTax's experienced support team via phone.

- Live chat: Access live chat support for quick answers to your questions.

- Online community: Join the TurboTax online community to connect with other users and get answers to common questions.

- Resource center: Visit the TurboTax resource center for access to guides, tutorials, and FAQs.

Tips and Reminders

- File early: Don't wait until the last minute to file your Form 7004. Submit your filing well in advance of the deadline to avoid any potential issues.

- Double-check information: Ensure that your business information and estimated tax liability are accurate to avoid errors or delays.

- Keep records: Maintain a record of your filing confirmation and extension approval for your records.

Conclusion: Streamline Your Form 7004 Filing with TurboTax

E-filing Form 7004 with TurboTax is a convenient, accurate, and secure way to request an automatic extension of time to file your business tax return. By following the steps outlined in this article and taking advantage of TurboTax's support and resources, you can ensure a smooth and stress-free filing experience.

What is the deadline for filing Form 7004?

+The deadline for filing Form 7004 is the original due date of your business tax return.

Can I file Form 7004 electronically if I owe taxes?

+Yes, you can file Form 7004 electronically even if you owe taxes. However, you'll need to make a payment or arrange for payment by the original due date to avoid penalties and interest.

How long does it take to get approval for my Form 7004 filing?

+With TurboTax, you'll receive instant confirmation of your filing and extension approval.