Managing one's financial affairs can become increasingly complex, especially as individuals accumulate assets and investments over time. For those invested with Vanguard, one of the largest investment management companies globally, having a clear plan for the management of these assets is crucial, especially in cases of incapacitation or absence. This is where the Vanguard Power of Attorney form comes into play. A Power of Attorney (POA) is a document that allows an individual (the principal) to appoint another person (the agent or attorney-in-fact) to manage their financial affairs on their behalf.

For Vanguard investors, having a Power of Attorney form specific to their accounts can ensure that their financial matters continue to be handled smoothly, even if they are unable to do so themselves. This article will guide you through the process of obtaining and completing a Vanguard Power of Attorney form, as well as provide insights into the benefits and implications of this document.

Benefits of a Vanguard Power of Attorney

There are several benefits to having a Vanguard Power of Attorney form in place:

- Continuity of Financial Management: Ensures that your Vanguard accounts and investments are managed according to your wishes, even if you are unable to make decisions due to illness, injury, or absence.

- Convenience and Reduced Stress: Appoints someone you trust to handle financial matters, reducing the burden on you and your loved ones.

- Flexibility: Allows your agent to make a wide range of financial decisions on your behalf, from simple transactions to complex investment strategies.

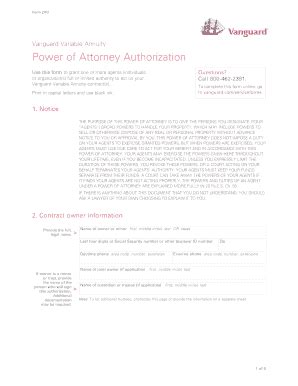

How to Obtain a Vanguard Power of Attorney Form

Obtaining a Vanguard Power of Attorney form can typically be done in a few steps:

-

Visit the Vanguard Website: The first step is to visit Vanguard's official website. They often have a section dedicated to forms and documents, including the Power of Attorney form.

-

Contact Vanguard Directly: If you cannot find the form online, you can contact Vanguard's customer service. They can provide you with the form or guide you on how to access it.

-

Consult with a Financial Advisor or Attorney: While not mandatory, consulting with a financial advisor or an attorney can be beneficial, especially if you have complex financial situations or specific wishes.

Completing the Vanguard Power of Attorney Form

Completing the Vanguard Power of Attorney form requires careful consideration and attention to detail. Here are the general steps involved:

- Read and Understand the Form: Before filling out the form, read it carefully to understand your rights and the responsibilities you are granting to your agent.

- Choose Your Agent: Select a trustworthy individual who is capable of managing your financial affairs. Ensure they are aware of their responsibilities and are willing to act on your behalf.

- Specify Powers: Clearly outline the powers you are granting to your agent. This can range from managing specific Vanguard accounts to making broader financial decisions.

- Sign and Notarize: Sign the document in the presence of a notary public to make it legally binding.

FAQs About Vanguard Power of Attorney

What is the Vanguard Power of Attorney form used for?

+The Vanguard Power of Attorney form is used to appoint an agent to manage your Vanguard accounts and investments on your behalf, especially in cases of incapacitation or absence.

Can I download the Vanguard Power of Attorney form online?

+Yes, the form is typically available on Vanguard's official website. If not, you can contact their customer service for assistance.

Do I need a lawyer to complete the Vanguard Power of Attorney form?

+No, you do not necessarily need a lawyer, but consulting with one can be beneficial, especially if you have complex financial situations or specific wishes.

In conclusion, having a Vanguard Power of Attorney form in place can provide peace of mind and ensure the smooth management of your financial affairs. By understanding the benefits, knowing how to obtain and complete the form, and being aware of the implications, you can make informed decisions about your financial future.

We hope this guide has been informative and helpful. If you have any further questions or would like to share your experiences with the Vanguard Power of Attorney form, please feel free to comment below. Sharing this article with others who might find it useful is also appreciated.