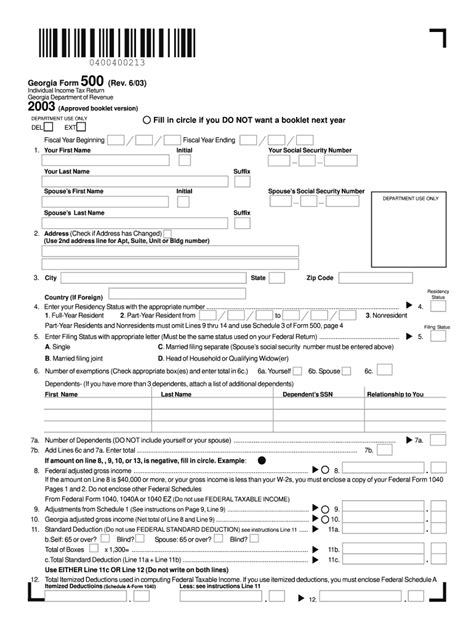

The GA Form 500 Schedule 3 is a crucial document for businesses operating in the state of Georgia, as it is used to report and calculate the state's income tax liability. In this article, we will delve into the instructions and guidelines for completing the GA Form 500 Schedule 3, ensuring that you are well-equipped to navigate the process with ease.

Understanding the Purpose of GA Form 500 Schedule 3

The GA Form 500 Schedule 3 is a supporting schedule to the GA Form 500, which is the primary form used to report a business's income tax liability in Georgia. The Schedule 3 is specifically designed to calculate the tax liability for corporations, S corporations, and partnerships that operate in the state.

Step-by-Step Instructions for Completing GA Form 500 Schedule 3

To ensure accuracy and avoid any potential errors, it is essential to follow the instructions carefully. Here is a step-by-step guide to help you complete the GA Form 500 Schedule 3:

Step 1: Gather Required Information and Documents

Before starting to fill out the Schedule 3, gather all the necessary information and documents, including:

- GA Form 500

- Federal income tax return (Form 1120 or Form 1120S)

- Supporting schedules and statements

- Records of income, deductions, and credits

Step 2: Complete the Header Section

The header section of the Schedule 3 requires you to provide basic information about your business, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Tax year and period

Step 3: Calculate Georgia Net Income

Calculate your business's Georgia net income by completing the following steps:

- Line 1: Enter the federal taxable income from your federal income tax return

- Line 2: Add any Georgia additions to income (e.g., interest income from Georgia obligations)

- Line 3: Subtract any Georgia deductions (e.g., depreciation, charitable contributions)

- Line 4: Calculate the net income by subtracting total deductions from total income

Step 4: Calculate Tax Liability

Calculate your business's tax liability by multiplying the net income by the applicable tax rate.

- Line 5: Enter the tax liability calculated in Step 3

- Line 6: Add any additional taxes (e.g., withholding taxes, tax credits)

- Line 7: Calculate the total tax liability

Step 5: Claim Credits and Deductions

Claim any available credits and deductions to reduce your tax liability.

- Line 8: Enter the total credits claimed

- Line 9: Enter the total deductions claimed

- Line 10: Calculate the net tax liability after credits and deductions

Step 6: Complete the Remaining Sections

Complete the remaining sections of the Schedule 3, including:

- Section A: Calculation of Net Operating Loss (NOL)

- Section B: Calculation of Capital Gains and Losses

Additional Guidelines and Tips

To ensure accuracy and avoid potential errors, keep the following guidelines and tips in mind:

- Use the correct tax rates and tables for the tax year

- Ensure accurate calculation of net income and tax liability

- Claim all available credits and deductions

- Attach supporting schedules and statements as required

- File the Schedule 3 with the GA Form 500 by the due date to avoid penalties and interest

Frequently Asked Questions (FAQs)

What is the purpose of the GA Form 500 Schedule 3?

+The GA Form 500 Schedule 3 is used to calculate the state's income tax liability for corporations, S corporations, and partnerships operating in Georgia.

What information and documents are required to complete the Schedule 3?

+Gather all necessary information and documents, including the GA Form 500, federal income tax return, supporting schedules and statements, and records of income, deductions, and credits.

What is the deadline for filing the GA Form 500 Schedule 3?

+File the Schedule 3 with the GA Form 500 by the due date to avoid penalties and interest.

Conclusion

Completing the GA Form 500 Schedule 3 requires careful attention to detail and accuracy. By following the step-by-step instructions and guidelines outlined in this article, you can ensure that your business's tax liability is accurately calculated and reported to the state of Georgia. If you have any further questions or concerns, please feel free to ask in the comments section below.