Changing the beneficiary of your Transamerica annuity is a crucial decision that can have significant implications for your loved ones' financial future. An annuity is a long-term investment that can provide a steady income stream for years to come, and naming the right beneficiary ensures that your assets are distributed according to your wishes. In this article, we will guide you through the process of changing your Transamerica annuity beneficiary in 5 easy steps.

Understanding the Importance of Updating Your Beneficiary

Life is full of unexpected events, and your annuity beneficiary designation should reflect any changes in your personal circumstances. For instance, you may have gotten married, divorced, or had children since you first purchased your annuity. Updating your beneficiary ensures that your assets are distributed correctly in the event of your passing.

Why Update Your Beneficiary Designation?

- To reflect changes in your marital status

- To include or exclude children or stepchildren

- To account for the passing of a previously named beneficiary

- To ensure that your assets are distributed according to your wishes

Step 1: Gather Required Documents and Information

Before you begin the process of changing your Transamerica annuity beneficiary, make sure you have the necessary documents and information readily available. You will need:

- Your annuity contract number

- The full names and dates of birth of your new beneficiaries

- The Social Security numbers or tax identification numbers of your new beneficiaries

- Your relationship to the new beneficiaries (e.g., spouse, child, parent)

Additional Requirements

- If you are naming a trust as your beneficiary, you will need to provide the trust's tax identification number and a copy of the trust document

- If you are naming a minor as your beneficiary, you may need to provide additional documentation, such as a court-appointed guardian's information

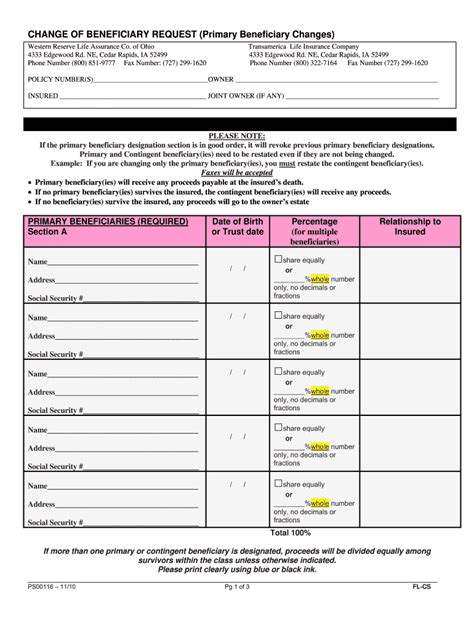

Step 2: Complete the Beneficiary Change Form

You can obtain the beneficiary change form from Transamerica's website or by contacting their customer service department. The form will typically require you to provide the following information:

- Your annuity contract number

- The names and dates of birth of your current beneficiaries

- The names and dates of birth of your new beneficiaries

- Your relationship to the new beneficiaries

- Your signature and date

Tips for Completing the Form

- Make sure to use black ink and sign the form in the presence of a notary public, if required

- Keep a copy of the completed form for your records

- If you have any questions or concerns, contact Transamerica's customer service department for assistance

Step 3: Submit the Beneficiary Change Form

Once you have completed the beneficiary change form, you can submit it to Transamerica via mail, fax, or email. Make sure to follow the instructions provided with the form to ensure that it is processed correctly.

Submission Options

- Mail: Send the completed form to the address listed on the form

- Fax: Fax the completed form to the number listed on the form

- Email: Email the completed form to the email address listed on the form

Step 4: Verify the Beneficiary Change

After submitting the beneficiary change form, verify that the changes have been processed correctly. You can do this by:

- Contacting Transamerica's customer service department

- Checking your annuity contract documents

- Reviewing your online account information

Why Verification is Important

- To ensure that your beneficiary designation is up-to-date and accurate

- To prevent any delays or disputes in the event of your passing

- To give you peace of mind knowing that your assets will be distributed according to your wishes

Step 5: Review and Update Your Beneficiary Designation Regularly

It is essential to review and update your beneficiary designation regularly to ensure that it remains accurate and reflects any changes in your personal circumstances. You should review your beneficiary designation:

- Every 5-10 years

- When you experience a major life event (e.g., marriage, divorce, birth of a child)

- When you update your will or other estate planning documents

Benefits of Regular Review

- Ensures that your assets are distributed correctly in the event of your passing

- Reflects any changes in your personal circumstances

- Gives you peace of mind knowing that your beneficiary designation is up-to-date and accurate

By following these 5 easy steps, you can change your Transamerica annuity beneficiary and ensure that your assets are distributed according to your wishes. Remember to review and update your beneficiary designation regularly to reflect any changes in your personal circumstances.

If you have any questions or concerns about changing your Transamerica annuity beneficiary, contact their customer service department for assistance.

What is the purpose of naming a beneficiary on my Transamerica annuity?

+Naming a beneficiary on your Transamerica annuity ensures that your assets are distributed correctly in the event of your passing. It allows you to designate who will receive the annuity benefits, providing them with a steady income stream for years to come.

Can I change my Transamerica annuity beneficiary at any time?

+Yes, you can change your Transamerica annuity beneficiary at any time. However, you should review and update your beneficiary designation regularly to ensure that it remains accurate and reflects any changes in your personal circumstances.

What happens if I don't name a beneficiary on my Transamerica annuity?

+If you don't name a beneficiary on your Transamerica annuity, the annuity benefits will be distributed according to the default beneficiary provisions outlined in the annuity contract. This may not align with your wishes, so it's essential to name a beneficiary to ensure that your assets are distributed correctly.