In today's fast-paced digital age, businesses and individuals alike are constantly seeking ways to streamline their operations and make tasks more efficient. One area where this is particularly important is in tax filing, where accuracy and timeliness are crucial. The Mef Form 7004 platform is a cutting-edge solution designed to modernize the e-file experience, making it easier and more convenient for users to manage their tax obligations. In this article, we will delve into the world of Mef Form 7004, exploring its features, benefits, and how it can revolutionize the way you approach tax filing.

What is Mef Form 7004?

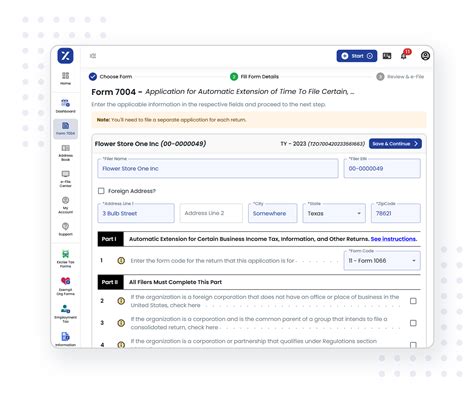

Mef Form 7004 is an electronic filing platform specifically designed for Automatic Extension of Time to File U.S. Individual Income Tax Return (Form 1040) and other tax-related forms. This platform utilizes the latest technology to provide a secure, efficient, and user-friendly experience for filers. With Mef Form 7004, users can quickly and easily submit their tax extensions, eliminating the need for paper forms and manual processing.

Key Features of Mef Form 7004

• Easy-to-use interface: The platform's intuitive design makes it simple for users to navigate and complete the filing process. • Secure data transmission: Mef Form 7004 employs advanced encryption methods to ensure that sensitive information is protected. • Real-time status updates: Users can track the status of their filing in real-time, providing peace of mind and reducing uncertainty. • Automated error checking: The platform's built-in validation checks help prevent errors and ensure that filings are accurate and complete.

Benefits of Using Mef Form 7004

The Mef Form 7004 platform offers numerous benefits for users, including:

Increased Efficiency

• Reduced processing time: Electronic filing eliminates the need for manual processing, resulting in faster turnaround times. • Streamlined workflow: The platform's automated features and real-time updates help users manage their workload more effectively.

Improved Accuracy

• Built-in validation checks: Mef Form 7004's automated error checking helps prevent errors and ensures that filings are accurate and complete. • Reduced risk of rejection: By minimizing errors, users can reduce the risk of their filing being rejected.

Enhanced Security

• Advanced encryption methods: The platform's secure data transmission ensures that sensitive information is protected. • Compliance with IRS regulations: Mef Form 7004 is designed to meet or exceed IRS security and compliance requirements.

How to Use Mef Form 7004

Getting started with Mef Form 7004 is easy. Simply follow these steps:

- Create an account: Register for an account on the Mef Form 7004 platform.

- Gather required information: Collect the necessary information and documentation for your tax filing.

- Complete the online form: Fill out the electronic form, using the platform's guided interface to ensure accuracy and completeness.

- Submit your filing: Once complete, submit your filing electronically through the platform.

- Track your status: Monitor the status of your filing in real-time, using the platform's tracking features.

Frequently Asked Questions

What types of tax forms can I file using Mef Form 7004?

+Mef Form 7004 supports the electronic filing of Form 1040, as well as other tax-related forms.

Is Mef Form 7004 secure?

+Yes, Mef Form 7004 employs advanced encryption methods to ensure that sensitive information is protected.

How long does it take to process a filing using Mef Form 7004?

+The processing time for filings submitted through Mef Form 7004 is typically faster than traditional paper-based methods.

As the tax landscape continues to evolve, it's essential to stay ahead of the curve with modern solutions like Mef Form 7004. By embracing this cutting-edge platform, you can streamline your tax filing experience, reduce errors, and enhance security. Take the first step towards a more efficient and stress-free tax season by exploring the benefits of Mef Form 7004 today.

If you have any questions or comments about Mef Form 7004, please don't hesitate to share them below. Your feedback is invaluable in helping us provide the best possible experience for our readers.