As a homeowner association (HOA) or condominium management company, filing tax returns can be a daunting task. The Form 1120-H is a crucial document that helps you report the income and expenses of your HOA to the Internal Revenue Service (IRS). In this article, we will provide you with 7 essential tips to help you navigate the Form 1120-H instructions and ensure a smooth filing process.

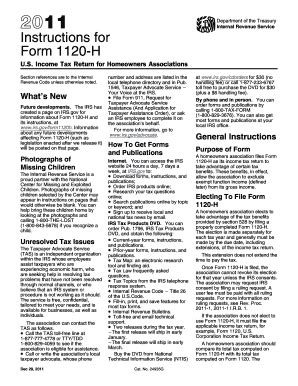

Understanding the Form 1120-H Purpose

The Form 1120-H is used by HOAs to report their income, expenses, and other financial activities to the IRS. This form is essential for HOAs to maintain their tax-exempt status and avoid penalties. As an HOA manager, it is crucial to understand the purpose of the Form 1120-H and the instructions that come with it.

Why is the Form 1120-H Important?

The Form 1120-H is important for several reasons:

- It helps the IRS to determine if your HOA is eligible for tax-exempt status.

- It provides the IRS with information about your HOA's income, expenses, and other financial activities.

- It helps your HOA to maintain compliance with tax laws and regulations.

Tips for Filing Form 1120-H

Here are 7 essential tips to help you navigate the Form 1120-H instructions:

1. Gather All Necessary Documents

Before starting the filing process, gather all necessary documents, including:

- Financial statements (income statement, balance sheet, and cash flow statement)

- Ledger accounts

- Bank statements

- Canceled checks

- Invoices and receipts

2. Understand the Form 1120-H Structure

The Form 1120-H consists of several sections, including:

- Part I: Income

- Part II: Deductions

- Part III: Tax and Payments

- Part IV: Additional Information

Understand the structure of the form and the instructions for each section to ensure accurate filing.

Breaking Down the Form 1120-H Sections

Here's a brief overview of each section:

- Part I: Income - Report all income earned by your HOA, including membership dues, interest, and rents.

- Part II: Deductions - Report all deductions, including operating expenses, taxes, and interest.

- Part III: Tax and Payments - Report all tax payments, including federal income tax, and any penalties or interest.

- Part IV: Additional Information - Provide additional information, including the HOA's name, address, and Employer Identification Number (EIN).

3. Report All Income Accurately

Report all income earned by your HOA, including:

- Membership dues

- Interest income

- Rent income

- Sales income

4. Claim All Eligible Deductions

Claim all eligible deductions, including:

- Operating expenses

- Taxes

- Interest

- Depreciation

5. Maintain Accurate Records

Maintain accurate records, including:

- Financial statements

- Ledger accounts

- Bank statements

- Canceled checks

- Invoices and receipts

6. Consult with a Tax Professional

Consult with a tax professional to ensure accurate filing and to address any questions or concerns you may have.

7. File on Time

File the Form 1120-H on time to avoid penalties and interest. The deadline for filing the Form 1120-H is typically March 15th of each year.

Final Thoughts

Filing the Form 1120-H can be a complex process, but by following these 7 essential tips, you can ensure a smooth filing process and maintain your HOA's tax-exempt status. Remember to gather all necessary documents, understand the form structure, report all income accurately, claim all eligible deductions, maintain accurate records, consult with a tax professional, and file on time.

What is the Form 1120-H used for?

+The Form 1120-H is used by homeowner associations (HOAs) to report their income, expenses, and other financial activities to the Internal Revenue Service (IRS).

Who needs to file the Form 1120-H?

+Homeowner associations (HOAs) and condominium management companies need to file the Form 1120-H.

What is the deadline for filing the Form 1120-H?

+The deadline for filing the Form 1120-H is typically March 15th of each year.

We hope this article has provided you with valuable insights and tips for filing the Form 1120-H. Remember to consult with a tax professional if you have any questions or concerns. Share your thoughts and experiences in the comments below!