As the tax season approaches, individuals and employers alike begin to prepare for the necessary filings and submissions. One crucial document in this process is the UMD W-2 form, a vital piece of paperwork that plays a significant role in the tax return process. In this article, we will delve into the world of the UMD W-2 form, explaining its importance, structure, and significance in the grand scheme of tax season.

The UMD W-2 form, also known as the Wage and Tax Statement, is a tax document that employers are required to provide to their employees and the Social Security Administration (SSA) by the end of January each year. This form serves as a report of the employee's income, taxes withheld, and other relevant information, making it an essential component of the tax filing process. For employees, the UMD W-2 form provides critical information needed to complete their tax returns accurately.

Why is the UMD W-2 Form Important?

The UMD W-2 form is crucial for several reasons:

- It provides employees with a detailed breakdown of their income, taxes withheld, and other relevant information, enabling them to complete their tax returns accurately.

- Employers use the UMD W-2 form to report their employees' income and taxes withheld to the SSA, ensuring compliance with tax regulations.

- The SSA uses the information provided on the UMD W-2 form to determine employees' Social Security benefits and Medicare eligibility.

Understanding the Structure of the UMD W-2 Form

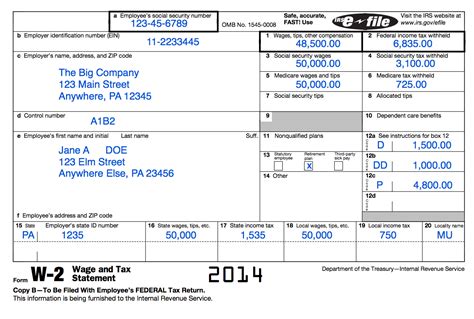

The UMD W-2 form consists of several sections, each containing vital information. The main sections include:

- Employee's Information: This section contains the employee's name, address, and Social Security number.

- Employer's Information: This section includes the employer's name, address, and Employer Identification Number (EIN).

- Wages, Tips, and Other Compensation: This section reports the employee's total wages, tips, and other compensation, including bonuses and commissions.

- Federal Income Tax Withheld: This section shows the total amount of federal income tax withheld from the employee's wages.

- Social Security Wages: This section reports the employee's Social Security wages, which are subject to Social Security tax.

- Social Security Tax Withheld: This section shows the total amount of Social Security tax withheld from the employee's wages.

- Medicare Wages and Tax Withheld: This section reports the employee's Medicare wages and the total amount of Medicare tax withheld.

What to Do with Your UMD W-2 Form

Once you receive your UMD W-2 form, follow these steps:

- Review the Form: Carefully review the form to ensure all information is accurate, including your name, address, and Social Security number.

- Use it to Complete Your Tax Return: Use the information provided on the UMD W-2 form to complete your tax return, ensuring you report your income and taxes withheld accurately.

- Keep it for Your Records: Keep a copy of the UMD W-2 form for your records, as you may need to refer to it in the future.

Common Mistakes to Avoid

When dealing with the UMD W-2 form, be aware of the following common mistakes:

- Inaccurate Information: Ensure all information on the form is accurate, including your name, address, and Social Security number.

- Missing or Lost Forms: If you don't receive your UMD W-2 form or it's lost, contact your employer or the SSA to obtain a replacement.

- Incorrect Tax Withholding: Review the form to ensure the correct amount of taxes is withheld, as this can impact your tax return.

UMD W-2 Form and Tax Season

The UMD W-2 form plays a significant role in the tax season, as it provides critical information needed to complete tax returns accurately. By understanding the structure and importance of the UMD W-2 form, you can navigate the tax season with confidence.

If you have any questions or concerns about the UMD W-2 form or tax season, don't hesitate to reach out to your employer or a tax professional. Share your thoughts and experiences with the UMD W-2 form in the comments below.

What is the deadline for employers to provide employees with the UMD W-2 form?

+Employers are required to provide employees with the UMD W-2 form by January 31st of each year.

What should I do if I don't receive my UMD W-2 form?

+If you don't receive your UMD W-2 form, contact your employer or the SSA to obtain a replacement.

Can I file my tax return without the UMD W-2 form?

+No, you cannot file your tax return without the UMD W-2 form, as it provides critical information needed to complete your tax return accurately.