Obtaining your UCSD W2 form in a timely manner is essential for filing your taxes and meeting the deadlines set by the Internal Revenue Service (IRS). The W2 form, also known as the Wage and Tax Statement, provides critical information about your income and the taxes withheld from your paycheck. If you're a University of California, San Diego (UCSD) employee, here are five ways to obtain your W2 form quickly:

Understanding the UCSD W2 Form

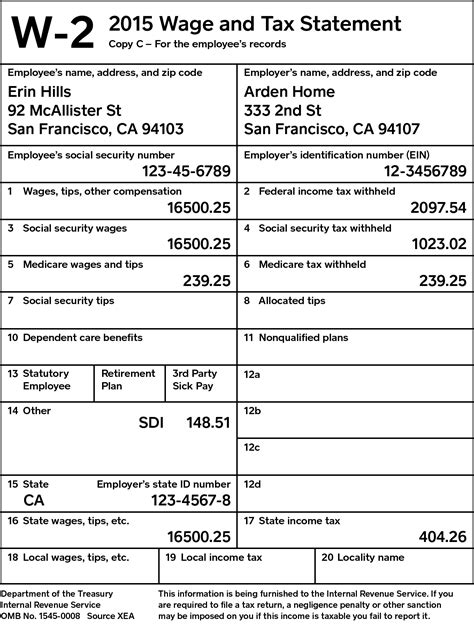

The UCSD W2 form is a document that reports your income and tax withholdings for the calendar year. It's usually issued by the UCSD Payroll Department by January 31st of each year. The form includes important details such as:

- Your name, address, and Social Security number

- UCSD's Employer Identification Number (EIN)

- Your income and tax withholdings for the year

- Any other relevant tax information

Method 1: Online Access through UCSD's Employee Portal

One of the fastest ways to obtain your UCSD W2 form is through the university's employee portal. If you're a current or former UCSD employee, you can log in to the portal and access your W2 form online. Here's how:

- Go to the UCSD employee portal website and log in with your username and password

- Click on the "Payroll" or "Benefits" tab

- Look for the "W2 Form" or "Tax Documents" section

- Click on the link to view and print your W2 form

Tips for Online Access

- Make sure you have the latest version of Adobe Acrobat Reader installed on your computer to view and print your W2 form

- If you're having trouble accessing your W2 form online, contact the UCSD Payroll Department for assistance

Method 2: Contact the UCSD Payroll Department

If you're unable to access your W2 form online or need a duplicate copy, you can contact the UCSD Payroll Department directly. Here's how:

- Call the UCSD Payroll Department at (858) 534-5555

- Email the payroll department at

- Visit the payroll department in person at the UCSD campus

Tips for Contacting the Payroll Department

- Be prepared to provide your employee ID number or Social Security number to verify your identity

- If you're requesting a duplicate W2 form, be prepared to provide a valid reason for the request

Method 3: Check Your Mailbox

If you're a current or former UCSD employee, you should receive your W2 form in the mail by January 31st of each year. Here's what you need to do:

- Check your mailbox regularly for a letter from the UCSD Payroll Department

- Look for a envelope with a UCSD logo and a return address from the payroll department

- Open the envelope and carefully review your W2 form for accuracy

Tips for Checking Your Mailbox

- Make sure your address is up-to-date with the UCSD Payroll Department to ensure timely delivery of your W2 form

- If you don't receive your W2 form by February 15th, contact the payroll department to request a duplicate copy

Method 4: Use the IRS Website

If you're unable to obtain your W2 form from UCSD, you can use the IRS website to get a copy. Here's how:

- Go to the IRS website at

- Click on the "Get Transcript" tab

- Select the "Get Transcript Online" option

- Follow the prompts to enter your Social Security number and other identifying information

- Select the "W2" option and choose the tax year you need

Tips for Using the IRS Website

- Make sure you have a valid Social Security number and other identifying information to access your W2 form

- If you're having trouble accessing your W2 form online, contact the IRS at (800) 829-1040 for assistance

Method 5: Contact the Social Security Administration

If you're unable to obtain your W2 form from UCSD or the IRS, you can contact the Social Security Administration (SSA) for assistance. Here's how:

- Call the SSA at (800) 772-1213

- Visit the SSA website at

- Visit your local SSA office in person

Tips for Contacting the SSA

- Be prepared to provide your Social Security number and other identifying information to verify your identity

- If you're requesting a duplicate W2 form, be prepared to provide a valid reason for the request

Conclusion: Get Your UCSD W2 Form Quickly and Easily

Obtaining your UCSD W2 form quickly and easily is essential for filing your taxes and meeting the deadlines set by the IRS. By following these five methods, you can get your W2 form in no time. Remember to act fast, as the IRS deadlines for filing taxes are strict, and late filers may face penalties and fines.

What is a UCSD W2 form?

+A UCSD W2 form is a document that reports your income and tax withholdings for the calendar year.

How do I access my UCSD W2 form online?

+You can access your UCSD W2 form online through the university's employee portal.

What if I don't receive my UCSD W2 form in the mail?

+If you don't receive your UCSD W2 form in the mail, you can contact the UCSD Payroll Department or use the IRS website to get a copy.