Transferring an account from one financial institution to another can be a daunting task, but it doesn't have to be. One of the most crucial steps in this process is filling out an account transfer form, also known as an account transfer request or account transfer authorization. This form serves as a formal request to transfer your account from one institution to another, and it's essential to complete it accurately to avoid any delays or complications.

Why is an Account Transfer Form Important?

An account transfer form is a critical document that helps financial institutions to facilitate a smooth transfer of your account. By completing this form, you're providing the necessary information for the transfer to take place. This form typically includes details such as your account information, the type of transfer you're requesting, and the receiving institution's details.

Benefits of Completing an Account Transfer Form

Completing an account transfer form offers several benefits, including:

- Streamlined Transfer Process: By providing all the necessary information upfront, you can ensure a faster and more efficient transfer process.

- Reduced Errors: An account transfer form helps minimize errors that can occur during the transfer process, ensuring that your account is transferred correctly.

- Increased Security: This form helps to verify your identity and account information, reducing the risk of unauthorized transfers.

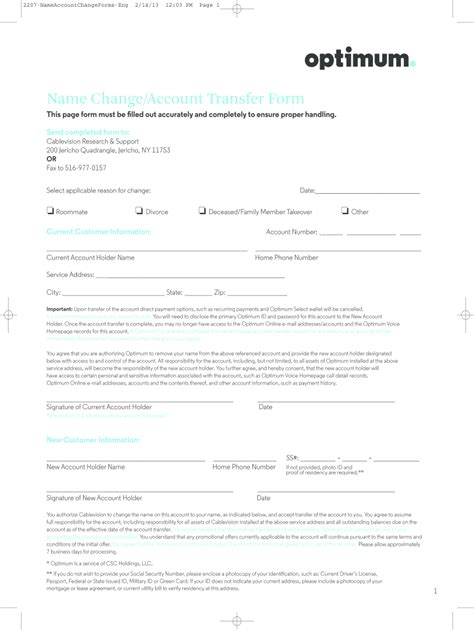

5 Ways to Complete an Optimum Account Transfer Form

To ensure that you complete an optimum account transfer form, follow these five steps:

1. Gather Required Information

Collecting Essential Details

Before starting the account transfer form, gather all the necessary information, including:

- Your account number and type

- The receiving institution's details, including their name, address, and routing number

- The type of transfer you're requesting (e.g., IRA, 401(k), or brokerage account)

2. Choose the Correct Transfer Type

Selecting the Right Transfer Option

Select the correct transfer type to ensure that your account is transferred correctly. Common transfer types include:

- Direct transfer: A direct transfer from one institution to another.

- Indirect transfer: A transfer that involves a third-party intermediary.

- Wire transfer: A transfer that uses a wire transfer service.

3. Verify Account Information

Confirming Account Details

Double-check your account information to ensure that it's accurate and up-to-date. This includes:

- Your account number and type

- The receiving institution's details

- Your name and address

4. Review and Sign the Form

Finalizing the Account Transfer Form

Carefully review the account transfer form to ensure that all information is accurate and complete. Sign the form to authorize the transfer.

5. Submit the Form

Completing the Transfer Process

Submit the completed account transfer form to the receiving institution, either in person, by mail, or online, depending on their requirements.

By following these five steps, you can complete an optimum account transfer form and ensure a smooth transfer of your account.

Now that you've learned how to complete an account transfer form, don't hesitate to reach out to your financial institution for assistance. Share this article with others who may benefit from this information, and leave a comment below with any questions or feedback.

What is an account transfer form?

+An account transfer form is a document that authorizes the transfer of an account from one financial institution to another.

Why do I need to complete an account transfer form?

+Completing an account transfer form helps to ensure a smooth transfer of your account by providing the necessary information for the transfer to take place.

What information do I need to provide on the account transfer form?

+You'll need to provide your account information, the receiving institution's details, and the type of transfer you're requesting.