Understanding the Importance of Sales Tax Exemption in Colorado

As a business owner or individual in Colorado, it's essential to understand the sales tax exemption process to avoid unnecessary tax liabilities. The Colorado Department of Revenue offers a sales tax exemption certificate, also known as Form DR 0563, to help eligible businesses and organizations purchase goods and services without paying sales tax. In this article, we'll delve into the details of the Colorado sales tax exemption certificate form DR 0563, its benefits, and provide a step-by-step guide on how to complete and use it.

Benefits of the Colorado Sales Tax Exemption Certificate

The Colorado sales tax exemption certificate form DR 0563 offers several benefits to eligible businesses and organizations. These benefits include:

- Reduced tax liabilities: By exempting eligible purchases from sales tax, businesses and organizations can reduce their overall tax liabilities.

- Increased cash flow: Exempting sales tax on purchases can help businesses and organizations conserve cash flow, which can be used for other essential expenses.

- Simplified tax compliance: The sales tax exemption certificate form DR 0563 helps businesses and organizations simplify their tax compliance by providing a clear and concise process for claiming exemptions.

Who is Eligible for the Colorado Sales Tax Exemption Certificate?

To be eligible for the Colorado sales tax exemption certificate form DR 0563, businesses and organizations must meet specific criteria. These criteria include:

- Being a registered business or organization in Colorado

- Having a valid Colorado sales tax account number

- Meeting specific exemption requirements, such as being a non-profit organization or a government agency

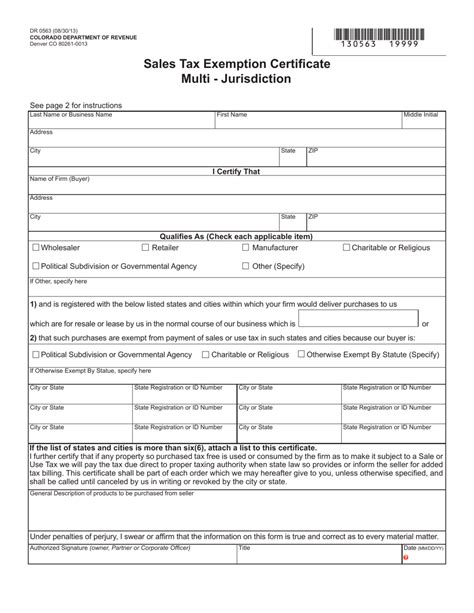

Step-by-Step Guide to Completing the Colorado Sales Tax Exemption Certificate Form DR 0563

Completing the Colorado sales tax exemption certificate form DR 0563 is a straightforward process. Here's a step-by-step guide to help you get started:

- Download the form: Download the Colorado sales tax exemption certificate form DR 0563 from the Colorado Department of Revenue website or obtain a copy from a local business office.

- Complete the form: Fill out the form with the required information, including your business or organization name, address, and sales tax account number.

- Specify the exemption type: Identify the type of exemption you're claiming, such as a non-profit organization or government agency.

- Provide documentation: Attach supporting documentation, such as a copy of your sales tax license or exemption certificate.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and complete.

Using the Colorado Sales Tax Exemption Certificate Form DR 0563

Once you've completed the Colorado sales tax exemption certificate form DR 0563, you can use it to claim exemptions on eligible purchases. Here's how:

- Present the form: Present the completed form to the seller or vendor at the time of purchase.

- Verify the exemption: Verify that the seller or vendor accepts the exemption certificate and will not charge sales tax.

- Keep records: Keep a copy of the exemption certificate and supporting documentation for your records.

Common Mistakes to Avoid When Completing the Colorado Sales Tax Exemption Certificate Form DR 0563

When completing the Colorado sales tax exemption certificate form DR 0563, it's essential to avoid common mistakes that can delay or reject your exemption claim. Here are some mistakes to avoid:

- Incomplete information: Ensure that you provide complete and accurate information on the form.

- Incorrect exemption type: Verify that you're claiming the correct exemption type.

- Missing documentation: Attach all required supporting documentation.

Conclusion

The Colorado sales tax exemption certificate form DR 0563 is an essential tool for businesses and organizations in Colorado to reduce tax liabilities and simplify tax compliance. By understanding the benefits, eligibility criteria, and completion process, you can ensure that you're taking advantage of this valuable exemption. Remember to avoid common mistakes and keep accurate records to support your exemption claims.

We'd love to hear from you!

Have you used the Colorado sales tax exemption certificate form DR 0563 before? Share your experiences or ask questions in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the purpose of the Colorado sales tax exemption certificate form DR 0563?

+The Colorado sales tax exemption certificate form DR 0563 is used to claim exemptions from sales tax on eligible purchases.

Who is eligible for the Colorado sales tax exemption certificate form DR 0563?

+Registered businesses and organizations in Colorado that meet specific exemption requirements are eligible for the Colorado sales tax exemption certificate form DR 0563.

How do I complete the Colorado sales tax exemption certificate form DR 0563?

+Complete the form with the required information, including your business or organization name, address, and sales tax account number. Specify the exemption type, provide documentation, and sign and date the form.