Kentucky is renowned for its stunning natural beauty, rich history, and vibrant culture. From the scenic Bluegrass Region to the rugged Appalachian Mountains, the state has a lot to offer. However, for nonresidents who have earned income from Kentucky sources, there's another aspect to consider - tax filing. In this article, we'll delve into the world of Kentucky Form 740NP, the nonresident tax return form, and provide a comprehensive guide on how to navigate it.

Kentucky Form 740NP is used by nonresidents to report their income earned from Kentucky sources. This form is a critical component of the state's tax system, ensuring that nonresidents contribute their fair share to the state's revenue. In the following sections, we'll explore the importance of Form 740NP, its components, and the filing process.

Understanding Kentucky Form 740NP

Before we dive into the details, let's understand what Kentucky Form 740NP is all about. This form is used by nonresidents to report their income earned from Kentucky sources, such as:

- Wages earned while working in Kentucky

- Income from Kentucky-based businesses or investments

- Rental income from Kentucky properties

- Income from Kentucky-based trusts or estates

The form is used to calculate the nonresident's tax liability, which is typically a percentage of their total income earned from Kentucky sources.

Who Needs to File Kentucky Form 740NP?

Not everyone who earns income from Kentucky sources needs to file Form 740NP. To determine if you need to file, ask yourself the following questions:

- Are you a nonresident of Kentucky?

- Did you earn income from Kentucky sources during the tax year?

- Is your total income from Kentucky sources greater than $12,000?

If you answered "yes" to all three questions, you'll likely need to file Kentucky Form 740NP.

Components of Kentucky Form 740NP

Kentucky Form 740NP consists of several sections, each with its own set of requirements and calculations. Here's a breakdown of the form's components:

- Personal Information: This section requires your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Income: This section requires you to report your income from Kentucky sources, including wages, business income, rental income, and income from trusts or estates.

- Adjustments and Deductions: This section allows you to claim adjustments and deductions, such as the standard deduction or itemized deductions.

- Tax Computation: This section calculates your tax liability based on your income and adjustments.

- Payments and Credits: This section requires you to report any payments or credits you're eligible for, such as the earned income tax credit (EITC).

Filing Status and Residency

When filing Kentucky Form 740NP, you'll need to indicate your filing status and residency. Your filing status will determine the tax rates and deductions you're eligible for. Your residency status will determine which income is subject to Kentucky taxation.

Filing Kentucky Form 740NP

Filing Kentucky Form 740NP can be done electronically or by mail. Here are the steps to follow:

- Electronic Filing: You can e-file your return using the Kentucky Department of Revenue's online portal. This is the fastest way to file and receive your refund.

- Mail Filing: You can also file your return by mail. Make sure to sign and date your return, and include all required documentation and payment.

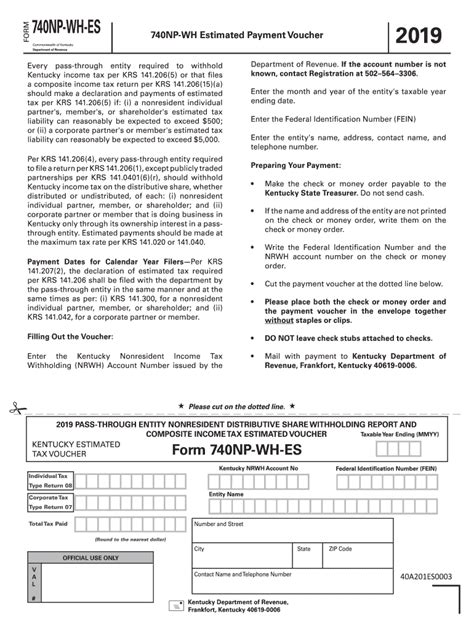

Payment Options

If you owe taxes, you can pay online, by phone, or by mail. Here are the payment options:

- Online Payment: You can pay online using the Kentucky Department of Revenue's online portal.

- Phone Payment: You can pay by phone using a credit or debit card.

- Mail Payment: You can pay by mail using a check or money order.

Common Errors and Penalties

When filing Kentucky Form 740NP, it's essential to avoid common errors and penalties. Here are some tips to help you avoid mistakes:

- Inaccurate Information: Make sure to provide accurate information, including your name, address, and Social Security number or ITIN.

- Missing Documentation: Ensure you include all required documentation, such as W-2s and 1099s.

- Incorrect Filing Status: Verify your filing status and residency to avoid errors.

- Late Filing: File your return on time to avoid late-filing penalties.

Audit and Appeal Process

If you're audited or disagree with your tax assessment, you have the right to appeal. Here's what you need to know:

- Audit Process: The Kentucky Department of Revenue may audit your return to verify the accuracy of your income and deductions.

- Appeal Process: If you disagree with your tax assessment, you can appeal to the Kentucky Board of Tax Appeals.

Conclusion

Filing Kentucky Form 740NP can seem daunting, but with this guide, you're well-equipped to navigate the process. Remember to provide accurate information, include all required documentation, and file on time to avoid errors and penalties. If you have any questions or concerns, don't hesitate to reach out to the Kentucky Department of Revenue.

We hope this article has provided you with valuable insights into Kentucky Form 740NP. If you have any questions or comments, please feel free to share them below.

FAQ Section:

Who needs to file Kentucky Form 740NP?

+Nonresidents who earn income from Kentucky sources, such as wages, business income, rental income, or income from trusts or estates, need to file Kentucky Form 740NP.

What is the filing deadline for Kentucky Form 740NP?

+The filing deadline for Kentucky Form 740NP is typically April 15th, but this may vary depending on the tax year and any extensions.

Can I e-file my Kentucky Form 740NP?

+Yes, you can e-file your Kentucky Form 740NP using the Kentucky Department of Revenue's online portal.