Navigating the complexities of government forms can be a daunting task, especially when dealing with sensitive information such as tax returns and employee data. Form 4025-R is one such document that requires careful attention to detail and accuracy. In this article, we will delve into the intricacies of Form 4025-R, providing a step-by-step guide on how to complete it correctly.

For employers, understanding Form 4025-R is crucial to avoid any potential penalties or fines. This form is used to report employee data to the relevant authorities, and its accuracy is paramount. In this article, we will break down the form into sections, providing a comprehensive guide on how to complete it.

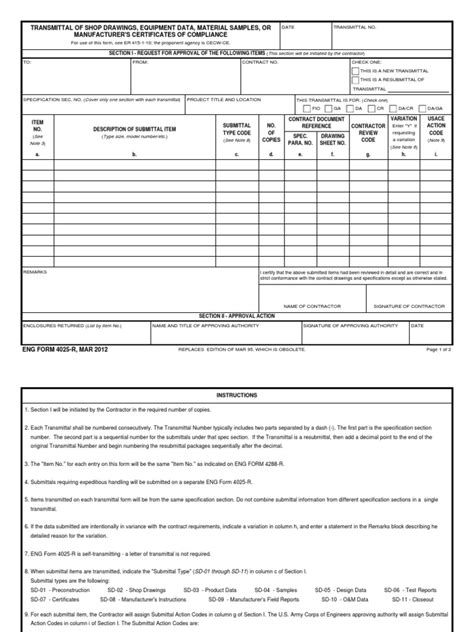

What is Form 4025-R?

Form 4025-R is a tax-related document used by employers to report employee data to the relevant authorities. The form requires employers to provide detailed information about their employees, including their names, addresses, social security numbers, and wages earned. The form is typically used for tax purposes, such as reporting income tax withholding and social security tax.

Why is Form 4025-R Important?

Form 4025-R is an essential document for employers, as it helps to ensure compliance with tax laws and regulations. Accurate completion of the form is crucial to avoid any potential penalties or fines. Moreover, the form provides valuable information to the authorities, which helps to identify and prevent tax evasion.

Step-by-Step Guide to Completing Form 4025-R

Completing Form 4025-R requires attention to detail and accuracy. Here is a step-by-step guide to help you complete the form correctly:

Section 1: Employer Information

In this section, you will need to provide information about your company, including:

- Company name and address

- Employer Identification Number (EIN)

- Tax year

Section 2: Employee Information

In this section, you will need to provide information about each of your employees, including:

- Employee name and address

- Social security number

- Wages earned

- Tax withheld

Section 3: Tax Withholding

In this section, you will need to provide information about tax withholding, including:

- Total tax withheld

- Federal income tax withheld

- Social security tax withheld

Common Mistakes to Avoid

When completing Form 4025-R, there are several common mistakes to avoid, including:

- Inaccurate employee information

- Incorrect tax withholding calculations

- Failure to report all employees

Conclusion

Completing Form 4025-R requires attention to detail and accuracy. By following the step-by-step guide provided in this article, you can ensure that you complete the form correctly and avoid any potential penalties or fines. Remember to double-check your information and calculations to ensure accuracy.

If you have any questions or concerns about Form 4025-R, please don't hesitate to reach out. We encourage you to share your experiences and tips for completing the form in the comments section below.

What is the purpose of Form 4025-R?

+Form 4025-R is used to report employee data to the relevant authorities for tax purposes.

Who needs to complete Form 4025-R?

+Employers need to complete Form 4025-R to report employee data to the relevant authorities.

What are the common mistakes to avoid when completing Form 4025-R?

+Inaccurate employee information, incorrect tax withholding calculations, and failure to report all employees are common mistakes to avoid when completing Form 4025-R.