As a student or family member of a student at the University of California, Davis, navigating the complexities of tax season can be overwhelming. One crucial document that plays a significant role in this process is the 1098-T form. In this article, we will delve into the world of the UC Davis 1098-T form, explaining its purpose, benefits, and how to accurately complete it for a seamless tax filing experience.

What is the 1098-T Form?

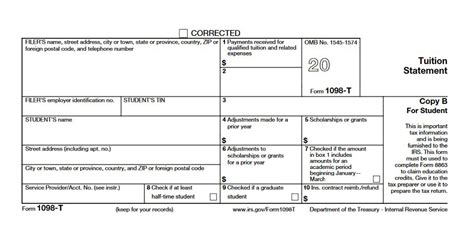

The 1098-T form, also known as the Tuition Statement, is a document provided by the University of California, Davis, to students who have paid qualified tuition and related expenses during the calendar year. The form reports the amount of tuition and fees paid, as well as any scholarships, grants, or other forms of financial aid received. The primary purpose of the 1098-T form is to assist students in claiming education-related tax credits and deductions on their tax returns.

Why is the 1098-T Form Important?

The 1098-T form is essential for several reasons:

- Tax Credits and Deductions: The form provides students with the necessary information to claim education-related tax credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Accurate Tax Filing: The 1098-T form helps students accurately report their tuition and fees paid, ensuring they receive the correct tax credits and deductions.

- Compliance with IRS Regulations: The University of California, Davis, is required to provide the 1098-T form to students who have paid qualified tuition and related expenses, as mandated by the Internal Revenue Service (IRS).

How to Read and Understand the 1098-T Form

The 1098-T form is divided into several sections, each providing critical information for tax filing purposes:

- Box 1: Payments Received: This section reports the total amount of tuition and fees paid during the calendar year.

- Box 2: Amounts Billed: This section reports the total amount of tuition and fees billed during the calendar year.

- Box 3: Scholarships and Grants: This section reports the total amount of scholarships, grants, and other forms of financial aid received during the calendar year.

- Box 4: Adjustments to Previous Year's Reporting: This section reports any adjustments made to the previous year's reporting.

Common Mistakes to Avoid When Completing the 1098-T Form

To ensure accurate tax filing, it is crucial to avoid common mistakes when completing the 1098-T form:

- Incorrect Student Information: Verify that the student's name, address, and Social Security number are accurate.

- Incorrect Payment Amounts: Ensure that the payment amounts reported in Box 1 and Box 2 are accurate.

- Failure to Report Scholarships and Grants: Failure to report scholarships and grants received may result in incorrect tax credits and deductions.

Tax Credits and Deductions: What You Need to Know

The 1098-T form is used to claim education-related tax credits and deductions. Two of the most common tax credits are:

- American Opportunity Tax Credit: This credit provides up to $2,500 per eligible student for qualified tuition and fees paid.

- Lifetime Learning Credit: This credit provides up to $2,000 per tax return for qualified tuition and fees paid.

How to Obtain a Duplicate 1098-T Form

If you need a duplicate 1098-T form, you can:

- Contact the University of California, Davis: Reach out to the university's student accounts office to request a duplicate form.

- Check Your Online Account: Log in to your online student account to access and print a duplicate form.

Conclusion

The UC Davis 1098-T form is a critical document for students and families navigating the complexities of tax season. By understanding the purpose, benefits, and how to accurately complete the form, you can ensure a seamless tax filing experience. Remember to avoid common mistakes and take advantage of education-related tax credits and deductions. If you have any questions or concerns, don't hesitate to reach out to the University of California, Davis, or consult with a tax professional.

We hope this article has provided you with a comprehensive understanding of the UC Davis 1098-T form. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and experiences with us in the comments section below.