The Kansas K-4 form is an essential document for Kansas residents who want to withhold a specific amount of state income tax from their wages. Whether you're a new employee or an existing one, understanding how to file the K-4 form accurately is crucial to avoid any discrepancies in your tax withholding. In this article, we will provide you with 5 valuable tips for filing the Kansas K-4 form, ensuring you get it right the first time.

Understanding the Purpose of the Kansas K-4 Form

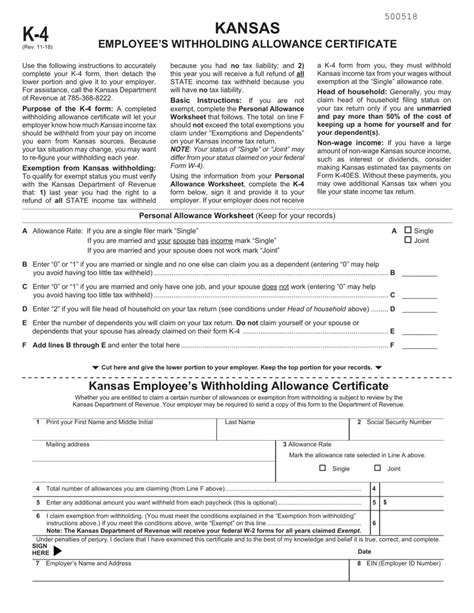

The Kansas K-4 form, also known as the Employee's Withholding Allowance Certificate, is used to determine the amount of Kansas state income tax to be withheld from an employee's wages. The form takes into account the employee's marital status, number of allowances, and any additional withholding amounts.

Tip 1: Gather Required Information Before Filing

Before filing the Kansas K-4 form, it's essential to gather all the required information to avoid any errors or delays. You will need to provide your:

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Marital status

- Number of allowances

- Additional withholding amount (if applicable)

Make sure you have all this information readily available to ensure a smooth filing process.

Number of Allowances: What You Need to Know

The number of allowances you claim on the K-4 form will directly impact the amount of state income tax withheld from your wages. Claiming too many allowances might result in under-withholding, while claiming too few might lead to over-withholding. It's essential to carefully review the number of allowances you claim to ensure accurate tax withholding.

Tip 2: Determine Your Marital Status

Your marital status plays a significant role in determining your tax withholding. On the K-4 form, you will need to indicate whether you are single, married, or head of household. This information will help determine your tax filing status and the corresponding withholding amount.

How to Claim Head of Household Status

To claim head of household status on the K-4 form, you must meet specific requirements, such as:

- Being unmarried or considered unmarried on the last day of the tax year

- Having paid more than half the cost of keeping up a home for the year

- Having a qualifying person living with you in the home for more than six months of the year

If you meet these requirements, you can claim head of household status on the K-4 form, which might result in a lower tax withholding amount.

Tip 3: Claim Additional Allowances (If Applicable)

If you have dependents or other qualifying individuals, you might be eligible to claim additional allowances on the K-4 form. This can include:

- Dependents, such as children or elderly parents

- Other qualifying individuals, such as a disabled spouse or dependent

Claiming additional allowances can reduce your tax withholding amount, but be sure to only claim allowances you are eligible for to avoid any discrepancies.

Tip 4: Submit the Form to Your Employer

Once you have completed the K-4 form, submit it to your employer as soon as possible. Your employer will use the information on the form to determine the correct amount of state income tax to withhold from your wages.

What to Expect After Submission

After submitting the K-4 form, your employer will update your tax withholding information and adjust your payroll accordingly. You might notice a change in the amount of state income tax withheld from your wages, depending on the information you provided on the form.

Tip 5: Review and Update the Form as Necessary

It's essential to review the K-4 form regularly to ensure the information is accurate and up-to-date. If you experience any changes in your marital status, number of allowances, or additional withholding amounts, update the form accordingly.

By following these 5 tips for filing the Kansas K-4 form, you can ensure accurate tax withholding and avoid any discrepancies. Remember to gather required information, determine your marital status, claim additional allowances (if applicable), submit the form to your employer, and review and update the form as necessary.

Don't forget to share this article with your friends and family who might be filing the Kansas K-4 form. If you have any questions or comments, please leave them below.

What is the purpose of the Kansas K-4 form?

+The Kansas K-4 form is used to determine the amount of Kansas state income tax to be withheld from an employee's wages.

What information do I need to provide on the K-4 form?

+You will need to provide your Social Security number or ITIN, marital status, number of allowances, and additional withholding amount (if applicable).

How often should I review and update the K-4 form?

+It's essential to review the K-4 form regularly to ensure the information is accurate and up-to-date. You should update the form whenever you experience any changes in your marital status, number of allowances, or additional withholding amounts.