The Earned Income Tax Credit (EIC) is a refundable tax credit designed to benefit low-to-moderate-income working individuals and families. As part of the EIC process, the IRS requires taxpayers to complete Form 886-EIC, also known as the Earned Income Credit (EIC) Supplemental Qualification Worksheet. This form is used to verify the eligibility of taxpayers for the EIC and ensure they receive the correct credit amount. In this article, we will delve into the world of Form 886-EIC, exploring its purpose, who needs to file it, and what information is required.

What is Form 886-EIC?

Form 886-EIC is an IRS form used to supplement the EIC claimed on a taxpayer's tax return. It is a worksheet that helps taxpayers determine if they meet the eligibility requirements for the EIC and calculates the correct credit amount. The form is designed to ensure that taxpayers receive the correct EIC amount and prevent errors or potential audits.

Why is Form 886-EIC necessary?

The IRS requires Form 886-EIC to verify the EIC eligibility of taxpayers and prevent potential errors or abuse. The form helps the IRS to:

- Verify the taxpayer's income and family size

- Determine if the taxpayer meets the EIC eligibility requirements

- Calculate the correct EIC amount

By completing Form 886-EIC, taxpayers can ensure they receive the correct EIC amount and avoid potential delays or audits.

Who needs to file Form 886-EIC?

Not all taxpayers need to file Form 886-EIC. However, if you claim the EIC on your tax return, you may need to complete this form if:

- You have a qualifying child and claim the EIC

- You have a disabled or elderly family member and claim the EIC

- You have a complex tax situation, such as self-employment income or investment income

- You have a change in income or family size that affects your EIC eligibility

If you are unsure whether you need to file Form 886-EIC, consult with a tax professional or contact the IRS.

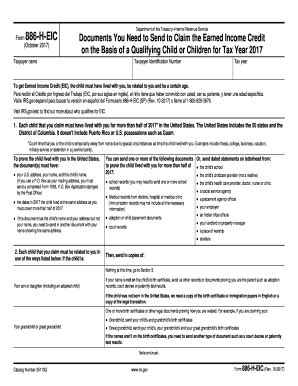

What information is required on Form 886-EIC?

Form 886-EIC requires taxpayers to provide information about their income, family size, and EIC eligibility. The form asks for the following information:

- Taxpayer's name and Social Security number

- Income information, including wages, self-employment income, and investment income

- Family size and information about qualifying children or disabled family members

- Information about any prior year EIC claims or audits

Taxpayers must also complete a worksheet to calculate their EIC amount and determine if they meet the eligibility requirements.

How to complete Form 886-EIC

Completing Form 886-EIC requires taxpayers to follow these steps:

- Gather all necessary documents, including tax returns, W-2 forms, and 1099 forms

- Complete the EIC worksheet to calculate the credit amount

- Answer questions about income, family size, and EIC eligibility

- Sign and date the form

- Attach the form to the tax return (Form 1040)

It is essential to complete Form 886-EIC accurately and thoroughly to avoid delays or audits.

Tips for completing Form 886-EIC

To ensure accurate completion of Form 886-EIC, follow these tips:

- Use the correct form version for the tax year

- Read the instructions carefully

- Use the EIC worksheet to calculate the credit amount

- Double-check math calculations

- Keep a copy of the completed form for your records

By following these tips, taxpayers can ensure accurate completion of Form 886-EIC and avoid potential issues.

Common mistakes to avoid when completing Form 886-EIC

When completing Form 886-EIC, taxpayers should avoid the following common mistakes:

- Inaccurate income reporting

- Incorrect family size or qualifying child information

- Failure to complete the EIC worksheet

- Math errors or incorrect credit calculations

- Failure to sign and date the form

By avoiding these common mistakes, taxpayers can ensure accurate completion of Form 886-EIC and avoid potential delays or audits.

What happens if I make a mistake on Form 886-EIC?

If you make a mistake on Form 886-EIC, the IRS may:

- Delay processing your tax return

- Request additional information or documentation

- Conduct an audit to verify EIC eligibility

- Adjust or disallow the EIC claim

To avoid these consequences, it is essential to double-check your work and ensure accurate completion of Form 886-EIC.

Conclusion: Take control of your EIC claim with Form 886-EIC

Form 886-EIC is an essential part of the EIC process, ensuring that taxpayers receive the correct credit amount and meet the eligibility requirements. By understanding the purpose, eligibility, and requirements of Form 886-EIC, taxpayers can take control of their EIC claim and avoid potential delays or audits. Remember to complete the form accurately, avoid common mistakes, and seek professional help if needed.

We hope this article has provided you with a comprehensive understanding of Form 886-EIC and its importance in the EIC process. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form 886-EIC?

+Form 886-EIC is used to verify the eligibility of taxpayers for the Earned Income Tax Credit (EIC) and calculate the correct credit amount.

Who needs to file Form 886-EIC?

+Taxpayers who claim the EIC on their tax return may need to file Form 886-EIC, especially if they have a qualifying child, disabled or elderly family member, or complex tax situation.

What information is required on Form 886-EIC?

+Form 886-EIC requires taxpayers to provide information about their income, family size, and EIC eligibility, including tax returns, W-2 forms, and 1099 forms.