The world of mortgage lending can be complex and overwhelming, especially when it comes to calculating income. As a lender, it's essential to accurately determine a borrower's income to ensure they can afford the loan payments. Fannie Mae Form 1084 is a widely used tool in the mortgage industry to calculate income, but navigating it can be a challenge. In this article, we'll break down the form and provide a comprehensive guide on how to calculate income using Fannie Mae Form 1084.

Calculating income is a critical step in the mortgage lending process. It helps lenders determine a borrower's ability to repay the loan and ensures that they're not over-extending themselves. However, calculating income can be a complex task, especially when dealing with self-employed borrowers or those with non-traditional income sources. That's where Fannie Mae Form 1084 comes in – a standardized form used to calculate income and provide a clear picture of a borrower's financial situation.

Using Fannie Mae Form 1084: A Step-by-Step Guide

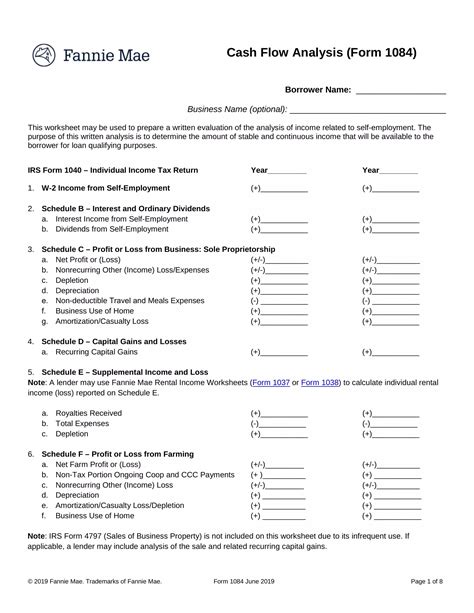

Fannie Mae Form 1084 is a three-page document that requires lenders to gather detailed information about a borrower's income, employment, and financial situation. The form is divided into several sections, each designed to capture specific information about the borrower's income. Here's a step-by-step guide on how to complete the form:

Section 1: Borrower Information

The first section of the form requires basic borrower information, including their name, social security number, and employment status. This section also asks for the borrower's job title, employer name, and length of employment.

Section 2: Income Calculation

This section is the heart of the form, where lenders calculate the borrower's income. The section is divided into several subsections, each addressing a different type of income:

- Salary and Wages: This subsection requires lenders to calculate the borrower's gross income from their primary job. Lenders must provide documentation, such as pay stubs and W-2 forms, to support the income calculation.

- Self-Employment Income: This subsection addresses self-employment income, including income from businesses, investments, and other sources. Lenders must provide documentation, such as tax returns and financial statements, to support the income calculation.

- Rental Income: This subsection calculates rental income from properties owned by the borrower. Lenders must provide documentation, such as rental agreements and tax returns, to support the income calculation.

- Other Income: This subsection addresses other sources of income, such as alimony, child support, and social security benefits.

Section 3: Adjustments to Income

This section requires lenders to make adjustments to the borrower's income, such as deductions for taxes, health insurance, and other expenses. The section also addresses income fluctuations, such as bonuses and commissions.

Section 4: Income Calculation Summary

The final section of the form provides a summary of the borrower's income calculation. Lenders must ensure that the income calculation is accurate and supported by documentation.

Benefits of Using Fannie Mae Form 1084

Using Fannie Mae Form 1084 offers several benefits, including:

- Standardized Income Calculation: The form provides a standardized approach to income calculation, ensuring consistency and accuracy.

- Reduced Risk: By accurately calculating income, lenders can reduce the risk of loan defaults and ensure that borrowers can afford the loan payments.

- Improved Efficiency: The form streamlines the income calculation process, reducing the time and effort required to process loan applications.

Common Challenges When Using Fannie Mae Form 1084

While Fannie Mae Form 1084 is a valuable tool, it's not without its challenges. Some common issues lenders face when using the form include:

- Complexity: The form can be complex and overwhelming, especially for lenders without experience in income calculation.

- Documentation Requirements: The form requires extensive documentation, which can be time-consuming to gather and review.

- Income Fluctuations: Income fluctuations, such as bonuses and commissions, can make it challenging to accurately calculate income.

Tips for Accurate Income Calculation

To ensure accurate income calculation, lenders should:

- Gather Complete Documentation: Ensure that all required documentation is gathered and reviewed carefully.

- Use a Standardized Approach: Use a standardized approach to income calculation to ensure consistency and accuracy.

- Consider Income Fluctuations: Consider income fluctuations, such as bonuses and commissions, when calculating income.

In conclusion, Fannie Mae Form 1084 is a valuable tool in the mortgage lending process. By following the steps outlined in this guide, lenders can accurately calculate income and ensure that borrowers can afford the loan payments. While challenges may arise, using a standardized approach and considering income fluctuations can help lenders navigate the form with ease.

We hope this article has provided you with a comprehensive understanding of Fannie Mae Form 1084 and how to calculate income using the form. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from this information, and don't forget to subscribe to our blog for more informative content.

What is Fannie Mae Form 1084?

+Fannie Mae Form 1084 is a standardized form used to calculate income in the mortgage lending process.

Why is accurate income calculation important?

+Accurate income calculation is essential to ensure that borrowers can afford the loan payments and reduce the risk of loan defaults.

What are some common challenges when using Fannie Mae Form 1084?

+Common challenges include complexity, documentation requirements, and income fluctuations.