Taking Control of Your Financial Future with Tyson 401k Hardship Withdrawal Form

Managing your finances can be challenging, especially during unexpected events or emergencies. When faced with a financial crisis, it's essential to explore all available options to ensure your financial stability. For employees of Tyson Foods, the Tyson 401k hardship withdrawal form offers a potential solution to access funds during difficult times. In this article, we will guide you through the process of completing the Tyson 401k hardship withdrawal form in three easy steps.

Tyson Foods, one of the largest food companies in the world, provides its employees with a comprehensive 401k plan to help them save for retirement. However, unforeseen circumstances may require you to access your retirement funds earlier than planned. The Tyson 401k hardship withdrawal form is designed to help you navigate this process, but it's crucial to understand the rules and regulations surrounding this option.

Understanding the Tyson 401k Hardship Withdrawal Rules

Before initiating the withdrawal process, it's essential to understand the rules and regulations surrounding the Tyson 401k hardship withdrawal. The Internal Revenue Service (IRS) allows 401k plan participants to withdraw funds in cases of "immediate and heavy financial need." This may include events such as:

- Unreimbursed medical expenses

- Purchase of a primary residence

- Tuition and related educational expenses

- Prevention of foreclosure or eviction

- Funeral expenses

It's crucial to review the Tyson 401k plan documents and consult with a financial advisor to determine if your situation meets the eligibility criteria for a hardship withdrawal.

Step 1: Gather Required Documentation

To initiate the withdrawal process, you'll need to gather specific documentation to support your request. This may include:

- Proof of income and expenses

- Medical bills or invoices

- Mortgage statements or rental agreements

- Tuition bills or educational expenses

- Funeral expenses or obituary notices

Ensure you have all required documents ready, as incomplete or missing information may delay the processing of your request.

Step 2: Complete the Tyson 401k Hardship Withdrawal Form

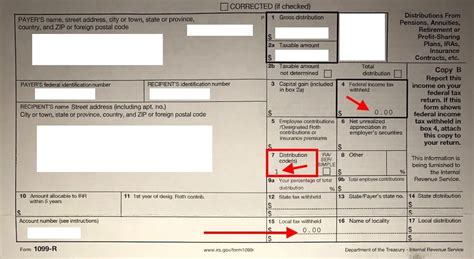

Once you've gathered all required documentation, you can proceed to complete the Tyson 401k hardship withdrawal form. This form will require you to provide detailed information about your financial situation, including:

- Your name and employee ID

- The reason for the withdrawal

- The amount you're requesting to withdraw

- Supporting documentation

Carefully review the form and ensure you've completed all required sections. Incomplete or inaccurate information may result in delays or rejection of your request.

Step 3: Submit the Form and Supporting Documentation

Once you've completed the Tyson 401k hardship withdrawal form, submit it along with the required documentation to the plan administrator. You can typically find the plan administrator's contact information on the Tyson Foods website or by reaching out to the HR department.

After submitting your request, the plan administrator will review your application and verify the information provided. If approved, the funds will be disbursed according to the plan's rules and regulations.

Tips and Reminders

- Carefully review the Tyson 401k plan documents and understand the rules and regulations surrounding hardship withdrawals.

- Ensure you have all required documentation ready before initiating the withdrawal process.

- Complete the Tyson 401k hardship withdrawal form accurately and thoroughly to avoid delays or rejection.

- Consider consulting with a financial advisor to explore alternative options and ensure you're making an informed decision.

By following these three easy steps, you can successfully complete the Tyson 401k hardship withdrawal form and access the funds you need during difficult times. Remember to carefully review the plan documents and understand the rules and regulations surrounding hardship withdrawals to ensure a smooth and efficient process.

Next Steps

If you're facing a financial crisis and considering a Tyson 401k hardship withdrawal, take the first step today. Gather the required documentation, complete the form, and submit it to the plan administrator. Remember to carefully review the plan documents and consider consulting with a financial advisor to ensure you're making an informed decision.

Don't let financial uncertainty hold you back. Take control of your financial future and explore the options available to you. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with colleagues who may be facing similar challenges.

What is a 401k hardship withdrawal?

+A 401k hardship withdrawal allows plan participants to withdraw funds from their retirement account in cases of "immediate and heavy financial need," as defined by the IRS.

What are the eligibility criteria for a Tyson 401k hardship withdrawal?

+The eligibility criteria for a Tyson 401k hardship withdrawal include events such as unreimbursed medical expenses, purchase of a primary residence, tuition and related educational expenses, prevention of foreclosure or eviction, and funeral expenses.

How do I initiate the Tyson 401k hardship withdrawal process?

+To initiate the process, gather the required documentation, complete the Tyson 401k hardship withdrawal form, and submit it to the plan administrator.