The SSA Form 8001, also known as the application for Social Security lump-sum death payment, is an essential document that provides vital information and assistance to the survivors of a deceased Social Security beneficiary. Despite its importance, many people are unaware of the form's purpose, requirements, and benefits. In this article, we will delve into the top 5 essential facts about SSA Form 8001, providing you with a comprehensive understanding of this crucial document.

What is SSA Form 8001?

SSA Form 8001 is an application for a lump-sum death payment, which is a one-time payment made to the eligible spouse or children of a deceased Social Security beneficiary. The form is used to gather necessary information about the deceased and their survivors, ensuring that the correct individuals receive the payment. The SSA uses this form to determine eligibility, calculate the payment amount, and facilitate the payment process.

Who is Eligible for SSA Form 8001?

To be eligible for SSA Form 8001, the deceased must have been a Social Security beneficiary, and the survivor must meet specific requirements. The eligible survivors include:

- A spouse who was living with the deceased at the time of death

- A spouse who was receiving Social Security benefits based on the deceased's record

- A child who was receiving Social Security benefits based on the deceased's record

- A parent who was receiving Social Security benefits based on the deceased's record

It is essential to note that the eligibility requirements may vary depending on the circumstances of the deceased and their survivors.

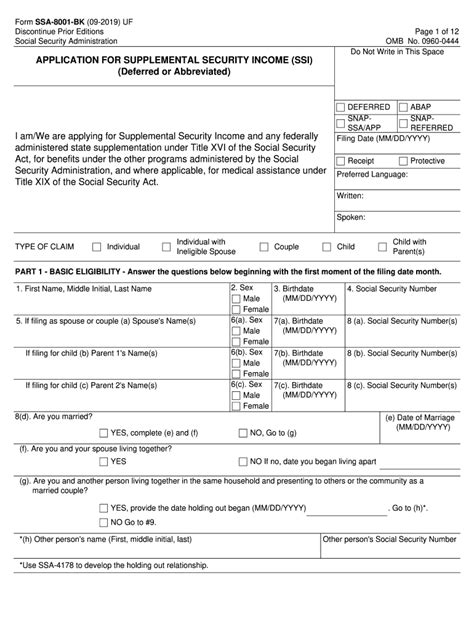

What Information is Required for SSA Form 8001?

When completing SSA Form 8001, you will need to provide various information about the deceased and their survivors. This includes:

- Personal details of the deceased, such as their name, Social Security number, and date of birth

- Information about the deceased's Social Security benefits, including their benefit amount and type of benefit

- Personal details of the survivor, including their name, Social Security number, and relationship to the deceased

- Information about the survivor's eligibility, including their age, disability status, and income level

How to Fill Out SSA Form 8001

Filling out SSA Form 8001 can be a straightforward process, but it is crucial to ensure that you provide accurate and complete information. Here are some tips to help you fill out the form correctly:

- Read the instructions carefully before starting the application process

- Gather all necessary documents and information before beginning the form

- Fill out the form legibly and accurately, using black ink and capital letters

- Sign and date the form, ensuring that you understand the certification and penalty statements

What Happens After Submitting SSA Form 8001?

Once you have submitted SSA Form 8001, the Social Security Administration will review your application to determine your eligibility for the lump-sum death payment. If your application is approved, you will receive the payment, which is typically $255. The payment is usually made to the eligible spouse or child, but in some cases, it may be split among multiple survivors.

Common Mistakes to Avoid When Filing SSA Form 8001

When filing SSA Form 8001, there are several common mistakes to avoid, including:

- Providing incomplete or inaccurate information

- Failing to sign and date the form correctly

- Not including required documentation or evidence

- Filing the form late or missing the deadline

By avoiding these mistakes, you can ensure a smooth and efficient application process, increasing your chances of receiving the lump-sum death payment.

Additional Resources for SSA Form 8001

If you need additional information or assistance with SSA Form 8001, there are several resources available, including:

- The Social Security Administration website (ssa.gov)

- The SSA's toll-free number (1-800-772-1213)

- Local SSA offices or representatives

- Online resources and support groups

Conclusion

In conclusion, SSA Form 8001 is a vital document that provides essential information and assistance to the survivors of a deceased Social Security beneficiary. By understanding the top 5 essential facts about this form, you can ensure a smooth and efficient application process, increasing your chances of receiving the lump-sum death payment.

We encourage you to share this article with others who may be affected by the loss of a loved one, and to reach out to us if you have any questions or concerns about SSA Form 8001.

What is the purpose of SSA Form 8001?

+SSA Form 8001 is an application for a lump-sum death payment, which is a one-time payment made to the eligible spouse or children of a deceased Social Security beneficiary.

Who is eligible for SSA Form 8001?

+The eligible survivors include a spouse who was living with the deceased at the time of death, a spouse who was receiving Social Security benefits based on the deceased's record, a child who was receiving Social Security benefits based on the deceased's record, and a parent who was receiving Social Security benefits based on the deceased's record.

What information is required for SSA Form 8001?

+The required information includes personal details of the deceased, information about the deceased's Social Security benefits, personal details of the survivor, and information about the survivor's eligibility.