As the world of hospitality continues to evolve, ensuring secure and efficient payment processing has become a top priority for hotels and resorts. One of the most popular hotel chains, Holiday Inn, requires a credit card authorization form to facilitate smooth transactions. In this article, we will delve into the requirements and intricacies of the Holiday Inn credit card authorization form, providing valuable insights for hoteliers, guests, and payment processors alike.

Understanding the Importance of Credit Card Authorization

Credit card authorization is a crucial step in securing payment for hotel reservations, amenities, and services. The authorization process verifies the cardholder's identity and confirms the availability of funds, reducing the risk of chargebacks and disputes. For hotels like Holiday Inn, obtaining a credit card authorization form is essential to ensure a seamless and secure payment experience.

Holiday Inn Credit Card Authorization Form Requirements

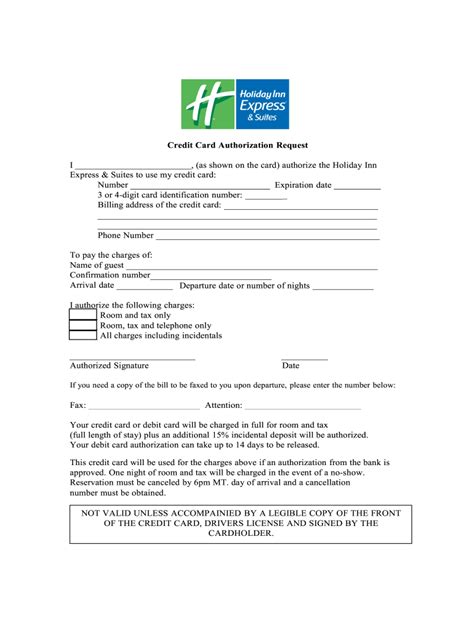

The Holiday Inn credit card authorization form is a standardized document that outlines the terms and conditions of payment. To ensure compliance, hotel staff must obtain a completed and signed authorization form from the guest before processing any payments. The form typically includes the following requirements:

- Cardholder Information: The guest's name, address, and contact details must match the information on the credit card.

- Credit Card Details: The credit card number, expiration date, and security code (CVV) must be provided to facilitate the authorization process.

- Authorization Amount: The total amount to be charged, including any applicable taxes, fees, or deposits, must be specified.

- Signature: The guest's signature is required to confirm their authorization for the payment.

How to Complete the Holiday Inn Credit Card Authorization Form

To complete the authorization form, guests must provide the required information and sign the document. Hotel staff must ensure that the form is completed accurately and in its entirety to avoid any discrepancies or disputes. Here's a step-by-step guide to completing the form:

- Review the Form: Carefully review the authorization form to ensure all required fields are completed.

- Verify Cardholder Information: Verify the guest's name, address, and contact details match the information on the credit card.

- Enter Credit Card Details: Enter the credit card number, expiration date, and security code (CVV) accurately.

- Specify Authorization Amount: Specify the total amount to be charged, including any applicable taxes, fees, or deposits.

- Obtain Signature: Obtain the guest's signature to confirm their authorization for the payment.

Best Practices for Managing Credit Card Authorization Forms

To ensure a smooth and secure payment experience, hotel staff must follow best practices for managing credit card authorization forms. Here are some tips:

- Maintain Accurate Records: Maintain accurate records of all authorization forms, including completed forms and any supporting documentation.

- Secure Storage: Store completed authorization forms in a secure location, such as a locked file cabinet or a secure digital storage system.

- Compliance with PCI-DSS: Ensure compliance with the Payment Card Industry Data Security Standard (PCI-DSS) to protect sensitive cardholder data.

Common Challenges and Solutions

Despite the importance of credit card authorization forms, hotels may encounter challenges in managing these documents. Here are some common challenges and solutions:

- Incomplete or Inaccurate Forms: Ensure that guests complete the authorization form accurately and in its entirety. Verify cardholder information and credit card details to avoid discrepancies.

- Lost or Misplaced Forms: Implement a secure storage system to prevent loss or misplacement of authorization forms. Consider digitizing forms to reduce the risk of physical loss.

- Disputes and Chargebacks: Ensure that authorization forms are completed accurately and signed by the guest to reduce the risk of disputes and chargebacks.

Conclusion

In conclusion, the Holiday Inn credit card authorization form is a critical document that ensures a secure and efficient payment experience. By understanding the requirements and intricacies of the authorization form, hotel staff can provide a seamless and secure payment experience for guests. By following best practices for managing credit card authorization forms, hotels can reduce the risk of disputes and chargebacks, ensuring a positive and memorable experience for all guests.

What is the purpose of a credit card authorization form?

+The purpose of a credit card authorization form is to verify the cardholder's identity and confirm the availability of funds, reducing the risk of chargebacks and disputes.

What information is required on a Holiday Inn credit card authorization form?

+The Holiday Inn credit card authorization form requires cardholder information, credit card details, authorization amount, and the guest's signature.

How can hotels ensure compliance with PCI-DSS?

+Hotels can ensure compliance with PCI-DSS by implementing secure storage systems, encrypting sensitive cardholder data, and regularly training staff on PCI-DSS guidelines.