As a publisher monetizing your online content through Google AdSense, you're required to submit a W-9 form to Google. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document that provides Google with your accurate tax identification information. In this article, we'll walk you through a step-by-step guide on how to fill out the Google AdSense W-9 form.

Why is the W-9 form necessary?

Before we dive into the filing process, it's essential to understand why the W-9 form is necessary. The W-9 form serves as a verification tool for Google to ensure that they're complying with the US tax laws. By providing your accurate tax identification information, you're helping Google to:

- Verify your identity and tax status

- Report your earnings accurately to the Internal Revenue Service (IRS)

- Withhold taxes correctly, if applicable

Gathering necessary information

Before filling out the W-9 form, make sure you have the following information readily available:

- Your business name (if applicable)

- Your Social Security number or Employer Identification Number (EIN)

- Your address

- Your tax classification (individual, sole proprietor, single-member LLC, etc.)

Step-by-Step Filing Guide

The W-9 form is a straightforward document that requires basic information. Follow these steps to fill out the form accurately:

Section 1: Name and Business Name

- If you're filing as an individual, enter your full name in the "Name" field.

- If you're filing as a business, enter your business name in the "Business Name" field.

Section 2: Business Entity Type

- Select the correct tax classification for your business:

- Sole proprietor or single-member LLC: Check "Individual/ Sole proprietor or single-member LLC"

- Corporation: Check "C Corporation" or "S Corporation"

- Partnership: Check "Partnership"

- Trust/estate: Check "Trust/estate"

Section 3: Taxpayer Identification Number

- Enter your Social Security number or EIN in the "Taxpayer Identification Number" field.

Section 4: Certification

- Sign and date the form to certify that the information provided is accurate.

Submitting the W-9 form

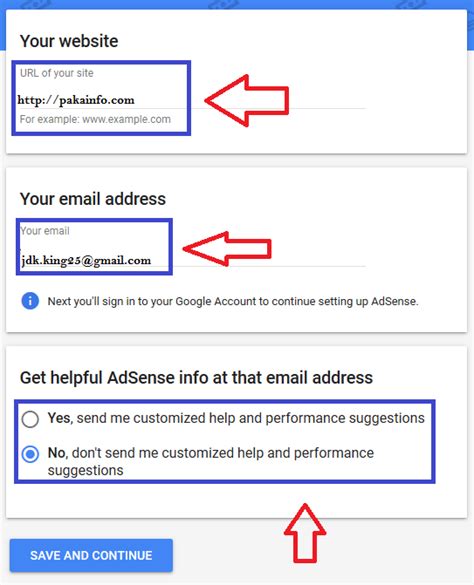

Once you've completed the W-9 form, you can submit it to Google through your AdSense account. Follow these steps:

- Sign in to your AdSense account

- Click on the "Payments" tab

- Click on the "Manage tax info" link

- Upload the completed W-9 form

Common mistakes to avoid

When filling out the W-9 form, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Using an incorrect tax classification

Conclusion

Filing the Google AdSense W-9 form is a straightforward process that requires basic information. By following this step-by-step guide, you can ensure that your tax identification information is accurate and up-to-date. Remember to avoid common mistakes and submit the form through your AdSense account.

Additional Tips

- Make sure to keep a copy of the completed W-9 form for your records.

- If you need to update your tax information, you can resubmit the W-9 form at any time.

- Google may request additional documentation or information to verify your tax status.

FAQs

What is the purpose of the W-9 form?

+The W-9 form is used to verify your tax identification information and ensure that Google is complying with US tax laws.

What information do I need to provide on the W-9 form?

+You'll need to provide your name, business name (if applicable), Social Security number or EIN, address, and tax classification.

How do I submit the W-9 form to Google?

+You can submit the W-9 form through your AdSense account by clicking on the "Payments" tab and then the "Manage tax info" link.

We hope this guide has helped you understand the process of filling out the Google AdSense W-9 form. If you have any further questions or concerns, feel free to comment below.