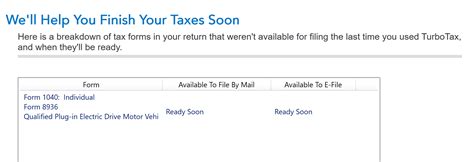

As the tax season approaches, individuals and businesses alike are scrambling to gather their financial documents and prepare their returns. For those who have invested in qualified plug-in electric vehicles, one crucial form to complete is the Turbotax Form 8936, also known as the Qualified Plug-in Electric Drive Motor Vehicle Credit. In this article, we will delve into the world of Turbotax Form 8936 and explore five ways to master it.

Understanding Turbotax Form 8936

Turbotax Form 8936 is used to calculate the Qualified Plug-in Electric Drive Motor Vehicle Credit, which can be claimed by individuals and businesses who have purchased a qualified plug-in electric vehicle. The credit is a non-refundable tax credit, meaning it can only reduce the taxpayer's liability to zero, but not result in a refund. The credit is calculated based on the vehicle's battery capacity, with a maximum credit of $7,500.

5 Ways to Master Turbotax Form 8936

1. Determine Eligibility

Before diving into the form, it's essential to determine whether you're eligible for the credit. To qualify, the vehicle must be a new, qualified plug-in electric drive motor vehicle, and the taxpayer must have purchased it after December 31, 2009. Additionally, the vehicle must have a gross vehicle weight rating of less than 14,000 pounds and meet specific emission standards.

2. Gather Required Documents

To complete Turbotax Form 8936, you'll need to gather specific documents, including:

- The vehicle's Manufacturer's Certification Statement, which can be obtained from the vehicle's manufacturer or the dealer who sold the vehicle

- The vehicle's Vehicle Identification Number (VIN)

- Proof of purchase, such as a sales contract or invoice

- Proof of registration, such as a registration card or title

Required Information

When gathering documents, make sure to have the following information:

- Vehicle make and model

- Vehicle Identification Number (VIN)

- Date of purchase

- Gross vehicle weight rating

- Battery capacity

3. Calculate the Credit

Once you have all the required documents, it's time to calculate the credit. The credit is calculated based on the vehicle's battery capacity, with a maximum credit of $7,500. The credit is phased out once the manufacturer has sold 200,000 qualified vehicles.

4. Complete the Form

Now that you've gathered all the required documents and calculated the credit, it's time to complete Turbotax Form 8936. The form is divided into two parts: Part I, which calculates the credit, and Part II, which reports the credit.

Part I: Credit Calculation

- Line 1: Enter the vehicle's battery capacity

- Line 2: Enter the credit phase-out amount (if applicable)

- Line 3: Calculate the credit

Part II: Credit Reporting

- Line 4: Enter the credit calculated in Part I

- Line 5: Enter the credit carryforward (if applicable)

5. Review and Submit

Once you've completed the form, review it carefully to ensure accuracy. Make sure to attach all required documents, including the Manufacturer's Certification Statement and proof of purchase. Finally, submit the form with your tax return.

Common Mistakes to Avoid

When completing Turbotax Form 8936, it's essential to avoid common mistakes that can delay or even disallow the credit. Some common mistakes include:

- Failing to attach required documents

- Incorrectly calculating the credit

- Failing to report the credit on the correct form

Conclusion

Mastering Turbotax Form 8936 requires attention to detail, accurate calculations, and careful documentation. By following the five steps outlined in this article, you can ensure a smooth and successful tax filing experience. Remember to review and submit the form carefully, and avoid common mistakes that can delay or disallow the credit.

Final Thoughts

Completing Turbotax Form 8936 may seem daunting, but with the right guidance and preparation, it can be a straightforward process. By taking the time to understand the form, gather required documents, and calculate the credit accurately, you can claim the Qualified Plug-in Electric Drive Motor Vehicle Credit and reduce your tax liability.

What is the maximum credit available for Turbotax Form 8936?

+The maximum credit available for Turbotax Form 8936 is $7,500.

What is the vehicle's gross vehicle weight rating requirement for Turbotax Form 8936?

+The vehicle's gross vehicle weight rating must be less than 14,000 pounds.

What documents are required to complete Turbotax Form 8936?

+The required documents include the Manufacturer's Certification Statement, Vehicle Identification Number (VIN), proof of purchase, and proof of registration.