Tax season can be a daunting time for many individuals and businesses, and one of the most important tax forms is the Form 1045, also known as the Application for Tentative Refund. This form is used to claim a refund for overpaid taxes, and it's essential to understand how to schedule it correctly to avoid any delays or penalties. In this article, we'll explore five ways to schedule a Form 1045, along with some valuable tips and insights to help you navigate the process.

Understanding Form 1045

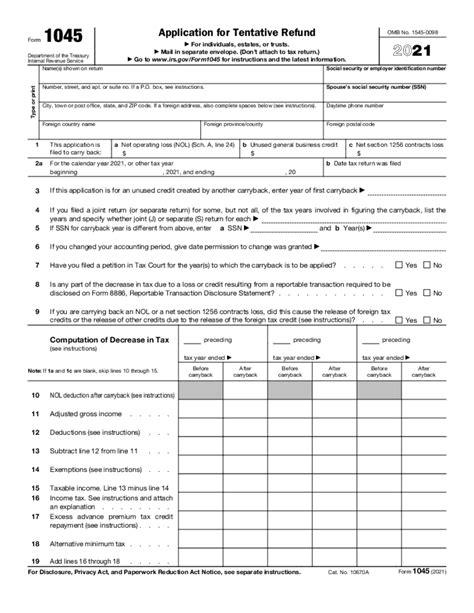

Before we dive into the scheduling process, let's quickly understand what Form 1045 is all about. This form is used to claim a refund for overpaid taxes, which can occur due to various reasons such as changes in income, deductions, or credits. The form allows taxpayers to calculate their tentative refund and request a refund from the IRS.

Method 1: E-Filing with Tax Software

One of the most convenient ways to schedule a Form 1045 is by using tax software that supports e-filing. Many popular tax software programs, such as TurboTax, H&R Block, and TaxAct, allow you to prepare and e-file your Form 1045. These programs will guide you through the process, ensuring that you provide all the necessary information and calculations.

Method 2: Mailing a Paper Form

If you prefer to file a paper Form 1045, you can download the form from the IRS website or pick one up from your local IRS office. Make sure to fill out the form accurately and attach all required supporting documents, such as your tax return and proof of overpayment. Mail the form to the IRS address listed in the instructions, and be sure to keep a copy for your records.

Method 3: Using a Tax Professional

If you're not comfortable preparing and filing your Form 1045 yourself, you can hire a tax professional to do it for you. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise and knowledge to ensure that your form is prepared accurately and filed correctly. They can also represent you in case of an audit or other issues.

Method 4: Using the IRS Free File Program

If you meet certain income and eligibility requirements, you may be able to use the IRS Free File program to prepare and e-file your Form 1045. This program is a partnership between the IRS and several tax software providers, offering free tax preparation and filing services to eligible taxpayers.

Method 5: Filing an Amended Return

In some cases, you may need to file an amended return (Form 1040X) instead of a Form 1045. This typically occurs when you need to correct errors or omissions on your original tax return. If you've already filed your tax return and realize that you overpaid taxes, you can file an amended return to claim a refund.

Tips and Insights

When scheduling a Form 1045, keep the following tips and insights in mind:

- Make sure to file your Form 1045 by the deadline, which is typically three years from the original tax filing deadline.

- Keep accurate records of your overpayment and supporting documentation, as you may need to provide this information to the IRS.

- If you're filing a paper Form 1045, make sure to use the correct mailing address and follow the instructions carefully.

- Consider hiring a tax professional if you're unsure about the filing process or need representation in case of an audit.

By following these methods and tips, you can ensure that your Form 1045 is scheduled correctly and that you receive your refund in a timely manner.

Common Mistakes to Avoid

When filing a Form 1045, it's essential to avoid common mistakes that can delay or even prevent your refund. Here are some mistakes to watch out for:

- Inaccurate or incomplete information

- Failure to attach supporting documentation

- Using the wrong mailing address or filing method

- Missing the filing deadline

By being aware of these common mistakes, you can take steps to avoid them and ensure a smooth filing process.

Next Steps

Now that you've scheduled your Form 1045, it's essential to follow up with the IRS to ensure that your refund is processed correctly. Here are some next steps to take:

- Check the status of your refund on the IRS website or by calling the IRS refund hotline.

- If you receive a notice or letter from the IRS, respond promptly and follow the instructions carefully.

- Keep accurate records of your refund and any correspondence with the IRS.

By following these next steps, you can ensure that your refund is processed correctly and that you receive your money in a timely manner.

We hope this article has provided you with valuable insights and information on how to schedule a Form 1045. Remember to take your time, follow the instructions carefully, and seek professional help if needed.

FAQ Section

What is the deadline for filing a Form 1045?

+The deadline for filing a Form 1045 is typically three years from the original tax filing deadline.

Can I file a Form 1045 electronically?

+Yes, you can file a Form 1045 electronically using tax software that supports e-filing.

What happens if I miss the filing deadline for my Form 1045?

+If you miss the filing deadline, you may be subject to penalties and interest on your overpayment.