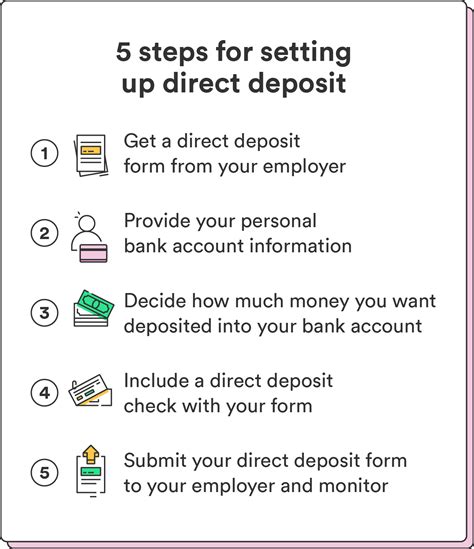

Managing your finances effectively is crucial in today's fast-paced world. One of the simplest ways to streamline your financial routine is by setting up direct deposit for your paycheck, benefits, or other regular payments. Truist Bank, formed by the merger of BB&T and SunTrust, offers a convenient and secure way to manage your money through its direct deposit services. Here's how you can set up Truist Bank direct deposit in 5 easy steps.

Understanding Truist Bank Direct Deposit

Direct deposit is a digital payment method that transfers funds directly from the payer's account to the recipient's account. This method eliminates the need for physical checks or cash, reducing the risk of lost, stolen, or damaged payments. Truist Bank's direct deposit service is designed to be user-friendly, ensuring that you can easily manage your finances online or through their mobile app.

Benefits of Using Truist Bank Direct Deposit

- Convenience: Funds are deposited directly into your account, saving you a trip to the bank or the hassle of waiting for a check to clear.

- Security: Direct deposit reduces the risk of check fraud or loss.

- Speed: Deposits are made quickly, often sooner than traditional check deposits.

- Environmentally Friendly: By reducing the need for paper checks, direct deposit is an eco-friendly option.

Step 1: Gather Necessary Information

Before you start the process, make sure you have the following information ready:

- Your Truist Bank account number

- The routing number for your account (found on the bottom of your checks or through the Truist Bank website/app)

- Your employer's or payer's information (if applicable)

Why Routing and Account Numbers Are Important

- Routing Number: Also known as the ABA (American Bankers Association) number, this is a 9-digit code that identifies Truist Bank and its location. It's crucial for ensuring that your deposits are directed to the correct bank.

- Account Number: This is your unique identifier within Truist Bank. It ensures that the deposit goes into your specific account.

Step 2: Set Up Direct Deposit with Your Employer or Payer

If your direct deposit is coming from an employer or a regular payer, you'll need to fill out a direct deposit authorization form. This form typically requires your name, address, account number, and routing number. Some employers or payers may have an online portal for setting up direct deposit, while others may require a physical form.

Tips for Filling Out the Authorization Form

- Double-check your account and routing numbers to avoid any errors.

- Make sure you understand the timing of when your deposits will be made.

- Ask about any specific requirements your employer or payer may have.

Step 3: Verify Your Account Information

After submitting your direct deposit authorization, it's crucial to verify that your account information is correct and active. You can do this by:

- Logging into your Truist Bank online banking or mobile app

- Contacting Truist Bank customer service

- Checking your next pay stub or payment notification

Importance of Verification

- Ensures correct deposits: Verifying your account ensures that your payments are deposited into the correct account.

- Reduces errors: It helps in identifying and correcting any errors before they cause inconvenience.

Step 4: Monitor Your Account Activity

Once your direct deposit is set up and verified, make it a habit to regularly monitor your account activity. This includes checking your balance, transaction history, and ensuring that your deposits are being made as expected.

Tips for Effective Account Monitoring

- Set up account alerts for large transactions or low balances.

- Regularly review your statements to catch any discrepancies early.

- Keep your contact information updated with Truist Bank to ensure you receive notifications.

Step 5: Adjust as Necessary

Life changes, such as a new job, moving to a new state, or changes in payment amounts, may require adjustments to your direct deposit setup. Truist Bank allows you to easily manage and update your direct deposit information through their online platform or by contacting their customer service.

Making Adjustments with Ease

- Log into your online banking or use the mobile app to make changes.

- Contact Truist Bank's customer service for assistance if you're unsure about the process.

- Keep records of your changes for future reference.

By following these 5 steps, you can easily set up and manage your Truist Bank direct deposit. Remember, direct deposit is a convenient, secure, and environmentally friendly way to manage your finances. Don't hesitate to reach out to Truist Bank's customer service if you have any questions or need assistance throughout the process.

Now that you know how to set up direct deposit with Truist Bank, consider sharing this article with friends or family who might find it useful. Have any questions about the process? Leave a comment below!

How long does it take for direct deposit to become active?

+The activation time for direct deposit can vary, typically taking a few pay cycles or about 2-4 weeks to become active, depending on the payer and the bank's processing time.

Can I have multiple direct deposits going into the same account?

+Yes, you can have multiple direct deposits going into the same account. This is common for individuals who receive a paycheck and other benefits, such as Social Security.

What happens if I enter incorrect account information?

+If you enter incorrect account information, your direct deposit may be delayed or rejected. It's essential to double-check your account and routing numbers to avoid any issues.