Filing taxes can be a daunting task, especially for those who are new to the process. In Maryland, residents are required to file their state income taxes using Form 510. While it may seem like a complex task, breaking down the process into smaller, manageable steps can make it much easier. In this article, we will guide you through the 7 essential steps for completing Maryland Form 510.

Understanding Maryland Form 510

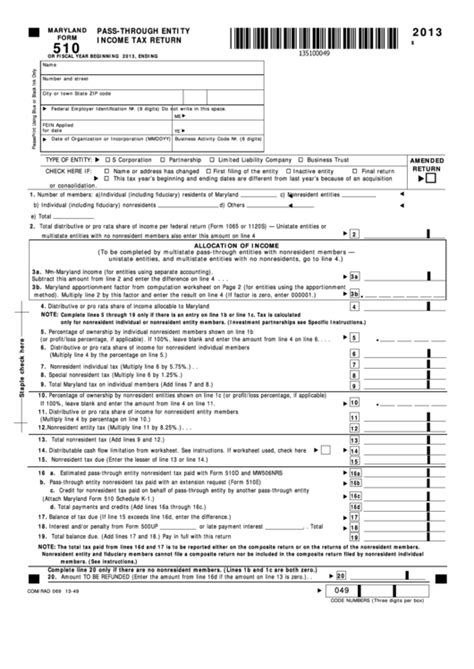

Before we dive into the steps, let's take a brief look at what Maryland Form 510 is. Form 510 is the Maryland state income tax return form that residents must file annually. It's used to report an individual's income, claim deductions and credits, and pay any state income tax owed.

Step 1: Gather Necessary Documents

To start filling out Form 510, you'll need to gather some necessary documents. These include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Having all these documents in one place will make it easier to complete the form.

Step 2: Determine Your Filing Status

Your filing status determines which tax rates and deductions you're eligible for. In Maryland, you can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Step 3: Report Your Income

This step involves reporting all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Unemployment benefits

You'll need to report this income on the corresponding lines of Form 510.

Step 4: Claim Deductions and Credits

Deductions and credits can help reduce your tax liability. In Maryland, you can claim deductions for:

- Charitable donations

- Medical expenses

- Mortgage interest

- State and local taxes

You can also claim credits for:

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Credit

- Education Credits

Step 5: Calculate Your Tax Liability

Once you've reported your income and claimed deductions and credits, you'll need to calculate your tax liability. This involves multiplying your taxable income by the applicable tax rate.

Step 6: Pay Any Tax Owed or Request a Refund

If you owe taxes, you'll need to pay the amount due by the filing deadline to avoid penalties and interest. If you're due a refund, you can request it by direct deposit or check.

Step 7: File Your Return

Finally, you'll need to file your completed Form 510 with the Maryland Comptroller's Office. You can file electronically or by mail.

By following these 7 essential steps, you'll be able to complete Maryland Form 510 with ease. Remember to double-check your math and ensure you've claimed all eligible deductions and credits.

If you have any questions or need further guidance, feel free to comment below. Share this article with others who may be struggling with their Maryland state income taxes.

What is the deadline for filing Maryland Form 510?

+The deadline for filing Maryland Form 510 is typically April 15th of each year.

Can I file Maryland Form 510 electronically?

+Yes, you can file Maryland Form 510 electronically through the Maryland Comptroller's website.

What is the penalty for late filing of Maryland Form 510?

+The penalty for late filing of Maryland Form 510 is 1% of the unpaid tax per month, up to a maximum of 25%.