The W-2 form is one of the most important documents you'll receive each year, providing valuable information about your income and taxes. While it may seem like a simple piece of paper, your W-2 form contains a wealth of information that can help you navigate the tax season and make informed financial decisions. In this article, we'll explore five key things your W-2 form tells you and what you can do with that information.

What is a W-2 Form?

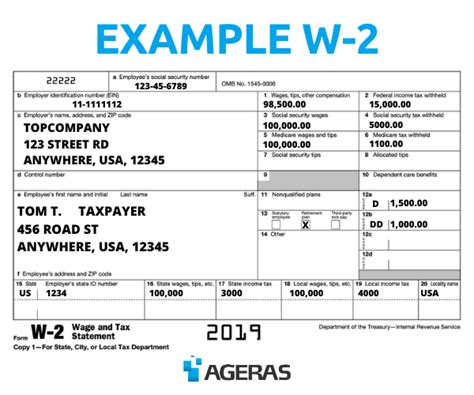

Before we dive into the details, let's quickly cover what a W-2 form is. A W-2 form, also known as the Wage and Tax Statement, is a document provided by your employer that reports your income and taxes withheld for the previous tax year. You should receive a W-2 form from each employer you worked for during the tax year.

1. Your Income and Tax Withholding

One of the most obvious things your W-2 form tells you is your income and tax withholding for the year. Box 1 on the form shows your total wages, tips, and other compensation, while Box 2 shows the total amount of federal income tax withheld. You'll also see the state and local taxes withheld in Boxes 15 and 17, respectively.

This information is crucial for completing your tax return, as you'll need to report your income and tax withholding accurately to avoid any errors or penalties. Make sure to review this information carefully and compare it to your pay stubs to ensure everything matches.

Tips for Reporting Income and Tax Withholding

- Verify that your income and tax withholding match your pay stubs and tax return from the previous year.

- If you have multiple W-2 forms, ensure you report all income and tax withholding on your tax return.

- Consider adjusting your tax withholding for the upcoming year if you notice you've been over- or under-withheld.

2. Your Social Security and Medicare Taxes

In addition to income and tax withholding, your W-2 form also reports the Social Security and Medicare taxes withheld from your paycheck. Box 4 shows the total amount of Social Security taxes withheld, while Box 6 shows the total amount of Medicare taxes withheld.

These taxes fund important social programs, including retirement benefits, disability insurance, and healthcare for seniors and low-income individuals. Understanding how much you've paid in Social Security and Medicare taxes can help you plan for your future and make informed decisions about your benefits.

Tips for Understanding Social Security and Medicare Taxes

- Check that your Social Security and Medicare taxes are correct and match your pay stubs.

- Consider consulting with a financial advisor to understand how these taxes impact your retirement and healthcare benefits.

- Review your Social Security statement to see how your taxes are affecting your future benefits.

3. Your Retirement Plan Contributions

If you participate in a retirement plan, such as a 401(k) or 403(b), your W-2 form will show the amount you contributed to the plan. Box 12 on the form reports the total amount of retirement plan contributions, including any employer matching contributions.

This information is important for reporting your retirement plan contributions on your tax return and for understanding how much you've saved for retirement. Make sure to review this information carefully and consider consulting with a financial advisor to optimize your retirement plan contributions.

Tips for Maximizing Retirement Plan Contributions

- Contribute as much as possible to your retirement plan, especially if your employer offers matching contributions.

- Consider contributing to a Roth IRA or traditional IRA in addition to your employer-sponsored retirement plan.

- Review your retirement plan contributions regularly to ensure you're on track to meet your retirement goals.

4. Your Health Insurance Premiums

If you receive health insurance through your employer, your W-2 form will report the amount of health insurance premiums paid on your behalf. Box 12 on the form shows the total amount of health insurance premiums, including any premiums paid by your employer.

This information is important for reporting your health insurance premiums on your tax return and for understanding how much you've paid for health insurance. Make sure to review this information carefully and consider consulting with a tax professional to ensure you're taking advantage of any available tax credits or deductions.

Tips for Reporting Health Insurance Premiums

- Verify that your health insurance premiums match your pay stubs and tax return from the previous year.

- Consider consulting with a tax professional to ensure you're taking advantage of any available tax credits or deductions.

- Review your health insurance premiums regularly to ensure you're getting the best value for your money.

5. Your Employer's Identity and Contact Information

Finally, your W-2 form provides important information about your employer's identity and contact information. The form shows your employer's name, address, and Employer Identification Number (EIN).

This information is crucial for reporting your income and taxes withheld on your tax return. Make sure to review this information carefully and verify that it matches your pay stubs and tax return from the previous year.

Tips for Verifying Employer Information

- Verify that your employer's name, address, and EIN match your pay stubs and tax return from the previous year.

- Contact your employer immediately if you notice any errors or discrepancies.

- Consider keeping a copy of your W-2 form for your records, in case you need to reference it in the future.

Now that you know what your W-2 form tells you, take the time to review it carefully and verify that all information is accurate. If you have any questions or concerns, don't hesitate to reach out to your employer or a tax professional for assistance.

What is a W-2 form?

+A W-2 form, also known as the Wage and Tax Statement, is a document provided by your employer that reports your income and taxes withheld for the previous tax year.

What information is reported on a W-2 form?

+A W-2 form reports your income, tax withholding, Social Security and Medicare taxes, retirement plan contributions, health insurance premiums, and employer's identity and contact information.

Why is it important to review my W-2 form carefully?

+Reviewing your W-2 form carefully ensures that all information is accurate and complete, which is crucial for reporting your income and taxes withheld on your tax return.