As we navigate the complexities of retirement planning, understanding the intricacies of required minimum distributions (RMDs) can be a daunting task. For account holders with TD Ameritrade, completing the RMD form is a crucial step in ensuring compliance with IRS regulations. In this article, we will break down the TD Ameritrade RMD form, providing a clear and concise guide to help you navigate the process.

The Importance of RMDs

RMDs are mandatory withdrawals from tax-deferred retirement accounts, such as 401(k), IRA, and 403(b) plans. The IRS requires account holders to take RMDs starting from the age of 72, as this marks the beginning of the distribution period. Failing to comply with RMD regulations can result in severe penalties, making it essential to understand the process.

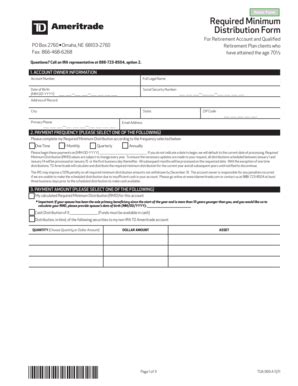

Understanding the TD Ameritrade RMD Form

The TD Ameritrade RMD form is a straightforward document that account holders must complete to initiate the RMD process. The form is designed to gather essential information about the account holder's retirement accounts and determine the correct RMD amount.

What Information is Required on the TD Ameritrade RMD Form?

To complete the TD Ameritrade RMD form, you will need to provide the following information:

- Account holder's name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Retirement account type (e.g., IRA, 401(k), 403(b))

- Account number and name of the retirement account

- Birthdate and age of the account holder

- Required minimum distribution (RMD) amount

How to Calculate Your RMD Amount

Calculating your RMD amount can be a complex process, but TD Ameritrade provides a helpful RMD calculator on their website. To use the calculator, you will need to provide the following information:

- Account balance as of December 31st of the previous year

- Life expectancy factor (based on the Uniform Lifetime Table)

Once you have entered the required information, the calculator will provide your RMD amount for the current year.

Completing the TD Ameritrade RMD Form

To complete the TD Ameritrade RMD form, follow these steps:

- Log in to your TD Ameritrade account online or contact a representative for assistance.

- Download and print the RMD form or complete it online.

- Fill in the required information, including your name, Social Security number or ITIN, and retirement account details.

- Calculate your RMD amount using the TD Ameritrade RMD calculator or consult with a financial advisor.

- Review and sign the form, then submit it to TD Ameritrade.

Key Considerations for RMDs

When completing the TD Ameritrade RMD form, keep the following key considerations in mind:

- RMD Deadline: The deadline for taking RMDs is December 31st of each year, starting from the age of 72.

- Penalties for Non-Compliance: Failure to comply with RMD regulations can result in a 50% penalty on the undistributed amount.

- Tax Implications: RMDs are considered taxable income, so it's essential to factor this into your tax planning strategy.

Conclusion

Completing the TD Ameritrade RMD form is a crucial step in ensuring compliance with IRS regulations and avoiding potential penalties. By understanding the process and key considerations, you can navigate the RMD landscape with confidence. If you have any further questions or concerns, don't hesitate to reach out to TD Ameritrade or consult with a financial advisor.

What is the deadline for taking RMDs?

+The deadline for taking RMDs is December 31st of each year, starting from the age of 72.

How do I calculate my RMD amount?

+You can use the TD Ameritrade RMD calculator or consult with a financial advisor to calculate your RMD amount.

What are the tax implications of RMDs?

+RMDs are considered taxable income, so it's essential to factor this into your tax planning strategy.

We hope this article has provided you with a comprehensive guide to the TD Ameritrade RMD form. If you have any further questions or concerns, don't hesitate to comment below or share this article with your friends and family.