When it comes to saving for retirement, having a solid plan in place is crucial. For many employees, a Simple IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) can be an attractive option. A Simple IRA Salary Reduction Agreement, specifically offered by Edward Jones, allows employees to contribute to their retirement savings through automatic payroll deductions. Here are five tips to help you navigate this agreement and make the most of your Simple IRA:

Understanding the Simple IRA Salary Reduction Agreement

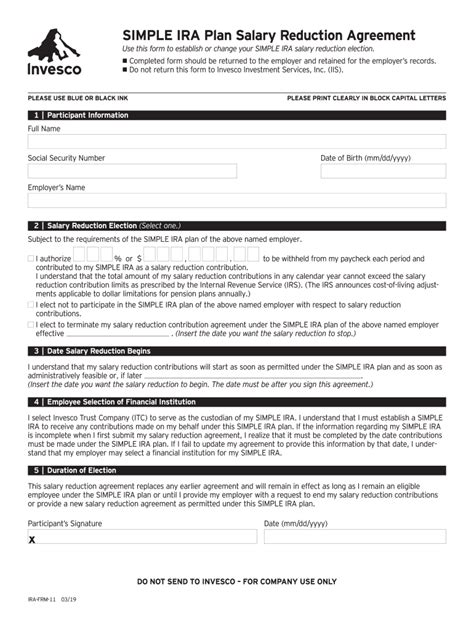

The Edward Jones Simple IRA Salary Reduction Agreement is a plan that enables employees to make tax-deductible contributions to their retirement account through payroll deductions. This agreement outlines the terms and conditions of the plan, including the contribution limits, eligibility requirements, and investment options.

Key Components of the Agreement

Before signing the agreement, it's essential to understand the key components, including:

- Eligibility requirements: Who is eligible to participate in the plan?

- Contribution limits: How much can you contribute to your Simple IRA each year?

- Investment options: What investment options are available through Edward Jones?

- Employer matching contributions: Will your employer make matching contributions to your Simple IRA?

Tips for Maximizing Your Simple IRA Contributions

To get the most out of your Simple IRA, follow these tips:

1. Contribute as Much as Possible

Contribute as much as possible to your Simple IRA, especially if your employer offers matching contributions. The more you contribute, the more you'll receive in matching funds.

2. Take Advantage of Employer Matching Contributions

If your employer offers matching contributions, make sure to contribute enough to maximize the match. This is essentially free money that can help your retirement savings grow faster.

3. Choose Your Investments Wisely

Select investment options that align with your retirement goals and risk tolerance. Edward Jones offers a range of investment options, including stocks, bonds, and mutual funds.

4. Review and Adjust Your Contributions Regularly

Regularly review your contributions and adjust them as needed. You may need to increase your contributions over time to keep pace with inflation or changing financial goals.

5. Consider Catch-Up Contributions

If you're 50 or older, consider making catch-up contributions to your Simple IRA. This can help you boost your retirement savings and make up for any lost time.

Investment Options with Edward Jones

Edward Jones offers a range of investment options for your Simple IRA, including:

- Stocks: Individual stocks or stock mutual funds

- Bonds: Government and corporate bonds

- Mutual Funds: A variety of mutual funds covering different asset classes

- Exchange-Traded Funds (ETFs): ETFs that track specific market indices

Benefits of a Simple IRA Salary Reduction Agreement

A Simple IRA Salary Reduction Agreement offers several benefits, including:

- Tax-deductible contributions: Reduce your taxable income by contributing to your Simple IRA

- Employer matching contributions: Receive free money from your employer to boost your retirement savings

- Flexibility: Adjust your contributions as needed to accommodate changing financial goals

- Investment options: Choose from a range of investment options to grow your retirement savings

Conclusion

A Simple IRA Salary Reduction Agreement can be a valuable tool for saving for retirement. By understanding the key components of the agreement and following the tips outlined above, you can maximize your contributions and make the most of your Simple IRA.

We hope this article has provided you with a comprehensive understanding of the Simple IRA Salary Reduction Agreement and how to make the most of it. If you have any questions or comments, please feel free to share them below.

What is a Simple IRA Salary Reduction Agreement?

+A Simple IRA Salary Reduction Agreement is a plan that allows employees to make tax-deductible contributions to their retirement account through payroll deductions.

Who is eligible to participate in a Simple IRA plan?

+Eligibility requirements vary depending on the employer, but generally, employees who are 21 years old and have worked for the employer for at least one year are eligible to participate.

What are the contribution limits for a Simple IRA?

+The contribution limits for a Simple IRA vary depending on the year and the individual's age. For 2022, the contribution limit is $14,000, and an additional $3,000 catch-up contribution is allowed for individuals 50 and older.