The convenience of direct deposit is a game-changer for individuals and businesses alike. Gone are the days of waiting for checks to arrive, only to then deposit them and wait for the funds to clear. With direct deposit, you can have your funds deposited directly into your account, saving you time and effort. In this article, we will explore the ICCU direct deposit form, its benefits, and how to easily enroll and set up this convenient service.

What is Direct Deposit?

Direct deposit is an electronic payment system that allows individuals and businesses to receive payments directly into their bank accounts. This service is offered by many financial institutions, including Idaho Central Credit Union (ICCU). With direct deposit, you can receive payments from various sources, including your employer, government agencies, and other financial institutions.

Benefits of Direct Deposit

Direct deposit offers numerous benefits, including:

- Convenience: No need to physically deposit checks or wait for funds to clear

- Speed: Funds are deposited directly into your account, making them available immediately

- Security: Reduced risk of lost or stolen checks

- Environmentally friendly: Reduces the need for paper checks and envelopes

How Does Direct Deposit Work?

The direct deposit process is straightforward. Here's how it works:

- The payer initiates a direct deposit transaction, providing the necessary information, including the recipient's account number and routing number.

- The transaction is processed electronically through the Automated Clearing House (ACH) network.

- The recipient's bank receives the transaction and deposits the funds into the designated account.

ICCU Direct Deposit Form: Easy Enrollment and Setup

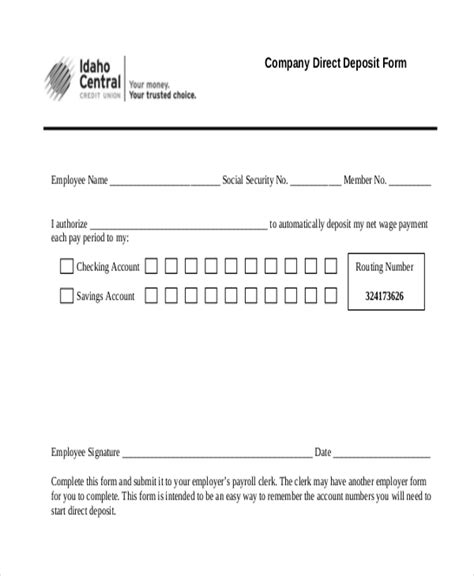

Enrolling in ICCU's direct deposit service is a simple process. Here's a step-by-step guide to help you get started:

- Gather required information: You will need your account number and routing number, which can be found on your ICCU checks or through online banking.

- Download the ICCU direct deposit form: Visit the ICCU website and download the direct deposit form. You can also obtain the form by visiting an ICCU branch or contacting their customer service.

- Complete the form: Fill out the form with the required information, including your account number, routing number, and the type of deposit you want to receive (e.g., payroll, social security benefits).

- Submit the form: Return the completed form to ICCU through the mail, fax, or in-person at a branch.

- Verify setup: Once ICCU receives and processes your form, they will verify the setup and ensure that your account is configured for direct deposit.

Tips for Successful Direct Deposit Setup

To ensure a smooth direct deposit setup process, keep the following tips in mind:

- Double-check information: Verify that your account number and routing number are accurate to avoid any delays or errors.

- Notify payers: Inform your payers (e.g., employer, government agencies) that you have enrolled in direct deposit and provide them with the necessary information.

- Monitor your account: Regularly check your account to ensure that deposits are being made correctly.

Common Issues with Direct Deposit

While direct deposit is a reliable service, issues can arise. Here are some common problems and their solutions:

- Delayed deposits: If your deposit is delayed, contact ICCU to investigate the issue. Ensure that your account information is accurate and that the payer has initiated the transaction correctly.

- Incorrect deposits: If you receive an incorrect deposit, contact ICCU immediately to resolve the issue. Provide them with the necessary information to correct the error.

Direct Deposit FAQ

- Q: Is direct deposit secure? A: Yes, direct deposit is a secure service that reduces the risk of lost or stolen checks.

- Q: Can I set up direct deposit for multiple accounts? A: Yes, you can set up direct deposit for multiple accounts, including checking and savings accounts.

- Q: How long does it take for direct deposit to become active? A: The setup process typically takes a few days to a week, depending on the payer and the financial institution.

What is the ICCU direct deposit form?

+The ICCU direct deposit form is a document that allows you to enroll in ICCU's direct deposit service. You can download the form from the ICCU website or obtain it by visiting an ICCU branch or contacting their customer service.

How do I set up direct deposit with ICCU?

+To set up direct deposit with ICCU, follow these steps: gather required information, download the ICCU direct deposit form, complete the form, submit the form, and verify setup.

What are the benefits of direct deposit?

+The benefits of direct deposit include convenience, speed, security, and environmental friendliness. Direct deposit reduces the need for paper checks and envelopes, making it a more sustainable option.

In conclusion, ICCU's direct deposit service offers a convenient, secure, and environmentally friendly way to receive payments. By following the easy enrollment and setup process, you can start enjoying the benefits of direct deposit today. If you have any further questions or concerns, don't hesitate to reach out to ICCU or leave a comment below. Share this article with friends and family who may benefit from direct deposit, and help spread the word about this convenient service!