The importance of central registry clearance cannot be overstated, especially for individuals and organizations looking to access critical services, loans, or even employment opportunities. A central registry is a database that stores information on individuals' or businesses' credit history, loan defaults, and other relevant data. Having a good understanding of the central registry clearance process is essential for anyone looking to navigate this complex system. In this article, we will outline the 5 steps to central registry clearance success, providing you with the knowledge and tools necessary to achieve a positive outcome.

Understanding the Central Registry Clearance Process

Before we dive into the 5 steps, it's essential to understand what central registry clearance entails. Central registry clearance is a verification process that checks an individual's or organization's credit history, loan defaults, and other relevant data against a central database. This process is crucial for lenders, employers, and other stakeholders who need to assess an individual's or organization's creditworthiness.

Why is Central Registry Clearance Important?

Central registry clearance is vital for several reasons:

- It helps lenders and creditors assess the creditworthiness of borrowers.

- It enables employers to verify the credit history of potential employees.

- It provides a standardized way of evaluating credit risk.

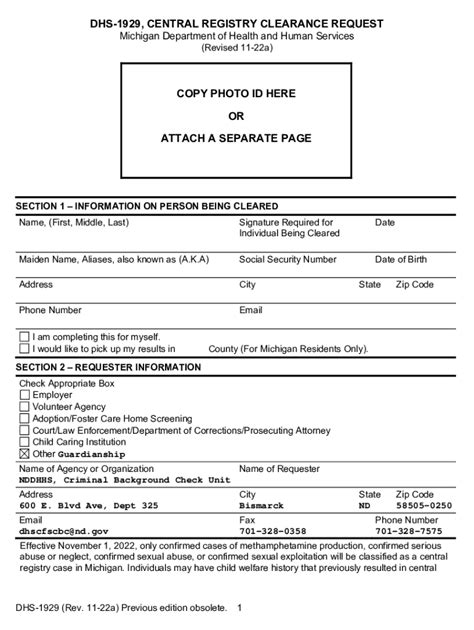

Step 1: Gathering Required Documents

The first step to central registry clearance success is gathering all the required documents. These documents typically include:

- Identification documents (e.g., passport, driver's license)

- Proof of income (e.g., payslips, tax returns)

- Proof of address (e.g., utility bills, bank statements)

- Credit reports from all three major credit bureaus

It's essential to ensure that all documents are up-to-date and accurate, as any discrepancies can lead to delays or rejection.

Tips for Gathering Required Documents

- Make sure to gather all documents in advance to avoid last-minute rushes.

- Verify the authenticity of documents to avoid any potential issues.

- Keep copies of all documents for future reference.

Step 2: Checking Credit Reports

The second step to central registry clearance success is checking credit reports from all three major credit bureaus. This step is crucial in identifying any errors or inaccuracies that could impact the clearance process.

- Obtain credit reports from Equifax, Experian, and TransUnion.

- Review reports carefully to identify any errors or inaccuracies.

- Dispute any errors or inaccuracies with the credit bureau.

Tips for Checking Credit Reports

- Check credit reports regularly to ensure accuracy.

- Dispute any errors or inaccuracies promptly to avoid delays.

- Keep copies of credit reports for future reference.

Step 3: Submitting Clearance Requests

The third step to central registry clearance success is submitting clearance requests to the relevant authorities. This step typically involves:

- Submitting clearance requests to the central registry.

- Providing all required documents and information.

- Paying any applicable fees.

Tips for Submitting Clearance Requests

- Submit clearance requests well in advance to avoid delays.

- Ensure all documents and information are accurate and complete.

- Keep copies of clearance requests for future reference.

Step 4: Addressing Any Issues

The fourth step to central registry clearance success is addressing any issues that may arise during the process. This step typically involves:

- Responding to any queries or requests for additional information.

- Addressing any errors or inaccuracies in credit reports.

- Providing additional documentation or information as required.

Tips for Addressing Any Issues

- Respond promptly to any queries or requests for additional information.

- Address any errors or inaccuracies in credit reports promptly.

- Keep copies of all correspondence and documentation.

Step 5: Receiving Clearance

The final step to central registry clearance success is receiving clearance. This step typically involves:

- Receiving clearance certificates or notifications.

- Verifying the accuracy of clearance certificates or notifications.

- Keeping copies of clearance certificates or notifications for future reference.

Tips for Receiving Clearance

- Verify the accuracy of clearance certificates or notifications.

- Keep copies of clearance certificates or notifications for future reference.

- Ensure all clearance certificates or notifications are up-to-date.

By following these 5 steps, individuals and organizations can achieve central registry clearance success. It's essential to remember that the clearance process can be complex and time-consuming, so it's crucial to be patient and persistent.

We encourage you to share your experiences and tips for achieving central registry clearance success in the comments section below. If you have any questions or need further clarification on any of the steps, please don't hesitate to ask.

What is central registry clearance?

+Central registry clearance is a verification process that checks an individual's or organization's credit history, loan defaults, and other relevant data against a central database.

Why is central registry clearance important?

+Central registry clearance is vital for several reasons, including helping lenders and creditors assess the creditworthiness of borrowers, enabling employers to verify the credit history of potential employees, and providing a standardized way of evaluating credit risk.

What documents are required for central registry clearance?

+The documents typically required for central registry clearance include identification documents, proof of income, proof of address, and credit reports from all three major credit bureaus.