The Internal Revenue Service (IRS) is constantly working to improve the tax filing process, making it more efficient and secure for taxpayers. One of the recent developments in this direction is the introduction of Form 8888, which allows taxpayers to direct deposit their refunds into multiple accounts. This feature, also known as "Total Refund Per Computer," is designed to provide taxpayers with greater flexibility and control over their refunds. In this article, we will delve into the details of Form 8888, exploring its benefits, how it works, and what taxpayers need to know to take advantage of this convenient feature.

What is Form 8888?

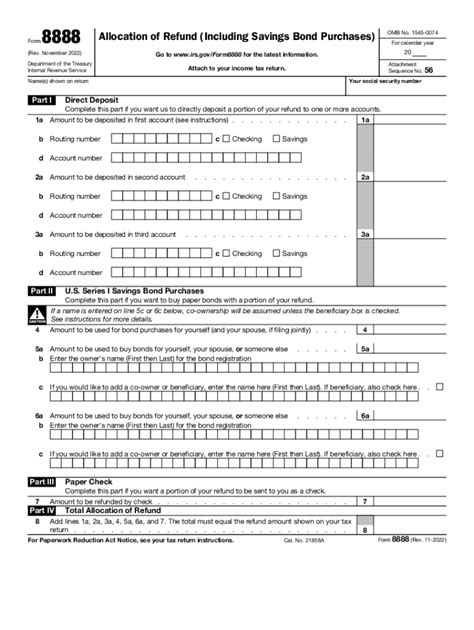

Form 8888, also known as the "Allocation of Refund (Including Savings Bond Purchases)" form, is a document that taxpayers can use to allocate their refund to multiple accounts. This includes checking and savings accounts, as well as the option to purchase U.S. savings bonds. By using Form 8888, taxpayers can divide their refund among different accounts, making it easier to manage their finances and achieve their financial goals.

Benefits of Using Form 8888

There are several benefits to using Form 8888 to direct deposit your refund into multiple accounts. Some of the key advantages include:

- Convenience: Form 8888 allows taxpayers to manage their refunds more efficiently, eliminating the need to wait for a paper check or deposit a single large sum into one account.

- Flexibility: Taxpayers can allocate their refund to multiple accounts, including checking and savings accounts, as well as U.S. savings bonds.

- Security: Direct deposit is a secure way to receive your refund, reducing the risk of lost or stolen checks.

- Speed: Refunds are typically deposited into accounts within 1-2 weeks of filing, making it faster than waiting for a paper check.

How to Use Form 8888

Using Form 8888 is a relatively straightforward process. Here are the steps you need to follow:

- Gather required information: You will need to provide the routing and account numbers for each account you want to allocate your refund to.

- Complete Form 8888: Fill out Form 8888, making sure to include all required information, such as your name, Social Security number, and account details.

- Attach Form 8888 to your tax return: Attach the completed Form 8888 to your tax return (Form 1040) and submit it to the IRS.

- Review and verify: Review your Form 8888 carefully to ensure accuracy and verify that the information is correct.

Total Refund Per Computer Explained

The "Total Refund Per Computer" feature on Form 8888 allows taxpayers to allocate their refund to multiple accounts using a single computer-generated form. This feature is designed to simplify the refund allocation process, making it easier for taxpayers to manage their refunds.

To use the "Total Refund Per Computer" feature, you will need to:

- Use tax preparation software: You will need to use tax preparation software that supports the "Total Refund Per Computer" feature, such as TurboTax or H&R Block.

- Complete the refund allocation section: Complete the refund allocation section of the software, entering the routing and account numbers for each account you want to allocate your refund to.

- Generate Form 8888: The software will generate a completed Form 8888, which you can then attach to your tax return.

Common Mistakes to Avoid

When using Form 8888, there are several common mistakes to avoid:

- Incorrect account information: Make sure to double-check the routing and account numbers for each account to ensure accuracy.

- Insufficient refund: Ensure that you have enough refund to cover the allocations to each account.

- Failed direct deposit: If the direct deposit fails, the IRS will issue a paper check, which may delay receipt of your refund.

Tips and Best Practices

Here are some tips and best practices to keep in mind when using Form 8888:

- Use tax preparation software: Using tax preparation software can simplify the refund allocation process and reduce the risk of errors.

- Review and verify: Carefully review and verify the information on Form 8888 to ensure accuracy.

- Keep records: Keep a copy of Form 8888 and your tax return for your records.

Conclusion

In conclusion, Form 8888 is a convenient and flexible way to manage your tax refund, allowing you to direct deposit your refund into multiple accounts. By following the steps outlined in this article and avoiding common mistakes, you can take advantage of this feature and achieve your financial goals.

We encourage you to share your thoughts and experiences with Form 8888 in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is Form 8888?

+Form 8888 is a document that taxpayers can use to allocate their refund to multiple accounts, including checking and savings accounts, as well as U.S. savings bonds.

How do I use Form 8888?

+To use Form 8888, gather the required information, complete the form, attach it to your tax return, and review and verify the information carefully.

What is the "Total Refund Per Computer" feature?

+The "Total Refund Per Computer" feature allows taxpayers to allocate their refund to multiple accounts using a single computer-generated form.