The Iowa W4p form, also known as the Certificate of Withholding for Iowa Pension and Annuity Payments, is a crucial document for both employees and employers in Iowa. This form is used to determine the amount of Iowa state income tax that should be withheld from pension and annuity payments. In this article, we will delve into the details of the Iowa W4p form, its importance, and how it affects both employees and employers.

What is the Iowa W4p Form?

The Iowa W4p form is a certificate that employees use to notify their employers of the amount of Iowa state income tax that should be withheld from their pension and annuity payments. This form is used to ensure that the correct amount of state income tax is withheld from these payments, which is essential for both employees and employers.

Why is the Iowa W4p Form Important?

The Iowa W4p form is important for several reasons:

- It ensures that the correct amount of Iowa state income tax is withheld from pension and annuity payments.

- It helps employees to avoid underpayment or overpayment of Iowa state income tax.

- It provides employers with the necessary information to withhold the correct amount of Iowa state income tax from pension and annuity payments.

How to Complete the Iowa W4p Form

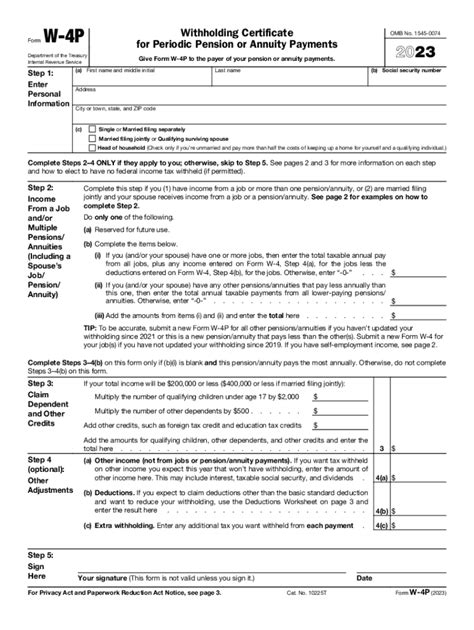

Completing the Iowa W4p form is a straightforward process. Here are the steps to follow:

- Download the Iowa W4p form from the Iowa Department of Revenue website or obtain it from your employer.

- Fill in your name, address, and Social Security number.

- Choose the filing status that applies to you (single, married, head of household, etc.).

- Enter the number of allowances you claim (if any).

- Sign and date the form.

Allowances and Exemptions

When completing the Iowa W4p form, you may be eligible for certain allowances and exemptions that can reduce the amount of Iowa state income tax withheld from your pension and annuity payments. These include:

- Personal allowance: You can claim one personal allowance for yourself and one for your spouse (if applicable).

- Dependent allowance: You can claim one dependent allowance for each dependent you claim on your Iowa state income tax return.

- Exemption from withholding: If you are exempt from Iowa state income tax withholding, you can claim this exemption on the Iowa W4p form.

Employer's Responsibilities

As an employer, you have certain responsibilities when it comes to the Iowa W4p form. These include:

- Providing the Iowa W4p form to employees who receive pension and annuity payments.

- Withholding the correct amount of Iowa state income tax from pension and annuity payments based on the information provided on the Iowa W4p form.

- Submitting the Iowa W4p form to the Iowa Department of Revenue if an employee claims exemption from withholding.

Penalties for Non-Compliance

Failure to comply with the Iowa W4p form requirements can result in penalties for both employees and employers. These penalties can include:

- Fines and interest for underpayment or overpayment of Iowa state income tax.

- Penalties for failure to withhold the correct amount of Iowa state income tax from pension and annuity payments.

FAQs

Here are some frequently asked questions about the Iowa W4p form:

- Q: Who is required to complete the Iowa W4p form? A: Employees who receive pension and annuity payments are required to complete the Iowa W4p form.

- Q: How often do I need to update my Iowa W4p form? A: You should update your Iowa W4p form whenever your tax status changes (e.g., marriage, divorce, birth of a child, etc.).

- Q: Can I claim exemption from withholding on the Iowa W4p form? A: Yes, you can claim exemption from withholding on the Iowa W4p form if you meet certain requirements.

What is the purpose of the Iowa W4p form?

+The Iowa W4p form is used to determine the amount of Iowa state income tax that should be withheld from pension and annuity payments.

Who is required to complete the Iowa W4p form?

+Employees who receive pension and annuity payments are required to complete the Iowa W4p form.

How often do I need to update my Iowa W4p form?

+You should update your Iowa W4p form whenever your tax status changes (e.g., marriage, divorce, birth of a child, etc.).

We hope this guide has provided you with a comprehensive understanding of the Iowa W4p form and its importance for both employees and employers. If you have any further questions or concerns, please do not hesitate to comment below. Share this article with others who may find it useful, and take the necessary steps to ensure compliance with the Iowa W4p form requirements.