Tax season can be a daunting time for many individuals, especially when it comes to navigating the complexities of the tax code. For residents of New Jersey, filing the 1040 form can seem like a monumental task. However, with a little guidance, it can be a relatively straightforward process. In this article, we will break down the steps involved in filing the 1040 form in NJ, highlighting key points to consider and providing valuable tips to make the process as smooth as possible.

Understanding the 1040 Form

The 1040 form is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. It is used to report an individual's income, deductions, and credits, as well as to calculate their tax liability. The form is typically filed annually, with the deadline being April 15th of each year.

Who Needs to File a 1040 Form in NJ?

Not everyone is required to file a 1040 form in NJ. The IRS has specific guidelines for who must file, based on factors such as age, income, and filing status. Generally, if you are a resident of New Jersey and have income that meets certain thresholds, you will need to file a 1040 form. These thresholds vary depending on your filing status, but as a rough guide, you will need to file if your gross income exceeds:

- $12,950 if single and under 65

- $19,400 if single and 65 or older

- $25,900 if married filing jointly and both spouses under 65

- $27,300 if married filing jointly and one spouse 65 or older

- $30,700 if married filing jointly and both spouses 65 or older

Gathering Necessary Documents

Before you can start filing your 1040 form, you will need to gather various documents and information. These may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

Choosing a Filing Status

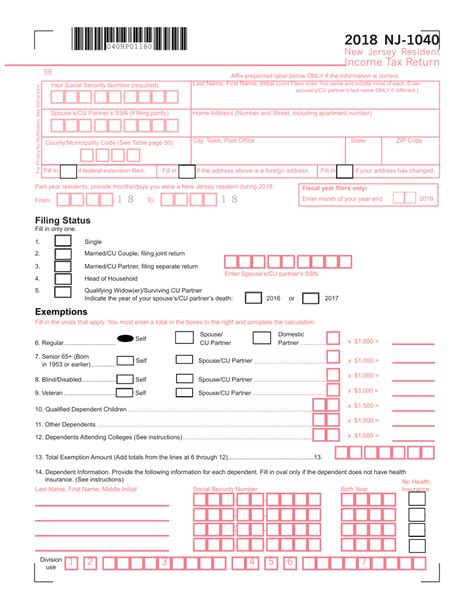

Your filing status is an important factor in determining your tax liability. You will need to choose one of the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Completing the 1040 Form

Once you have gathered all the necessary documents and chosen your filing status, you can begin completing the 1040 form. The form is divided into several sections, each dealing with a specific aspect of your income and taxes.

- Section 1: Income

- Section 2: Adjustments to income

- Section 3: Tax credits

- Section 4: Tax

Calculating Your Tax Liability

To calculate your tax liability, you will need to use the tax tables or tax rate schedules provided by the IRS. These tables take into account your filing status, income, and number of dependents to determine your tax rate.

New Jersey State Taxes

In addition to federal taxes, residents of New Jersey are also required to pay state taxes. The state tax rate ranges from 5.525% to 10.75%, depending on your income and filing status.

New Jersey Tax Credits

New Jersey offers several tax credits that can help reduce your state tax liability. These include:

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Credit

- Credit for Taxes Paid to Other States

E-Filing Your 1040 Form

The IRS and the state of New Jersey encourage taxpayers to e-file their tax returns. E-filing is a faster and more accurate way to file your taxes, and it can also help reduce errors and processing times.

Using Tax Software

If you are not comfortable preparing your tax return yourself, you can use tax software to help guide you through the process. Many tax software programs, such as TurboTax and H&R Block, offer e-filing options and can help you navigate the tax code.

Seeking Professional Help

If you are still unsure about filing your 1040 form in NJ, consider seeking the help of a tax professional. A certified public accountant (CPA) or enrolled agent (EA) can provide personalized guidance and help you navigate the tax code.

Taxpayer Assistance Centers

The IRS offers Taxpayer Assistance Centers (TACs) throughout New Jersey, where you can receive face-to-face help with your tax questions and concerns. You can find a list of TAC locations on the IRS website.

Staying Organized

To make the tax filing process easier, it's essential to stay organized throughout the year. Keep track of your income, expenses, and receipts, and consider setting up a filing system to keep all your tax documents in one place.

Reviewing and Revising Your Return

Before submitting your tax return, review it carefully to ensure accuracy and completeness. If you need to make any revisions, do so before submitting your return to avoid delays or penalties.

Conclusion

Filing your 1040 form in NJ may seem like a daunting task, but by following these steps and staying organized, you can make the process much smoother. Remember to gather all necessary documents, choose the correct filing status, and take advantage of tax credits and deductions. If you're unsure about any aspect of the tax filing process, consider seeking the help of a tax professional.

We hope this guide has provided you with a comprehensive understanding of the 1040 form and the tax filing process in NJ. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing my 1040 form in NJ?

+The deadline for filing your 1040 form in NJ is typically April 15th of each year.

Do I need to file a 1040 form if I don't have any income?

+Even if you don't have any income, you may still need to file a 1040 form if you have other types of income, such as interest or dividends.

Can I e-file my 1040 form in NJ?

+Yes, you can e-file your 1040 form in NJ through the IRS website or using tax software.