As a taxpayer, it's essential to understand the various forms and filing requirements that the Internal Revenue Service (IRS) mandates. One such form is the Form 3520, which is used to report certain transactions with foreign trusts and the receipt of certain foreign gifts. In this comprehensive guide, we'll delve into the world of Form 3520, exploring its purpose, who needs to file it, and the filing requirements.

Understanding Form 3520

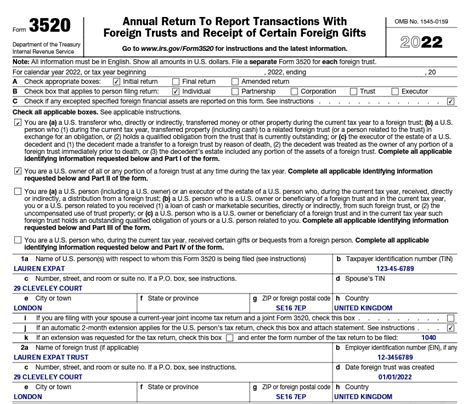

Form 3520 is an annual information return that is required to be filed by certain U.S. persons who have transactions with foreign trusts or receive certain foreign gifts. The form is used to report information about these transactions to the IRS, which helps the agency to ensure compliance with tax laws and regulations.

Who Needs to File Form 3520?

The following U.S. persons are required to file Form 3520:

- U.S. citizens and resident aliens who are beneficiaries of foreign trusts

- U.S. citizens and resident aliens who receive distributions from foreign trusts

- U.S. grantors who transfer property to foreign trusts

- U.S. persons who are responsible for withholding taxes on distributions from foreign trusts

- U.S. persons who receive certain foreign gifts or bequests

Filing Requirements for Form 3520

To file Form 3520, you'll need to gather certain information and follow specific instructions. Here are the key filing requirements:

- Due Date: Form 3520 is due on the 15th day of the fourth month following the end of the trust's tax year. For example, if the trust's tax year ends on December 31, the Form 3520 is due on April 15.

- Where to File: Form 3520 should be filed with the IRS at the following address: Internal Revenue Service Center for Foreign Account Compliance 9859 Pacific Heights Blvd. Attn: 3520 Processing El Monte, CA 91731

- Required Information: You'll need to provide detailed information about the foreign trust, including its name, address, and tax identification number. You'll also need to report the type and value of the transactions with the trust, as well as any distributions or gifts received.

- Penalties for Non-Compliance: Failure to file Form 3520 or filing it late can result in significant penalties, including fines and interest.

Transactions with Foreign Trusts

Form 3520 requires you to report certain transactions with foreign trusts, including:

- Contributions: If you contribute property to a foreign trust, you'll need to report the value of the contribution and the trust's tax identification number.

- Distributions: If you receive distributions from a foreign trust, you'll need to report the amount and type of distribution, as well as any withholding taxes that were paid.

- Loan Transactions: If you have loan transactions with a foreign trust, you'll need to report the terms of the loan, including the interest rate and repayment terms.

Foreign Gifts and Bequests

Form 3520 also requires you to report certain foreign gifts and bequests, including:

- Gifts: If you receive a gift from a foreign person, you'll need to report the value of the gift and the giver's name and address.

- Bequests: If you receive a bequest from a foreign estate, you'll need to report the value of the bequest and the estate's tax identification number.

Withholding Taxes on Foreign Trust Distributions

If you receive distributions from a foreign trust, you may be required to withhold taxes on those distributions. Form 3520 requires you to report any withholding taxes that were paid, as well as the amount of tax withheld.

Conclusion

Filing Form 3520 is a critical requirement for U.S. persons who have transactions with foreign trusts or receive certain foreign gifts. By understanding the purpose and filing requirements of Form 3520, you can ensure compliance with tax laws and regulations. Remember to gather all required information and follow the specific instructions for filing Form 3520.

We encourage you to share your thoughts and experiences with filing Form 3520 in the comments below. Additionally, if you have any questions or concerns, feel free to ask, and we'll do our best to provide guidance.

What is the purpose of Form 3520?

+Form 3520 is used to report certain transactions with foreign trusts and the receipt of certain foreign gifts.

Who needs to file Form 3520?

+U.S. citizens and resident aliens who are beneficiaries of foreign trusts, receive distributions from foreign trusts, or are responsible for withholding taxes on distributions from foreign trusts.

What is the due date for filing Form 3520?

+The due date for filing Form 3520 is the 15th day of the fourth month following the end of the trust's tax year.