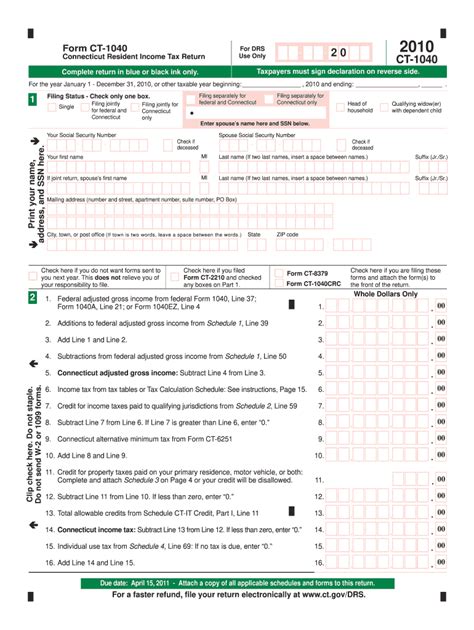

Filling out tax forms can be a daunting task, but with the right guidance, it can be made easier. The Connecticut state income tax form, CT-1040, is used by residents to report their annual income and claim any applicable credits or deductions. In this article, we will provide you with 7 tips to help you fill out the CT-1040 form correctly.

Importance of Accurate Tax Filing

Accurate tax filing is crucial to avoid any penalties or delays in processing your tax return. Inaccurate or incomplete information can lead to a range of issues, from simple errors to audits or even tax evasion charges. By following these tips, you can ensure that your CT-1040 form is filled out correctly, and you can avoid any potential issues.

Tip 1: Gather Required Documents

Before starting to fill out the CT-1040 form, gather all the required documents, including:

- Your social security number or individual taxpayer identification number (ITIN)

- Your spouse's social security number or ITIN (if filing jointly)

- Your dependents' social security numbers or ITINs

- W-2 forms from all employers

- 1099 forms for any freelance work or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Any other relevant tax documents

Tip 2: Choose the Correct Filing Status

Your filing status affects the tax rates and deductions you are eligible for. The CT-1040 form offers the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your marital status and family situation.

Tip 3: Report All Income

Report all income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Retirement account distributions

- Any other income

Use the W-2 and 1099 forms to report income from employers and other sources.

Tip 4: Claim Applicable Deductions and Credits

The CT-1040 form offers various deductions and credits that can reduce your tax liability. Some of the most common deductions and credits include:

- Standard deduction

- Itemized deductions (e.g., mortgage interest, charitable donations)

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

- Retirement savings contributions credit

Claim all applicable deductions and credits to minimize your tax liability.

Tip 5: Complete the Connecticut Income Tax Schedule

The Connecticut income tax schedule is used to calculate your state income tax liability. Complete this schedule by:

- Reporting your federal adjusted gross income (AGI)

- Calculating your Connecticut AGI

- Applying any applicable deductions and credits

- Calculating your state income tax liability

Tip 6: Sign and Date the Form

Once you have completed the CT-1040 form, sign and date it. This is a critical step, as the form will not be processed without your signature.

Tip 7: File Electronically or by Mail

Finally, file your CT-1040 form electronically or by mail. Electronic filing is faster and more convenient, but you can also file by mail if you prefer.

Conclusion: Take Control of Your Tax Filing

Filling out the CT-1040 form correctly requires attention to detail and a basic understanding of tax laws. By following these 7 tips, you can ensure that your tax return is accurate and complete, and you can avoid any potential issues. Take control of your tax filing today and ensure a smooth tax season.

What is the deadline for filing the CT-1040 form?

+The deadline for filing the CT-1040 form is typically April 15th of each year, but it may vary if you are filing for an extension or amended return.

Can I file the CT-1040 form electronically?

+Yes, you can file the CT-1040 form electronically through the Connecticut Department of Revenue Services (DRS) website or through a tax preparation software.

What is the penalty for late filing or payment of taxes in Connecticut?

+The penalty for late filing or payment of taxes in Connecticut is 10% of the unpaid tax, plus interest and any applicable fees.