Tax season is upon us, and for Canadians, that means it's time to tackle the T1 form. The T1 form, also known as the General 2019 T1 form, is the standard form used by the Canada Revenue Agency (CRA) to report an individual's income and claim deductions and credits. In this article, we'll break down the T1 form, exploring its components, benefits, and provide a step-by-step guide on how to fill it out.

Understanding the T1 Form

The T1 form is a crucial document for Canadians, as it determines the amount of taxes owed to the government or the refund amount. The form is divided into several sections, each designed to capture specific information about an individual's income, deductions, and credits.

T1 Form Sections

The T1 form consists of the following sections:

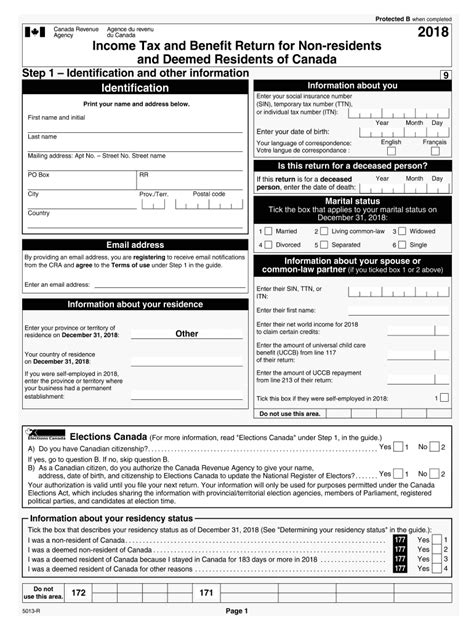

- Identification: This section requires personal and contact information, such as name, address, and Social Insurance Number (SIN).

- Income: This section reports employment income, self-employment income, and other types of income, such as investments and pension income.

- Deductions: This section allows individuals to claim deductions for items like RRSP contributions, moving expenses, and child care expenses.

- Credits: This section calculates the total amount of credits, including the basic personal amount, spousal amount, and tuition credits.

- Net Income: This section calculates the individual's net income, taking into account income, deductions, and credits.

Benefits of Filing a T1 Form

Filing a T1 form offers several benefits, including:

- Refund: If an individual has overpaid their taxes throughout the year, filing a T1 form can result in a refund.

- Reduced Tax Liability: Claiming deductions and credits can reduce the amount of taxes owed.

- Improved Financial Planning: Filing a T1 form helps individuals understand their financial situation, making it easier to plan for the future.

- Access to Government Benefits: Filing a T1 form is required to receive government benefits, such as the Canada Child Benefit and Old Age Security.

Who Needs to File a T1 Form?

Not everyone needs to file a T1 form. However, if you meet any of the following conditions, you are required to file:

- You owe taxes or have taxes owing.

- You want to claim a refund.

- You receive a pension or other income that requires a T1 form.

- You have self-employment income or employment expenses.

- You have investments or rental income.

Step-by-Step Guide to Filling Out the T1 Form

Filling out the T1 form can seem daunting, but with this step-by-step guide, you'll be well on your way:

- Gather necessary documents, including:

- T4 slips (employment income)

- T4A slips (scholarships and fellowships)

- T5 slips (investment income)

- RRSP contribution receipts

- Medical expense receipts

- Complete the identification section, including name, address, and SIN.

- Report employment income, self-employment income, and other types of income.

- Claim deductions, such as RRSP contributions and moving expenses.

- Calculate credits, including the basic personal amount and spousal amount.

- Calculate net income, taking into account income, deductions, and credits.

- Review and sign the form.

Tips and Reminders

- File your T1 form on time to avoid penalties and interest.

- Use certified tax software or consult a tax professional to ensure accuracy.

- Keep receipts and documents for at least six years in case of an audit.

- Consider filing electronically for faster processing and refunds.

Common Mistakes to Avoid

- Forgetting to report income or claim deductions.

- Miscalculating net income or credits.

- Not signing or dating the form.

- Failing to keep receipts and documents.

Conclusion

Filing a T1 form is a crucial part of tax season in Canada. By understanding the form's components, benefits, and following this step-by-step guide, individuals can ensure accuracy and maximize their refund. Remember to file on time, keep receipts and documents, and consult a tax professional if needed.

What is the deadline for filing a T1 form?

+The deadline for filing a T1 form is April 30th for most individuals. However, if you or your spouse/common-law partner have self-employment income, the deadline is June 15th.

Can I file my T1 form electronically?

+Yes, you can file your T1 form electronically using certified tax software or the CRA's NETFILE service.

What happens if I miss the deadline for filing my T1 form?

+If you miss the deadline, you may be subject to penalties and interest on any taxes owing. It's essential to file as soon as possible to minimize these charges.