Form RP-5217 is a crucial document in the world of real estate, particularly in New York State. It's a form that plays a significant role in the process of buying and selling properties, and understanding its intricacies can make a huge difference in the outcome of a transaction. In this article, we'll delve into the essential facts about Form RP-5217, exploring its purpose, benefits, and working mechanisms.

What is Form RP-5217?

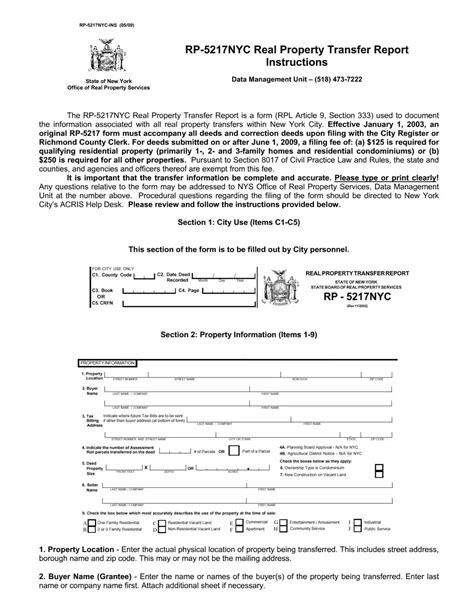

Form RP-5217, also known as the "Real Property Transfer Report," is a document required by the New York State Department of Taxation and Finance. It's a crucial part of the property transfer process, and its primary purpose is to report the transfer of real property ownership.

Why is Form RP-5217 Important?

The importance of Form RP-5217 cannot be overstated. This document serves several purposes, including:

- Reporting the transfer of real property ownership to the state

- Providing essential information about the property and the transaction

- Ensuring compliance with state tax laws and regulations

- Facilitating the calculation of transfer taxes and fees

How Does Form RP-5217 Work?

Form RP-5217 is typically completed by the seller or the seller's representative, usually an attorney or real estate agent. The form requires detailed information about the property, including:

- Property description and location

- Type of property (residential, commercial, etc.)

- Transfer date and price

- Buyer and seller information

Once completed, the form is submitted to the county clerk's office, where it's reviewed and verified. The information provided on the form is used to calculate the transfer taxes and fees owed to the state.

Benefits of Form RP-5217

While Form RP-5217 may seem like just another bureaucratic hurdle, it provides several benefits to buyers and sellers alike. Some of the key benefits include:

- Ensures compliance with state tax laws and regulations

- Provides a clear and transparent record of the property transfer

- Facilitates the calculation of transfer taxes and fees

- Helps to prevent errors and discrepancies in the transfer process

Common Mistakes to Avoid

When completing Form RP-5217, it's essential to avoid common mistakes that can delay or even invalidate the transfer process. Some of the most common mistakes include:

- Inaccurate or incomplete information

- Failure to sign or date the form

- Incorrect calculation of transfer taxes and fees

- Failure to submit the form to the county clerk's office

Tips for Completing Form RP-5217

To ensure a smooth and hassle-free transfer process, follow these tips when completing Form RP-5217:

- Read the instructions carefully and complete the form accurately

- Verify the information provided to ensure accuracy and completeness

- Use a calculator to ensure accurate calculation of transfer taxes and fees

- Sign and date the form in the presence of a notary public

Conclusion

In conclusion, Form RP-5217 is a critical document in the world of real estate, particularly in New York State. Understanding its purpose, benefits, and working mechanisms can help buyers and sellers navigate the property transfer process with ease. By avoiding common mistakes and following tips for completing the form, individuals can ensure a smooth and hassle-free transfer process.

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form RP-5217?

+The primary purpose of Form RP-5217 is to report the transfer of real property ownership to the state.

Who completes Form RP-5217?

+Form RP-5217 is typically completed by the seller or the seller's representative, usually an attorney or real estate agent.

What happens if I make a mistake on Form RP-5217?

+If you make a mistake on Form RP-5217, it can delay or even invalidate the transfer process. It's essential to double-check the information provided and ensure accuracy and completeness.