As a business owner, it's essential to maintain compliance with the state's requirements to ensure your corporation remains in good standing. One crucial aspect of this compliance is filing a Statement of Information (SOI) form, also known as a Statement of Business Information or Annual Report. This document provides the state with updated information about your corporation's business activities, management structure, and other vital details. In this article, we'll delve into the importance of filing a Statement of Information corporation form and provide you with 5 essential tips to help you navigate the process.

Why Filing a Statement of Information Corporation Form is Crucial

Filing a Statement of Information corporation form is a mandatory requirement for corporations in most states. The purpose of this document is to provide the state with updated information about your corporation's business activities, management structure, and other vital details. This information helps the state maintain accurate records of businesses operating within its jurisdiction. Failure to file a Statement of Information corporation form can result in penalties, fines, and even the suspension or revocation of your corporation's license to operate.

Tip 1: Review and Understand the Filing Requirements

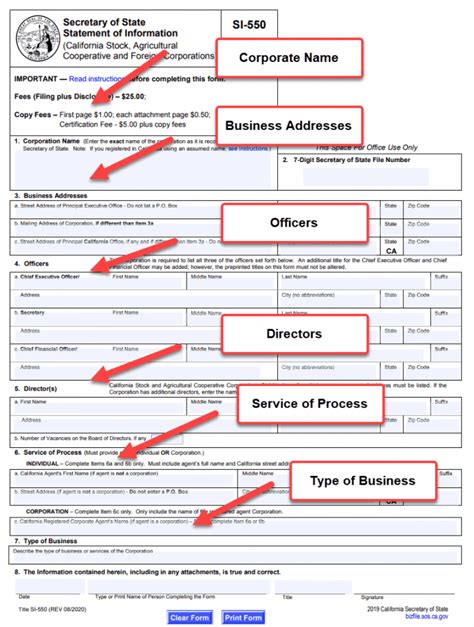

Before you start filling out the Statement of Information corporation form, it's essential to review and understand the filing requirements. Each state has its own set of requirements, so make sure you check with your state's business registration agency to determine the specific requirements for your corporation. Some common requirements include:

- The name and address of your corporation

- The name and address of your registered agent

- The names and addresses of your corporate officers and directors

- A description of your corporation's business activities

- The number of shares of stock issued and outstanding

Common Filing Errors to Avoid

When reviewing the filing requirements, make sure you avoid common errors that can delay or even reject your filing. Some common mistakes include:

- Incomplete or inaccurate information

- Failure to sign the form

- Failure to pay the required filing fee

- Incorrect filing date

Tip 2: Gather All Required Information

Before you start filling out the Statement of Information corporation form, make sure you gather all the required information. This may include:

- Your corporation's articles of incorporation

- Your corporation's bylaws

- A list of your corporate officers and directors

- A list of your shareholders

- A description of your corporation's business activities

Organizing Your Documents

To ensure a smooth filing process, it's essential to organize your documents in a logical and accessible manner. This may include:

- Creating a folder or binder to store your corporation's documents

- Labeling and indexing your documents for easy reference

- Scanning and digitizing your documents for electronic storage

Tip 3: Use the Correct Form and Filing Method

When filing a Statement of Information corporation form, it's essential to use the correct form and filing method. You can obtain the correct form from your state's business registration agency or download it from their website. Make sure you follow the correct filing method, whether it's online, by mail, or in person.

Online Filing vs. Paper Filing

Many states offer online filing options for Statement of Information corporation forms. Online filing can be faster and more convenient, but it's essential to ensure you follow the correct procedure and pay the required filing fee.

Tip 4: File on Time and Pay the Required Filing Fee

Filing a Statement of Information corporation form on time is crucial to avoid penalties and fines. Make sure you check with your state's business registration agency to determine the filing deadline and required filing fee.

Consequences of Late Filing

Failure to file a Statement of Information corporation form on time can result in penalties, fines, and even the suspension or revocation of your corporation's license to operate. It's essential to prioritize timely filing to avoid these consequences.

Tip 5: Review and Verify Your Filing

After filing a Statement of Information corporation form, it's essential to review and verify your filing to ensure accuracy and completeness. This may include:

- Reviewing your filing for errors or omissions

- Verifying your filing with your state's business registration agency

- Obtaining a confirmation or receipt of your filing

Post-Filing Procedures

After filing a Statement of Information corporation form, you may need to follow up with additional procedures, such as:

- Updating your corporation's records and documents

- Notifying your corporate officers and directors of the filing

- Ensuring compliance with ongoing reporting requirements

What is a Statement of Information corporation form?

+A Statement of Information corporation form is a document that provides the state with updated information about your corporation's business activities, management structure, and other vital details.

Why is it essential to file a Statement of Information corporation form?

+Filing a Statement of Information corporation form is crucial to maintain compliance with the state's requirements and ensure your corporation remains in good standing.

What are the consequences of late filing?

+Failure to file a Statement of Information corporation form on time can result in penalties, fines, and even the suspension or revocation of your corporation's license to operate.

In conclusion, filing a Statement of Information corporation form is a critical aspect of maintaining compliance with the state's requirements. By following these 5 essential tips, you can ensure a smooth and accurate filing process. Remember to review and understand the filing requirements, gather all required information, use the correct form and filing method, file on time and pay the required filing fee, and review and verify your filing. If you have any further questions or concerns, feel free to comment below or share this article with your colleagues.