The Importance of Meeting the S Corp Tax Extension Form 7004 Filing Deadline

As a business owner, managing your company's taxes is crucial to avoiding penalties and ensuring compliance with the Internal Revenue Service (IRS). For S corporations, filing Form 7004 is essential to obtain an automatic six-month extension of time to file their tax return. However, missing the deadline can result in severe consequences, including late filing penalties and interest on unpaid taxes. In this article, we will discuss the importance of meeting the S Corp tax extension Form 7004 filing deadline, the benefits of filing for an extension, and provide a step-by-step guide on how to file Form 7004.

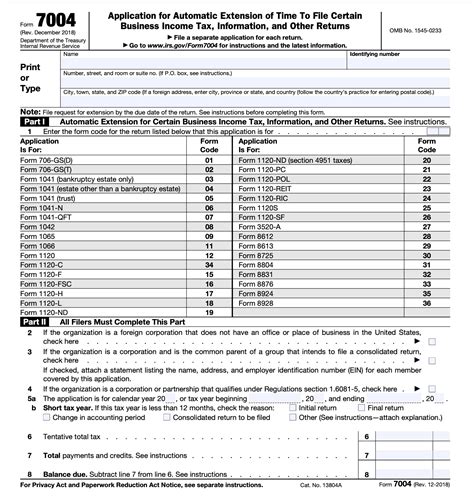

What is Form 7004?

Form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns. The form is used by businesses, including S corporations, to request an automatic six-month extension of time to file their tax return. The form must be filed on or before the original due date of the tax return to be considered timely.

Benefits of Filing for an Extension

Filing for an extension using Form 7004 provides several benefits to S corporations, including:

- Avoiding late filing penalties: By filing for an extension, S corporations can avoid late filing penalties, which can be up to 47.6% of the unpaid tax.

- Reducing stress and pressure: Filing for an extension provides additional time for S corporations to gather necessary documents and information, reducing stress and pressure.

- Allowing for more accurate filing: With more time, S corporations can ensure that their tax return is accurate and complete, reducing the risk of errors and audits.

S Corp Tax Extension Form 7004 Filing Deadline

The S Corp tax extension Form 7004 filing deadline is typically March 15th for calendar-year S corporations and the 15th day of the third month following the close of the fiscal year for fiscal-year S corporations. However, it is essential to check the IRS website for any changes to the deadline.

Consequences of Missing the Deadline

Missing the S Corp tax extension Form 7004 filing deadline can result in severe consequences, including:

- Late filing penalties: S corporations that fail to file Form 7004 by the deadline may be subject to late filing penalties, which can be up to 47.6% of the unpaid tax.

- Interest on unpaid taxes: In addition to late filing penalties, S corporations may also be subject to interest on unpaid taxes, which can accrue from the original due date of the tax return.

- Loss of extension: If Form 7004 is not filed by the deadline, the S corporation may not be eligible for an extension, and the tax return must be filed immediately.

Step-by-Step Guide to Filing Form 7004

Filing Form 7004 is a straightforward process that can be completed online or by mail. Here is a step-by-step guide to filing Form 7004:

- Gather necessary information: Before filing Form 7004, ensure that you have the necessary information, including the S corporation's name, address, and Employer Identification Number (EIN).

- Choose a filing method: Form 7004 can be filed online or by mail. The IRS recommends filing online, as it is faster and more secure.

- Complete Form 7004: Complete Form 7004, ensuring that all required information is provided. The form requires the S corporation's name, address, and EIN, as well as the reason for the extension request.

- Sign and date the form: Sign and date the form, ensuring that it is executed by an authorized representative of the S corporation.

- File the form: File Form 7004 on or before the deadline, either online or by mail.

Tips for Filing Form 7004

Here are some tips for filing Form 7004:

- File electronically: Filing Form 7004 electronically is faster and more secure than filing by mail.

- Use the correct form: Ensure that you use the correct form, as the IRS has different forms for different types of businesses.

- Provide accurate information: Ensure that all information provided on Form 7004 is accurate and complete.

- Keep a record: Keep a record of the filed form, including the confirmation number and date of filing.

Conclusion

In conclusion, filing Form 7004 is essential for S corporations to obtain an automatic six-month extension of time to file their tax return. Missing the deadline can result in severe consequences, including late filing penalties and interest on unpaid taxes. By following the step-by-step guide provided in this article, S corporations can ensure that they file Form 7004 correctly and on time.

Take Action Today

Don't wait until it's too late. File Form 7004 today to ensure that your S corporation receives an automatic six-month extension of time to file its tax return. If you have any questions or concerns, consult with a tax professional or contact the IRS for assistance.

What is the deadline for filing Form 7004?

+The deadline for filing Form 7004 is typically March 15th for calendar-year S corporations and the 15th day of the third month following the close of the fiscal year for fiscal-year S corporations.

What are the consequences of missing the deadline?

+Mising the deadline can result in severe consequences, including late filing penalties, interest on unpaid taxes, and loss of extension.

How do I file Form 7004?

+Form 7004 can be filed online or by mail. The IRS recommends filing online, as it is faster and more secure.