The importance of designating a beneficiary for your life insurance policy cannot be overstated. It ensures that your loved ones are taken care of in the event of your passing, and that your policy's benefits are distributed according to your wishes. For State Farm policyholders, completing a beneficiary form is a crucial step in securing their financial future. In this article, we will provide a comprehensive, step-by-step guide to help you navigate the process of filling out a State Farm beneficiary form.

Life insurance policies are an essential part of any financial plan, providing a safety net for your family in the event of your unexpected passing. By designating a beneficiary, you can rest assured that your policy's benefits will be distributed to the right person, helping them to cover funeral expenses, outstanding debts, and ongoing living costs. However, the process of completing a beneficiary form can be daunting, especially for those who are new to life insurance.

In this article, we will walk you through the process of filling out a State Farm beneficiary form, providing you with the information and guidance you need to ensure that your policy's benefits are distributed according to your wishes. We will cover the different types of beneficiaries, the information required to complete the form, and the steps you need to take to submit the form to State Farm.

Understanding the Different Types of Beneficiaries

Before we dive into the process of filling out the beneficiary form, it's essential to understand the different types of beneficiaries you can designate. State Farm allows you to choose from the following types of beneficiaries:

- Primary beneficiary: This is the person who will receive the policy's benefits in the event of your passing.

- Contingent beneficiary: This is the person who will receive the policy's benefits if the primary beneficiary is unable to receive them.

- Revocable beneficiary: This is a beneficiary who can be changed or removed at any time.

- Irrevocable beneficiary: This is a beneficiary who cannot be changed or removed without their consent.

Choosing the Right Beneficiary

Choosing the right beneficiary is a crucial decision, as it will determine who receives the policy's benefits in the event of your passing. When choosing a beneficiary, consider the following factors:

- Who will be financially affected by your passing?

- Who will need the policy's benefits to cover funeral expenses and ongoing living costs?

- Who do you want to receive the policy's benefits?

It's also essential to consider the tax implications of designating a beneficiary. For example, if you designate a minor as a beneficiary, you may need to establish a trust to manage the policy's benefits on their behalf.

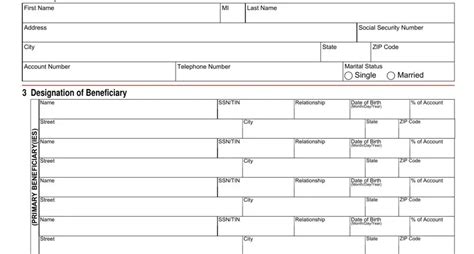

Completing the State Farm Beneficiary Form

Now that we've covered the different types of beneficiaries, let's move on to the process of completing the State Farm beneficiary form. The form will require you to provide the following information:

- Your policy number and type

- The name and address of the beneficiary

- The beneficiary's relationship to you

- The percentage of the policy's benefits that the beneficiary will receive

To complete the form, follow these steps:

- Download the State Farm beneficiary form from the company's website or request a copy from your agent.

- Fill out the form completely and accurately, making sure to sign and date it.

- Attach any required documentation, such as a copy of your policy or identification.

- Submit the form to State Farm via mail, fax, or email.

Required Documentation

In addition to the beneficiary form, you may need to provide additional documentation to State Farm. This may include:

- A copy of your policy

- Identification, such as a driver's license or passport

- Proof of address, such as a utility bill or lease agreement

Make sure to check with State Farm to determine what documentation is required to complete the beneficiary designation process.

Submitting the Form to State Farm

Once you've completed the beneficiary form and attached any required documentation, you can submit it to State Farm via mail, fax, or email. Make sure to follow these steps:

- Review the form for accuracy and completeness.

- Sign and date the form.

- Attach any required documentation.

- Submit the form to State Farm via mail, fax, or email.

State Farm's contact information is as follows:

- Mail: State Farm Life Insurance Company, One State Farm Plaza, Bloomington, IL 61710

- Fax: 1-309-766-3624

- Email:

FAQs

We've covered the basics of completing a State Farm beneficiary form, but you may still have some questions. Here are some frequently asked questions and their answers:

Q: Can I change my beneficiary at any time? A: Yes, you can change your beneficiary at any time by completing a new beneficiary form and submitting it to State Farm.

Q: Can I designate a minor as a beneficiary? A: Yes, you can designate a minor as a beneficiary, but you may need to establish a trust to manage the policy's benefits on their behalf.

Q: How do I know if my beneficiary form has been received by State Farm? A: You can contact State Farm's customer service department to confirm that your beneficiary form has been received and processed.

Q: Can I designate multiple beneficiaries? A: Yes, you can designate multiple beneficiaries, but you will need to specify the percentage of the policy's benefits that each beneficiary will receive.

What is the purpose of a beneficiary form?

+The purpose of a beneficiary form is to designate who will receive the policy's benefits in the event of your passing.

Can I change my beneficiary at any time?

+Yes, you can change your beneficiary at any time by completing a new beneficiary form and submitting it to State Farm.

How do I know if my beneficiary form has been received by State Farm?

+You can contact State Farm's customer service department to confirm that your beneficiary form has been received and processed.

By following the steps outlined in this article, you can ensure that your State Farm beneficiary form is completed accurately and submitted successfully. Remember to review your beneficiary designation periodically to ensure that it remains up-to-date and reflects your current wishes.