Filling out forms can be a daunting task, especially when it comes to government documents like the St-556 Illinois Form. This form is required for individuals and businesses who need to report and pay sales tax in the state of Illinois. In this article, we will guide you through the process of filling out the St-556 Illinois Form, highlighting five ways to make it easier and less time-consuming.

Understanding the St-556 Illinois Form

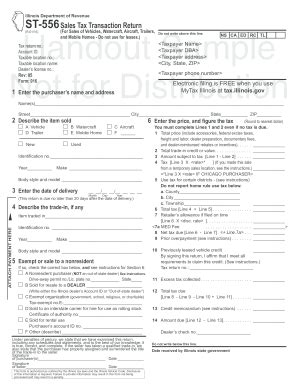

Before we dive into the ways to fill out the form, it's essential to understand what the St-556 Illinois Form is and what information it requires. The St-556 Form is a sales tax return form used by the Illinois Department of Revenue to collect sales tax from individuals and businesses. The form requires information about the taxpayer's identity, business type, and sales tax liability.

Breaking Down the Form

The St-556 Form consists of several sections, including:

- Taxpayer information

- Business type and activity

- Sales tax liability

- Credits and deductions

- Payment and signature

Each section requires specific information, which can be overwhelming for those who are not familiar with the form.

5 Ways to Fill Out the St-556 Illinois Form

To make filling out the St-556 Illinois Form easier, we have identified five ways to simplify the process:

1. Gather Required Information

Before starting to fill out the form, make sure you have all the required information. This includes:

- Taxpayer identification number (FEIN or SSN)

- Business name and address

- Type of business ( sole proprietorship, partnership, corporation, etc.)

- Sales tax permit number

- Gross sales and receipts

- Exemptions and deductions

Having all the necessary information ready will save you time and reduce errors.

2. Use Online Resources

The Illinois Department of Revenue provides online resources to help taxpayers fill out the St-556 Form. These resources include:

- Interactive forms

- Instructions and guides

- Frequently asked questions (FAQs)

- Contact information for support

Using online resources can help you understand the form and ensure you are filling it out correctly.

3. Seek Professional Help

If you are unsure about how to fill out the St-556 Form or need help with a specific section, consider seeking professional help. A certified public accountant (CPA) or tax professional can guide you through the process and ensure you are taking advantage of all the credits and deductions available to you.

4. Use Tax Preparation Software

Tax preparation software can help you fill out the St-556 Form quickly and accurately. These programs guide you through the form, ensuring you are completing all the necessary sections and taking advantage of available credits and deductions. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

5. Double-Check Your Work

Once you have completed the St-556 Form, double-check your work to ensure accuracy. Review each section carefully, making sure you have included all the necessary information and calculated your sales tax liability correctly.

Conclusion

Filling out the St-556 Illinois Form can be a daunting task, but by following these five ways, you can simplify the process. Remember to gather required information, use online resources, seek professional help, use tax preparation software, and double-check your work. By taking these steps, you can ensure you are filling out the form accurately and taking advantage of all the credits and deductions available to you.

We hope this article has been helpful in guiding you through the process of filling out the St-556 Illinois Form. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the St-556 Illinois Form?

+The St-556 Illinois Form is a sales tax return form used by the Illinois Department of Revenue to collect sales tax from individuals and businesses.

What information is required on the St-556 Form?

+The St-556 Form requires information about the taxpayer's identity, business type, and sales tax liability, including taxpayer identification number, business name and address, type of business, sales tax permit number, gross sales and receipts, and exemptions and deductions.

Can I file the St-556 Form online?

+Yes, you can file the St-556 Form online through the Illinois Department of Revenue's website.