Filling out a beneficiary form can be a daunting task, especially when it comes to ensuring that your assets are distributed according to your wishes after you pass away. For PNC customers, filling out a beneficiary form is an essential step in planning for the future. In this article, we will provide you with 5 tips for filling out a PNC beneficiary form.

Understanding the Importance of Beneficiary Forms

Before we dive into the tips, it's essential to understand the significance of beneficiary forms. A beneficiary form allows you to designate who will receive your assets, such as retirement accounts, life insurance policies, and other financial instruments, after you pass away. By filling out a beneficiary form, you can ensure that your loved ones are taken care of and that your assets are distributed according to your wishes.

Tip 1: Choose Your Beneficiaries Wisely

Choosing your beneficiaries is a crucial step in filling out a PNC beneficiary form. You can designate individuals, trusts, or charities as your beneficiaries. It's essential to consider the following factors when choosing your beneficiaries:

- Age: If you're naming minor children as beneficiaries, you may want to consider naming a guardian or trust to manage their inheritance until they come of age.

- Dependents: If you have dependents, such as a spouse or children, you may want to prioritize their needs when designating beneficiaries.

- Financial Situation: Consider the financial situation of your beneficiaries and whether they will need the assets you're leaving behind.

Tip 2: Understand the Types of Beneficiaries

PNC allows you to designate different types of beneficiaries, including:

- Primary Beneficiaries: These are the individuals or entities that will receive your assets first.

- Contingent Beneficiaries: These are the individuals or entities that will receive your assets if the primary beneficiaries are unable to do so.

- Trust Beneficiaries: These are trusts that you've established to manage your assets after you pass away.

It's essential to understand the differences between these types of beneficiaries and to designate them accordingly.

Tip 3: Keep Your Beneficiary Form Up-to-Date

Your beneficiary form should reflect any changes in your life, such as:

- Marriage or divorce

- Birth or adoption of children

- Death of a beneficiary

- Changes in your financial situation

It's essential to review and update your beneficiary form regularly to ensure that it reflects your current wishes.

Tip 4: Consider Naming a Secondary Beneficiary

Naming a secondary beneficiary, also known as a contingent beneficiary, can provide an added layer of protection for your assets. A secondary beneficiary will receive your assets if the primary beneficiary is unable to do so.

Tip 5: Seek Professional Advice

Filling out a beneficiary form can be complex, and it's essential to seek professional advice to ensure that you're making the right decisions. A financial advisor or attorney can help you navigate the process and ensure that your assets are distributed according to your wishes.

What to Expect When Filing a PNC Beneficiary Form

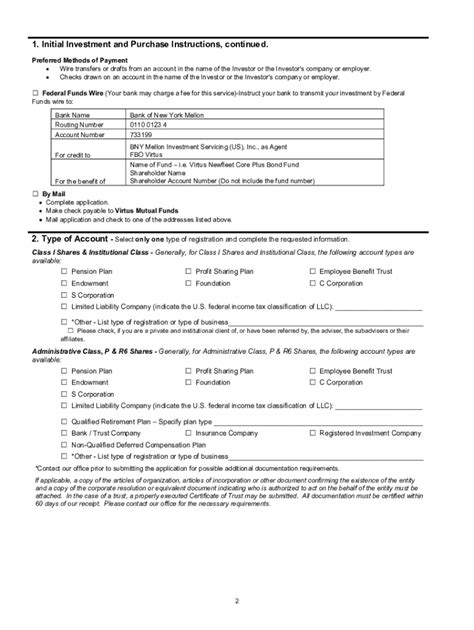

When filing a PNC beneficiary form, you can expect the following:

- You'll need to provide personal and beneficiary information, including names, addresses, and social security numbers.

- You'll need to designate the type of beneficiary and the percentage of assets they will receive.

- You'll need to sign and date the form.

Benefits of Filling Out a PNC Beneficiary Form

Filling out a PNC beneficiary form provides several benefits, including:

- Ensuring that your assets are distributed according to your wishes

- Avoiding probate, which can be time-consuming and costly

- Providing for your loved ones after you pass away

- Reducing taxes and other expenses associated with transferring assets

Common Mistakes to Avoid When Filling Out a PNC Beneficiary Form

When filling out a PNC beneficiary form, it's essential to avoid the following common mistakes:

- Not naming a beneficiary or naming the wrong beneficiary

- Not keeping the form up-to-date

- Not signing and dating the form

- Not providing accurate information

Stay Informed and Plan Ahead

Filling out a PNC beneficiary form is an essential step in planning for the future. By following these 5 tips, you can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of. Stay informed and plan ahead to avoid common mistakes and ensure a smooth transfer of assets.

We'd Love to Hear from You

Have you filled out a PNC beneficiary form? Share your experience in the comments below. Do you have any questions or concerns about filling out a beneficiary form? Ask us in the comments, and we'll do our best to help.

FAQ Section

What is a beneficiary form?

+A beneficiary form is a document that allows you to designate who will receive your assets after you pass away.

Why is it important to fill out a beneficiary form?

+Filling out a beneficiary form ensures that your assets are distributed according to your wishes and provides for your loved ones after you pass away.

Can I change my beneficiary form after I've filled it out?

+Yes, you can change your beneficiary form at any time by filling out a new form and submitting it to PNC.