As a California resident or business owner, it's essential to understand the importance of filing taxes accurately and on time. One of the crucial forms you may need to file is the California Form 592, also known as the Resident and Nonresident Withholding Statement. In this article, we will provide a comprehensive guide on California Form 592 instructions and filing to help you navigate the process with ease.

What is California Form 592?

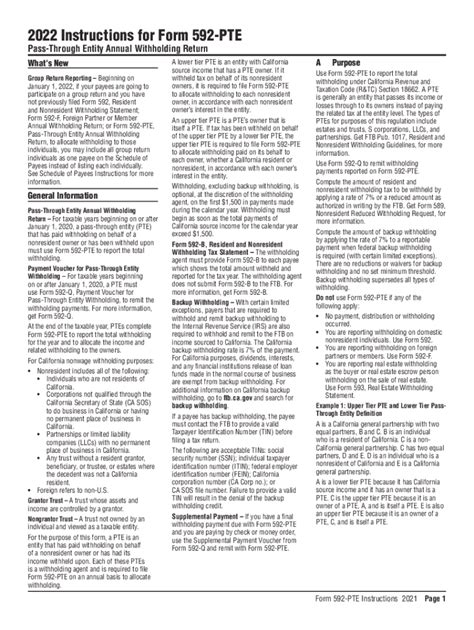

California Form 592 is a withholding statement required by the California Franchise Tax Board (FTB) to report and pay withholding on certain types of income earned by nonresidents or residents of California. The form is used to report withholding on income such as rent, dividends, and interest, as well as withholding on sales of real property.

Who Needs to File California Form 592?

If you are a resident or nonresident of California, you may need to file Form 592 if you have income that is subject to withholding. This includes:

- Rent or royalties from California sources

- Dividends or interest from California corporations

- Sales of real property in California

- Other types of income earned in California

Additionally, if you are a payor of income, such as a business or trust, you may need to file Form 592 to report withholding on payments made to nonresidents or residents of California.

California Form 592 Instructions

To file California Form 592, follow these steps:

- Determine the type of income: Identify the type of income you need to report, such as rent, dividends, or interest.

- Calculate the withholding: Calculate the amount of withholding required based on the type of income and the payee's tax rate.

- Complete Form 592: Fill out Form 592, providing the required information, including the payee's name, address, and tax identification number.

- Attach supporting documentation: Attach supporting documentation, such as a copy of the rental agreement or a statement from the payee, to Form 592.

- File the form: File Form 592 with the FTB by the required deadline, which is typically January 31st of each year.

Supporting Documentation

When filing Form 592, you may need to attach supporting documentation to substantiate the withholding. This may include:

- A copy of the rental agreement

- A statement from the payee

- A copy of the sale agreement for real property

- Other documentation as required by the FTB

California Form 592 Filing Deadlines

The filing deadline for California Form 592 is typically January 31st of each year. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Penalties for Late Filing

Failure to file Form 592 by the required deadline may result in penalties and interest. The FTB may impose a penalty of up to 10% of the withholding amount, as well as interest on the unpaid amount.

California Form 592 Payment Options

When filing Form 592, you may need to make a payment to the FTB. You can make payments online, by phone, or by mail. The following payment options are available:

- Online payment: You can make online payments through the FTB's website using a credit card or electronic funds transfer.

- Phone payment: You can make phone payments by calling the FTB's automated phone system.

- Mail payment: You can make mail payments by sending a check or money order to the FTB.

Payment Options for Withholding

When making a payment for withholding, you can use the following payment options:

- Electronic funds transfer (EFT)

- Credit card

- Check or money order

California Form 592 FAQs

Here are some frequently asked questions about California Form 592:

- Q: Who needs to file California Form 592? A: Residents and nonresidents of California who have income that is subject to withholding.

- Q: What type of income is subject to withholding? A: Rent, dividends, interest, and sales of real property, among other types of income.

- Q: How do I file California Form 592? A: You can file Form 592 online, by phone, or by mail.

What is the deadline for filing California Form 592?

+The deadline for filing California Form 592 is typically January 31st of each year.

What is the penalty for late filing of California Form 592?

+The penalty for late filing of California Form 592 is up to 10% of the withholding amount, as well as interest on the unpaid amount.

Can I file California Form 592 online?

+By following the instructions and guidelines outlined in this article, you can ensure accurate and timely filing of California Form 592. If you have any further questions or concerns, don't hesitate to reach out to the FTB or a qualified tax professional.