As we age, one of the most significant expenses we face is property taxes. For seniors living in Colorado, the burden of property taxes can be overwhelming, especially on a fixed income. However, the state of Colorado offers a senior property tax exemption to help alleviate some of this financial strain. In this article, we will break down the Colorado senior property tax exemption, its benefits, eligibility requirements, and how to apply.

What is the Colorado Senior Property Tax Exemption?

The Colorado senior property tax exemption is a state-funded program designed to provide relief to seniors who own and occupy their primary residence. The program allows eligible seniors to exempt 50% of their property's value from taxation, resulting in lower property tax bills.

Benefits of the Colorado Senior Property Tax Exemption

- Reduced property tax bills: By exempting 50% of the property's value, seniors can enjoy lower property tax bills, freeing up more money for living expenses.

- Increased disposable income: With lower property taxes, seniors can allocate more funds towards essential expenses, such as healthcare, food, and transportation.

- Preservation of assets: By reducing property taxes, seniors can preserve their assets, including their primary residence, for future generations.

Eligibility Requirements for the Colorado Senior Property Tax Exemption

To qualify for the Colorado senior property tax exemption, applicants must meet the following requirements:

- Age: Applicants must be at least 65 years old as of January 1 of the year they apply.

- Residency: Applicants must be Colorado residents and occupy their primary residence.

- Ownership: Applicants must own and occupy their primary residence.

- Income: Applicants' household income must not exceed $12,000 per year.

Application Process for the Colorado Senior Property Tax Exemption

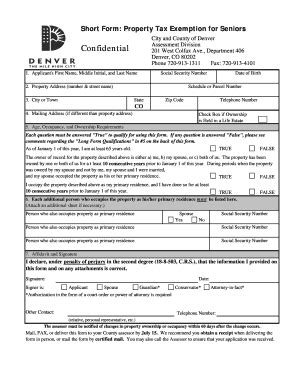

- Obtain an application form: Applicants can obtain an application form from their local county assessor's office or download it from the Colorado Department of Local Affairs website.

- Complete the application: Applicants must complete the application form and provide required documentation, including proof of age, residency, ownership, and income.

- Submit the application: Applicants must submit the completed application to their local county assessor's office by July 15 of the year they apply.

- Review and approval: The county assessor's office will review the application and notify the applicant of the approval or denial.

Additional Resources for Colorado Seniors

In addition to the senior property tax exemption, Colorado offers various resources to support seniors, including:

- Colorado Senior Lobby: A non-profit organization advocating for seniors' rights and interests.

- Colorado Department of Human Services: Provides resources and services for seniors, including healthcare, nutrition, and transportation.

- Area Agencies on Aging: Local agencies providing resources and services for seniors, including caregiver support, meal delivery, and transportation.

Tips for Colorado Seniors

- Plan ahead: Apply for the senior property tax exemption well in advance of the deadline to ensure timely processing.

- Review and update: Regularly review and update your application to ensure continued eligibility.

- Seek assistance: Contact local resources, such as the Colorado Senior Lobby or Area Agencies on Aging, for guidance and support.

By understanding the Colorado senior property tax exemption and taking advantage of available resources, seniors can enjoy a more comfortable and secure retirement.

Invite your fellow seniors to share their experiences and tips for navigating the Colorado senior property tax exemption process. How has this program helped you or a loved one? Share your stories and advice in the comments below.

What is the deadline to apply for the Colorado senior property tax exemption?

+The deadline to apply for the Colorado senior property tax exemption is July 15 of the year you apply.

Can I apply for the Colorado senior property tax exemption if I am a renter?

+No, the Colorado senior property tax exemption is only available to homeowners who occupy their primary residence.

How do I know if I am eligible for the Colorado senior property tax exemption?

+To determine your eligibility, review the eligibility requirements and contact your local county assessor's office or the Colorado Department of Local Affairs for guidance.