Managing tax-related documents efficiently is crucial for individuals and businesses alike. One such document is the SSTGB Form F0003, which is a vital part of sales tax compliance in certain jurisdictions. In this article, we will delve into the details of the SSTGB Form F0003, exploring what it is, its importance, and how to fill it out correctly. We will also provide guidance on where to download the form and offer tips for managing sales tax obligations.

Understanding the SSTGB Form F0003

The SSTGB Form F0003 is a sales tax return form used by businesses to report and pay sales tax owed to the state. The form requires detailed information about the business's sales tax activities for a specific period, typically a month or a quarter, depending on the filing frequency designated by the state.

Why is the SSTGB Form F0003 Important?

The SSTGB Form F0003 is crucial for several reasons:

- Compliance: Filing the SSTGB Form F0003 on time ensures that a business complies with state sales tax laws, avoiding penalties and fines associated with late filing or underpayment.

- Record Keeping: The process of filling out the form helps businesses maintain accurate records of their sales tax activities, which can be useful for future audits or financial planning.

- Tax Planning: By analyzing the data entered into the SSTGB Form F0003, businesses can better understand their sales tax liabilities and plan accordingly.

Downloading the SSTGB Form F0003

The SSTGB Form F0003 can be downloaded from the official website of the state's tax authority or department of revenue. The process typically involves the following steps:

- Visit the Official Website: Go to the official website of the state's tax authority.

- Search for Forms: Look for the "Forms" section and search for "SSTGB Form F0003".

- Select the Correct Form: Ensure you select the form for the correct tax year and period.

- Download the Form: Click on the download link to save the form to your computer.

Filling Out the SSTGB Form F0003

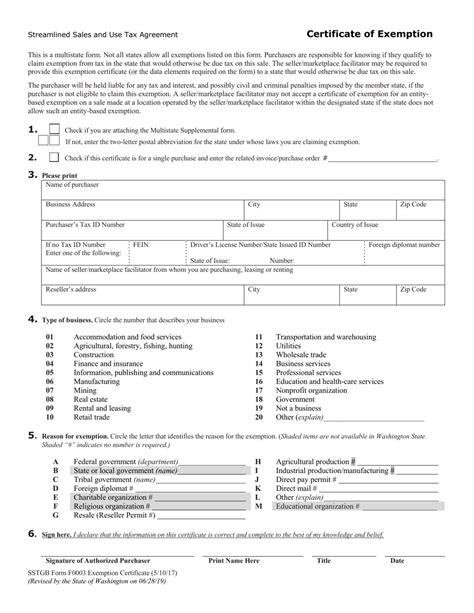

Filling out the SSTGB Form F0003 requires careful attention to detail to ensure accuracy and compliance. Here are the general steps to follow:

- Read the Instructions: Before starting, read the instructions provided with the form to understand the specific requirements.

- Enter Business Information: Fill in the business's name, address, and tax identification number.

- Report Sales Tax Activity: Enter the total sales, taxable sales, and sales tax collected for the period.

- Calculate Tax Liability: Use the form's calculations to determine the total sales tax liability.

- Sign and Date: Sign and date the form to certify its accuracy.

Tips for Managing Sales Tax Obligations

- Maintain Accurate Records: Keep detailed records of sales tax activities to ensure accurate reporting.

- Stay Informed: Regularly check the state's tax authority website for updates on sales tax laws and filing requirements.

- Seek Professional Help: If unsure about any aspect of the SSTGB Form F0003 or sales tax compliance, consider consulting a tax professional.

Conclusion

The SSTGB Form F0003 is a critical document for businesses to comply with sales tax laws. By understanding what the form entails, where to download it, and how to fill it out correctly, businesses can manage their sales tax obligations more effectively. Remember, staying compliant not only avoids penalties but also helps in maintaining a good financial and operational standing.

We hope this article has provided you with valuable insights into the SSTGB Form F0003 and sales tax compliance. If you have any further questions or need assistance with downloading or filling out the form, please don't hesitate to reach out.

What is the SSTGB Form F0003 used for?

+The SSTGB Form F0003 is used by businesses to report and pay sales tax owed to the state.

Where can I download the SSTGB Form F0003?

+The SSTGB Form F0003 can be downloaded from the official website of the state's tax authority or department of revenue.

What information do I need to fill out the SSTGB Form F0003?

+You will need to provide business information, report sales tax activity, calculate tax liability, and sign and date the form.