Managing the estate of a deceased loved one can be a daunting task, especially when it comes to navigating the complex legal landscape of California. One of the key documents that can simplify this process is the California Small Estate Affidavit, also known as Form 13100. In this article, we will guide you through the process of completing this form easily and efficiently.

Understanding the California Small Estate Affidavit

The California Small Estate Affidavit is a legal document used to transfer the assets of a deceased person's estate to their beneficiaries without the need for a full probate proceeding. This form is typically used when the estate is considered "small," meaning its value does not exceed $166,250 (as of 2022). The affidavit allows the beneficiaries to collect the assets of the estate quickly and with minimal court involvement.

Benefits of Using the California Small Estate Affidavit

Using the California Small Estate Affidavit can provide several benefits, including:

- Simplified Process: The affidavit simplifies the process of transferring assets, eliminating the need for a lengthy probate proceeding.

- Reduced Costs: By avoiding a full probate proceeding, beneficiaries can save on court fees and attorney costs.

- Faster Asset Transfer: The affidavit allows beneficiaries to collect assets quickly, usually within a few weeks.

- Less Court Involvement: The affidavit minimizes court involvement, reducing the risk of disputes and complications.

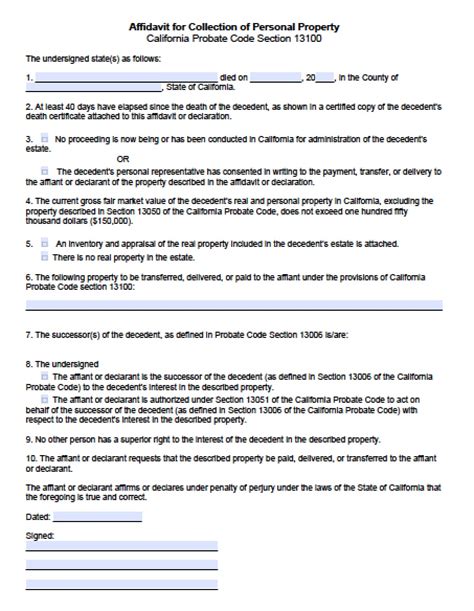

Completing the California Small Estate Affidavit Form 13100

To complete the California Small Estate Affidavit Form 13100, follow these steps:

Step 1: Gather Required Information

Before completing the form, gather the following information:

- Decedent's Information: The decedent's name, date of birth, and date of death.

- Estate Assets: A list of the estate's assets, including real property, personal property, and financial accounts.

- Beneficiaries: A list of the beneficiaries, including their names, addresses, and relationship to the decedent.

Step 2: Fill Out the Form

Complete the form by filling out the required sections:

- Section 1: Decedent's Information

- Section 2: Estate Assets

- Section 3: Beneficiaries

- Section 4: Affidavit

Section 1: Decedent's Information

- Decedent's Name: Enter the decedent's full name.

- Date of Birth: Enter the decedent's date of birth.

- Date of Death: Enter the decedent's date of death.

Section 2: Estate Assets

- Real Property: List the decedent's real property, including addresses and values.

- Personal Property: List the decedent's personal property, including descriptions and values.

- Financial Accounts: List the decedent's financial accounts, including account numbers and values.

Section 3: Beneficiaries

- Beneficiary Information: List the beneficiaries, including their names, addresses, and relationship to the decedent.

Section 4: Affidavit

- Affidavit Statement: Sign and date the affidavit statement, affirming that the information provided is true and accurate.

Step 3: Sign and Notarize the Form

Once the form is complete, sign and notarize it in the presence of a notary public.

Step 4: File the Form

File the completed and notarized form with the California Superior Court in the county where the decedent resided.

Practical Example

To illustrate the process, let's consider an example:

John, a California resident, passes away, leaving behind a small estate worth $100,000. His beneficiary, Jane, wants to collect the assets quickly and efficiently. She completes the California Small Estate Affidavit Form 13100, gathering the required information and filling out the form. She signs and notarizes the form and files it with the California Superior Court. Within a few weeks, Jane is able to collect the assets of John's estate.

Common Mistakes to Avoid

When completing the California Small Estate Affidavit Form 13100, avoid the following common mistakes:

- Inaccurate Information: Ensure that all information provided is accurate and complete.

- Missing Signatures: Sign and notarize the form in the presence of a notary public.

- Insufficient Documentation: Attach supporting documentation, such as death certificates and asset appraisals.

Conclusion

Completing the California Small Estate Affidavit Form 13100 can simplify the process of transferring assets and minimize court involvement. By following the steps outlined in this article and avoiding common mistakes, beneficiaries can efficiently collect the assets of the estate. If you have any questions or concerns, consult with an attorney or seek guidance from the California Superior Court.

Final Thoughts

Managing the estate of a deceased loved one can be a complex and emotional process. The California Small Estate Affidavit Form 13100 provides a simplified and efficient way to transfer assets, reducing costs and court involvement. By understanding the benefits and process of completing the form, beneficiaries can navigate the legal landscape with confidence.

Call to Action

If you are a beneficiary seeking to collect the assets of a small estate in California, consider using the California Small Estate Affidavit Form 13100. Consult with an attorney or seek guidance from the California Superior Court to ensure a smooth and efficient process. Share your experiences and questions in the comments below.

What is the California Small Estate Affidavit Form 13100?

+The California Small Estate Affidavit Form 13100 is a legal document used to transfer the assets of a deceased person's estate to their beneficiaries without the need for a full probate proceeding.

What are the benefits of using the California Small Estate Affidavit Form 13100?

+The benefits of using the California Small Estate Affidavit Form 13100 include a simplified process, reduced costs, faster asset transfer, and less court involvement.

How do I complete the California Small Estate Affidavit Form 13100?

+To complete the California Small Estate Affidavit Form 13100, gather the required information, fill out the form, sign and notarize it, and file it with the California Superior Court.