The Individual Retirement Account (IRA) contribution transmittal form is a crucial document for individuals who want to save for their retirement while enjoying tax benefits. However, the process of filling out and submitting this form can be overwhelming, especially for those who are new to IRA contributions. In this article, we will break down the 5 simple IRA contribution transmittal form essentials that you need to know to ensure a smooth and successful submission process.

Understanding the IRA Contribution Transmittal Form

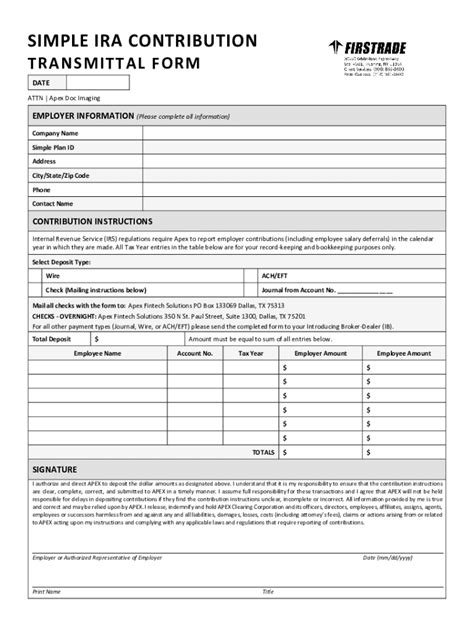

The IRA contribution transmittal form is a document that allows you to contribute funds to your IRA account. This form is typically used by individuals who want to make regular contributions to their IRA, such as through payroll deductions or automatic bank transfers. The form provides essential information about the contribution, including the amount, frequency, and type of contribution.

Essential 1: Accurate Account Information

The first essential element of the IRA contribution transmittal form is accurate account information. This includes your IRA account number, name, and address. It is crucial to ensure that this information is accurate to avoid any delays or issues with the contribution process.

- IRA account number: This is the unique identifier assigned to your IRA account.

- Name and address: This information should match the information on your IRA account.

Essential 2: Contribution Details

The second essential element of the IRA contribution transmittal form is the contribution details. This includes the amount, frequency, and type of contribution.

- Contribution amount: This is the amount you want to contribute to your IRA account.

- Contribution frequency: This is how often you want to make contributions, such as monthly or quarterly.

- Contribution type: This is the type of contribution you want to make, such as a traditional or Roth IRA contribution.

Essential 3: Payment Information

The third essential element of the IRA contribution transmittal form is payment information. This includes the payment method and payment details.

- Payment method: This is the method you want to use to make the contribution, such as a check or automatic bank transfer.

- Payment details: This includes the payment amount, payment date, and payment frequency.

Essential 4: Tax Information

The fourth essential element of the IRA contribution transmittal form is tax information. This includes your tax identification number and tax filing status.

- Tax identification number: This is your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Tax filing status: This is your tax filing status, such as single, married, or head of household.

Essential 5: Signature and Date

The fifth essential element of the IRA contribution transmittal form is your signature and date. This confirms that you have reviewed and agreed to the contribution details.

- Signature: This is your signature, which confirms that you have reviewed and agreed to the contribution details.

- Date: This is the date you signed the form.

Benefits of Using an IRA Contribution Transmittal Form

Using an IRA contribution transmittal form provides several benefits, including:

- Convenience: The form allows you to make regular contributions to your IRA account with ease.

- Accuracy: The form ensures that your contribution details are accurate, reducing the risk of errors.

- Tax benefits: The form helps you take advantage of tax benefits associated with IRA contributions.

Common Mistakes to Avoid

When filling out an IRA contribution transmittal form, there are several common mistakes to avoid, including:

- Inaccurate account information

- Incorrect contribution details

- Insufficient payment information

- Missing tax information

- Unsigned or undated form

Conclusion

In conclusion, the IRA contribution transmittal form is a crucial document for individuals who want to save for their retirement while enjoying tax benefits. By understanding the 5 simple IRA contribution transmittal form essentials, you can ensure a smooth and successful submission process. Remember to provide accurate account information, contribution details, payment information, tax information, and signature and date. Avoid common mistakes, and take advantage of the benefits of using an IRA contribution transmittal form.

FAQs

What is an IRA contribution transmittal form?

+An IRA contribution transmittal form is a document that allows you to contribute funds to your IRA account.

What are the essential elements of an IRA contribution transmittal form?

+The essential elements of an IRA contribution transmittal form include accurate account information, contribution details, payment information, tax information, and signature and date.

What are the benefits of using an IRA contribution transmittal form?

+The benefits of using an IRA contribution transmittal form include convenience, accuracy, and tax benefits.

We hope this article has provided you with a comprehensive understanding of the IRA contribution transmittal form essentials. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others.