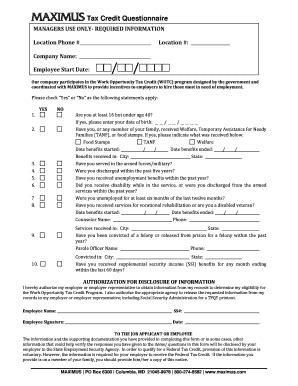

The Earned Income Tax Credit (EITC) is a vital tax relief program for low-to-moderate-income working individuals and families. To claim this credit, eligible taxpayers must fill out the Earned Income Tax Credit Questionnaire, also known as the EIC Questionnaire, or use a simplified version of it, like the Maximus Tax Credit Questionnaire Form. This form helps the Internal Revenue Service (IRS) verify the information provided by taxpayers to ensure they qualify for the EITC. Here, we will explore five ways to fill out the Maximus Tax Credit Questionnaire Form accurately and efficiently.

Understanding the EITC and the Maximus Tax Credit Questionnaire Form

Before diving into the ways to fill out the form, it's essential to understand the purpose of the EITC and the Maximus Tax Credit Questionnaire Form. The EITC is a refundable tax credit designed to help working individuals and families with low incomes. The Maximus Tax Credit Questionnaire Form is used to gather information from taxpayers to determine their eligibility for the EITC.

Why is the Maximus Tax Credit Questionnaire Form Important?

The Maximus Tax Credit Questionnaire Form is crucial in ensuring that taxpayers who claim the EITC are eligible for the credit. The form helps the IRS verify the information provided by taxpayers, reducing the risk of errors and fraud. By filling out the form accurately, taxpayers can avoid delays in receiving their refund and ensure they receive the correct amount of credit.

5 Ways to Fill Out the Maximus Tax Credit Questionnaire Form

Here are five ways to fill out the Maximus Tax Credit Questionnaire Form accurately and efficiently:

1. Gather Required Documents

Before filling out the form, gather all required documents, including:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if applicable)

- Your children's Social Security numbers or ITINs (if applicable)

- Your employment documents, including W-2 forms and 1099 forms

- Your income statements, including interest statements and dividend statements

Having all the required documents will help you fill out the form accurately and efficiently.

2. Read the Instructions Carefully

Read the instructions carefully before filling out the form. The instructions will provide you with an overview of the form and help you understand what information is required.

3. Fill Out the Form Accurately

Fill out the form accurately, providing all required information. Make sure to:

- Use your correct name and Social Security number or ITIN

- Report your income accurately, including all employment income and interest income

- List all your qualifying children, including their names, Social Security numbers or ITINs, and relationships to you

4. Use the Correct Filing Status

Use the correct filing status when filling out the form. Your filing status will determine the amount of credit you are eligible for. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

5. Review and Sign the Form

Review the form carefully before signing it. Make sure all information is accurate and complete. Sign the form in ink, and date it. Keep a copy of the form for your records.

Tips for Filling Out the Maximus Tax Credit Questionnaire Form

Here are some additional tips for filling out the Maximus Tax Credit Questionnaire Form:

- Use a pen or pencil to fill out the form, and make sure to write legibly.

- If you are unsure about any information, seek help from a tax professional or the IRS.

- Keep a copy of the form for your records.

- Make sure to sign and date the form.

By following these tips, you can ensure that you fill out the Maximus Tax Credit Questionnaire Form accurately and efficiently.

Common Mistakes to Avoid When Filling Out the Maximus Tax Credit Questionnaire Form

Here are some common mistakes to avoid when filling out the Maximus Tax Credit Questionnaire Form:

- Inaccurate or incomplete information

- Incorrect filing status

- Failure to sign and date the form

- Failure to keep a copy of the form for your records

By avoiding these common mistakes, you can ensure that you fill out the form accurately and efficiently.

Conclusion

Filling out the Maximus Tax Credit Questionnaire Form accurately and efficiently is crucial in ensuring that you receive the correct amount of credit. By following the tips outlined in this article, you can avoid common mistakes and ensure that you fill out the form correctly. Remember to gather all required documents, read the instructions carefully, fill out the form accurately, use the correct filing status, and review and sign the form. By doing so, you can ensure that you receive the credit you deserve.

What is the purpose of the Maximus Tax Credit Questionnaire Form?

+The Maximus Tax Credit Questionnaire Form is used to gather information from taxpayers to determine their eligibility for the Earned Income Tax Credit (EITC).

What documents do I need to fill out the Maximus Tax Credit Questionnaire Form?

+You will need to gather your Social Security number or Individual Taxpayer Identification Number (ITIN), your spouse's Social Security number or ITIN (if applicable), your children's Social Security numbers or ITINs (if applicable), your employment documents, and your income statements.

How do I know if I am eligible for the EITC?

+To be eligible for the EITC, you must meet certain requirements, including having a valid Social Security number, meeting the income limits, and having earned income from a job or self-employment.