As a Shipt shopper, you're likely aware that you're considered an independent contractor, not an employee. This classification affects how you're paid and how you report your income on your taxes. One crucial document you'll need to navigate is the Shipt 1099 form. Here's what you need to know about this essential tax document.

What is a 1099 Form?

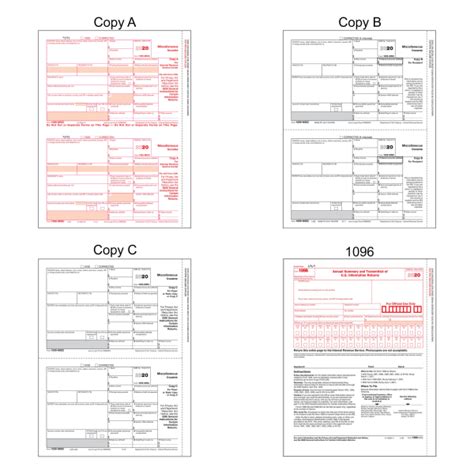

A 1099 form is a series of documents the Internal Revenue Service (IRS) uses to report various types of income that aren't subject to withholding. As a Shipt shopper, you'll receive a 1099-MISC form, which reports miscellaneous income. This form is used to report payments made to independent contractors, freelancers, and other non-employees.

Why Do I Need a 1099 Form?

As a Shipt shopper, you're required to report your income from Shipt on your tax return. The 1099 form provides you with the necessary information to accurately report your income. You'll need this form to complete your tax return and avoid any potential penalties or fines.

5 Essential Things to Know About the Shipt 1099 Form

Now that you understand the basics of the 1099 form, here are five essential things to know about the Shipt 1099 form:

1. Shipt Will Send You a 1099 Form

If you earned more than $600 from Shipt in a calendar year, the company is required to send you a 1099-MISC form by January 31st of the following year. This form will show the total amount of money you earned from Shipt during the previous year.

What if I Earned Less Than $600?

If you earned less than $600 from Shipt in a calendar year, you won't receive a 1099 form. However, you're still required to report your income from Shipt on your tax return.

Reporting Income Without a 1099 Form

Even if you don't receive a 1099 form, you're required to report your income from Shipt on your tax return. You can use your Shipt earnings statements or your own records to calculate your total income.

2. Understand the Information on Your 1099 Form

Your Shipt 1099 form will show the following information:

- Your name and address

- Shipt's name and address

- The amount of money you earned from Shipt during the previous year

- Any federal income tax withheld (there won't be any for a 1099-MISC form)

What if My 1099 Form is Incorrect?

If you notice any errors on your 1099 form, contact Shipt's support team immediately. They'll work with you to correct the mistake and provide you with an updated form.

Correcting Errors on Your 1099 Form

If you find an error on your 1099 form, follow these steps:

- Contact Shipt's support team

- Provide documentation to support the correction

- Wait for an updated 1099 form

3. You're Responsible for Paying Self-Employment Taxes

As a Shipt shopper, you're considered self-employed and are required to pay self-employment taxes. This includes both the employee and employer portions of payroll taxes. You'll report your self-employment taxes on Schedule SE (Form 1040).

What's the Self-Employment Tax Rate?

The self-employment tax rate is 15.3% of your net earnings from self-employment. This includes:

- 12.4% for Social Security (old-age, survivors, and disability insurance)

- 2.9% for Medicare (hospital insurance)

Calculating Self-Employment Taxes

To calculate your self-employment taxes, follow these steps:

- Calculate your net earnings from self-employment

- Multiply your net earnings by the self-employment tax rate (15.3%)

- Report your self-employment taxes on Schedule SE (Form 1040)

4. You May Need to Make Estimated Tax Payments

As a Shipt shopper, you're required to make estimated tax payments each quarter if you expect to owe more than $1,000 in taxes for the year. You'll use Form 1040-ES to make these payments.

What Are the Estimated Tax Payment Due Dates?

The estimated tax payment due dates are:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Making Estimated Tax Payments

To make estimated tax payments, follow these steps:

- Calculate your estimated tax liability

- Complete Form 1040-ES

- Submit your payment by the due date

5. Keep Accurate Records

As a Shipt shopper, it's essential to keep accurate records of your income and expenses. This includes:

- Your 1099 form

- Your Shipt earnings statements

- Receipts for business expenses

Why Are Accurate Records Important?

Accurate records are crucial for:

- Reporting your income and expenses accurately on your tax return

- Calculating your self-employment taxes

- Supporting your business expense deductions

Organizing Your Records

To keep accurate records, follow these steps:

- Set up a filing system for your tax documents

- Keep receipts for business expenses

- Review your records regularly to ensure accuracy

Conclusion

Understanding the Shipt 1099 form is crucial for reporting your income and paying your taxes accurately. By following these essential tips, you'll be able to navigate the tax season with confidence. Remember to keep accurate records, report your income correctly, and make estimated tax payments to avoid any penalties or fines.

What's Next?

Now that you've learned about the Shipt 1099 form, it's time to take action:

- Review your 1099 form carefully

- Calculate your self-employment taxes

- Make estimated tax payments

- Keep accurate records

By following these steps, you'll be well-prepared for the tax season and can focus on growing your Shipt business.

What is a 1099 form?

+A 1099 form is a series of documents the Internal Revenue Service (IRS) uses to report various types of income that aren't subject to withholding.

Do I need to report my Shipt income on my tax return?

+Yes, you're required to report your Shipt income on your tax return, even if you don't receive a 1099 form.

How do I calculate my self-employment taxes?

+To calculate your self-employment taxes, multiply your net earnings from self-employment by the self-employment tax rate (15.3%).