The rise of Onlyfans has revolutionized the way content creators monetize their influence and connect with their audience. With millions of active users, the platform has become a go-to destination for artists, musicians, and adult entertainers looking to share exclusive content and earn a living. However, as with any freelance or self-employed work, comes the responsibility of navigating taxes. In this article, we'll delve into the world of W9 tax form filing for Onlyfans creators, exploring the ins and outs of this crucial process.

What is a W9 Tax Form?

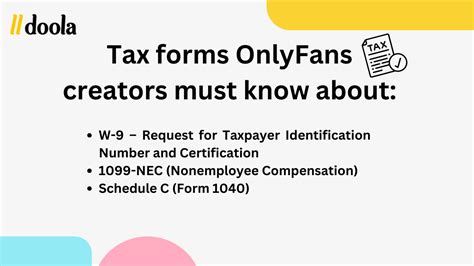

A W9 tax form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the Internal Revenue Service (IRS) to collect identifying information from freelancers, independent contractors, and other self-employed individuals. This form is essential for Onlyfans creators, as it allows them to provide their tax identification number (TIN) to the platform, ensuring accurate reporting of income and compliance with tax laws.

Why Do Onlyfans Creators Need to File a W9 Tax Form?

As an Onlyfans creator, you're considered a self-employed individual, responsible for reporting your income and paying taxes on your earnings. By filing a W9 tax form, you provide Onlyfans with your TIN, which is necessary for several reasons:

- Accurate income reporting: Onlyfans uses your TIN to report your income to the IRS, ensuring that your earnings are accurately recorded and reflected on your tax return.

- Compliance with tax laws: Filing a W9 tax form demonstrates your compliance with tax laws and regulations, reducing the risk of audits and penalties.

- Tax withholding: If you earn more than $600 in a calendar year, Onlyfans may be required to withhold taxes on your behalf. Providing your TIN ensures that the correct amount of taxes is withheld.

What Information Do You Need to Provide on the W9 Tax Form?

When completing the W9 tax form, you'll need to provide the following information:

- Name and address: Your full name and address, as shown on your tax return.

- Business name and address: If you're operating under a business name or pseudonym, provide this information along with your business address.

- Taxpayer identification number (TIN): Your Social Security number or Employer Identification Number (EIN).

- Type of tax classification: Indicate whether you're an individual, sole proprietor, partnership, or corporation.

How to File a W9 Tax Form as an Onlyfans Creator

Filing a W9 tax form as an Onlyfans creator is a straightforward process:

- Obtain a W9 tax form: Download the W9 tax form from the IRS website or request one from Onlyfans.

- Complete the form: Fill in the required information, making sure to sign and date the form.

- Submit the form: Return the completed form to Onlyfans, either by uploading it to your account or mailing it to their offices.

Additional Tax Obligations for Onlyfans Creators

As an Onlyfans creator, you're responsible for meeting additional tax obligations, including:

- Self-employment tax: You're required to pay self-employment tax on your net earnings from self-employment, which includes your Onlyfans income.

- Business expenses: You may be able to deduct business expenses related to your Onlyfans activities, such as equipment, software, or marketing expenses.

- Quarterly estimated tax payments: As a self-employed individual, you're required to make quarterly estimated tax payments to the IRS.

Conclusion: Simplifying W9 Tax Form Filing for Onlyfans Creators

Filing a W9 tax form as an Onlyfans creator is a crucial step in ensuring accurate income reporting and compliance with tax laws. By understanding the importance of this form and following the steps outlined above, you can simplify the tax filing process and focus on what matters most – creating content and building your audience.

Share your thoughts: Have you had any experiences with filing a W9 tax form as an Onlyfans creator? Share your tips and advice in the comments below!

Take action: Ensure you're meeting your tax obligations by filing a W9 tax form and exploring additional tax resources available to Onlyfans creators.

Explore more: Dive deeper into the world of taxes and entrepreneurship with our comprehensive guide to self-employment taxes and business expenses.

What is the deadline for filing a W9 tax form?

+The deadline for filing a W9 tax form varies depending on the payer's requirements. Typically, Onlyfans will request that you complete and return the form within a specified timeframe, often before you can receive payments.

Do I need to file a W9 tax form if I earn less than $600 on Onlyfans?

+No, if you earn less than $600 in a calendar year, you're not required to file a W9 tax form. However, it's still essential to report your income and pay taxes on your earnings.

Can I file a W9 tax form electronically?

+Yes, you can file a W9 tax form electronically through the IRS website or by uploading it to your Onlyfans account, if available.